US stock markets moved higher during the first trading session of a new week. So far it looks like markets are completely ignoring the FOMC taper that is expected to be announced tomorrow in the evening. Accelerating inflation does not look to be having a big impact on the market valuations either as investors are focusing on the ongoing Q3 earnings season. Almost 300 members of the S&P 500 index have already reported results for the third quarter and results of more than 80% of those companies have beat expectations. Supply chain issues are a common theme during earnings presentations and a big share of companies hint at the negative impact of those extending into early-2022.

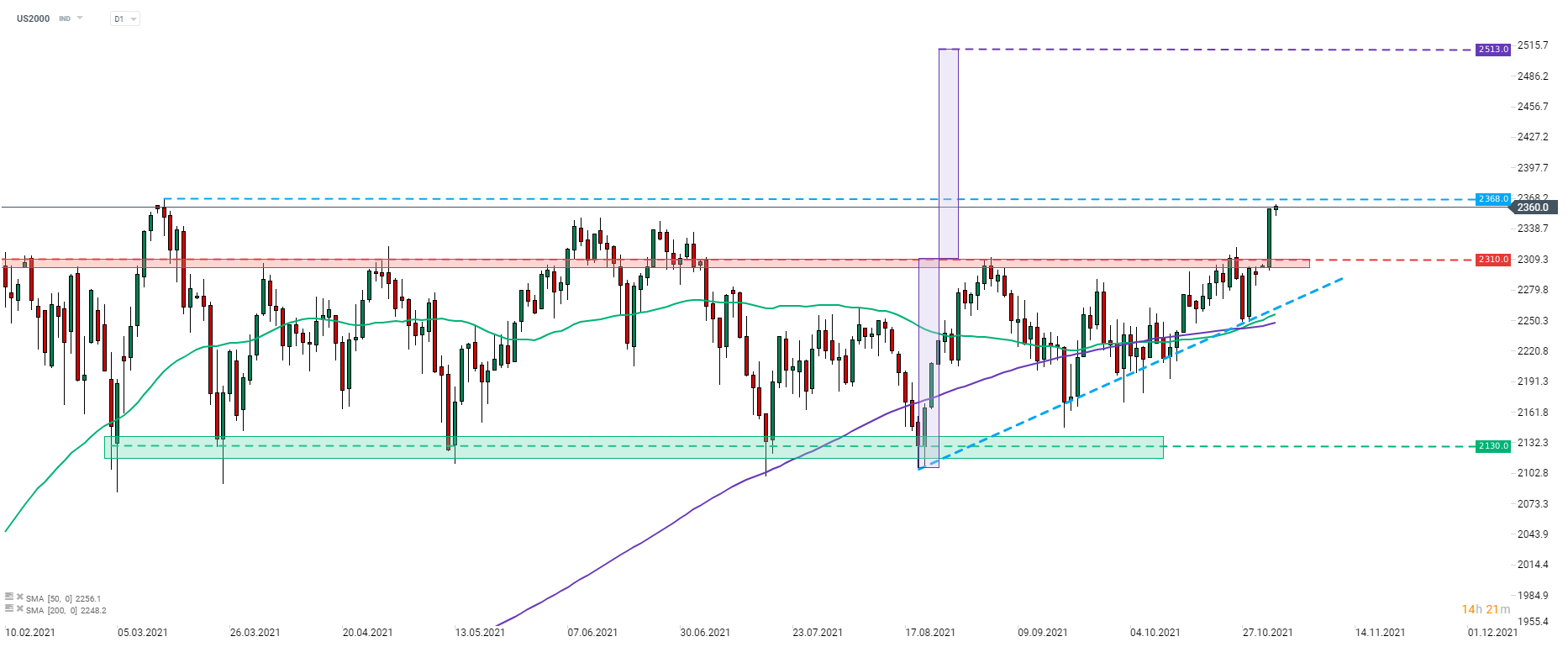

While all major US indices gained yesterday, it was the small-cap Russell 2000 (US2000) that stood out. The index rallied a massive 2.65% yesterday and climbed to the highest level since mid-March, just a touch below all-time highs (2,368 pts). US2000 broke above the 2,310 pts resistance zone yesterday, that marked the upper limit of the triangle pattern. A textbook range of the upside breakout from this pattern hints at a potential move above the 2,500 pts mark, over 6% above the current market price. FOMC meeting tomorrow is expected to a have a big impact on equity indices, including US2000.

Source: xStation5

Source: xStation5

Will the defense sector keep European stock markets afloat❓

Chart of the day: JP225 (08.01.2026) 💡

Daily summary: Alphabet shares support sentiments on Wall Street 🗽Oil, precious metals and crypto slide

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.