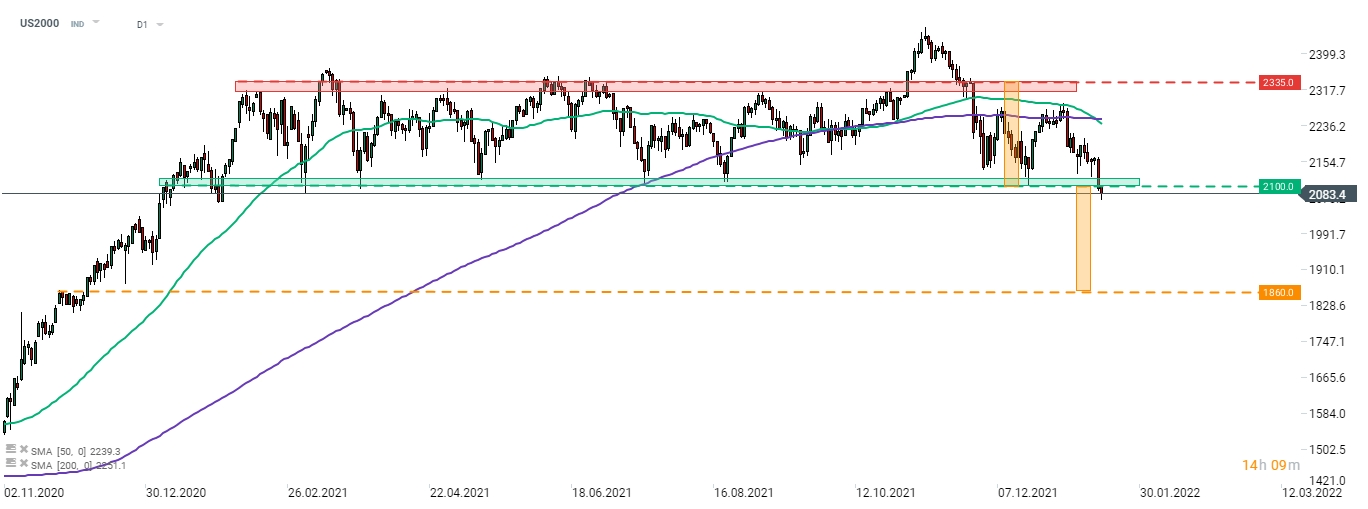

Market interest rates continue to rise with the US 10-year Treasury yield hovering near 1.9%. While higher rates are usually seen as negative for the tech sector that is often more indebted than other sectors, pick-up in yields is also negative for small caps. In fact, the small-cap index Russell 2000 has a debt-to-equity ratio of around 129% while this ratio for Nasdaq or S&P 500 stands at 89.5% and 114.5%, respectively. Dow Jones is even more indebted but a high share of financial institutions, like banks, cushions the index from a hit from higher rates.A break below the lower limit of Russell 2000 trading range that can be observed at press time was trigger by hawkish shift in Fed's policy but whether this breakout translates into a bigger sell-off will depend on whether Fed delivers on hawkish expectations.

Taking a look at Russell 2000 chart (US2000), we can see that the US small cap index dropped below the lower limit of a trading range today. In spite of other Wall Street indices reaching new all-time highs regularly, US2000 has been stuck in a 135 points wide consolidation for a year! Now this index is threatening to deliver a downside breakout from the pattern and according to classic technical analysis, such a scenario may herald a 135 points drop. This would push the price down to 1,860 pts - the lowest level since early-December 2020.

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Morning wrap (03.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.