Economic calendar today is light but traders will be offered some noteworthy data from Canada and the United States in the afternoon. Canadian retail sales data at 1:30 pm GMT is expected to show monthly drops in headline and ex-autos gauges while US existing home sales data for December is expected to show a drop compared to November. While neither of those is considered a top-tier piece of macro data, those reports tend to trigger short-term volatility on USD and CAD. This is especially true for CAD as Bank of Canada is set to announce its next monetary policy decision next week and retail sales print today is the final piece of macro data ahead.

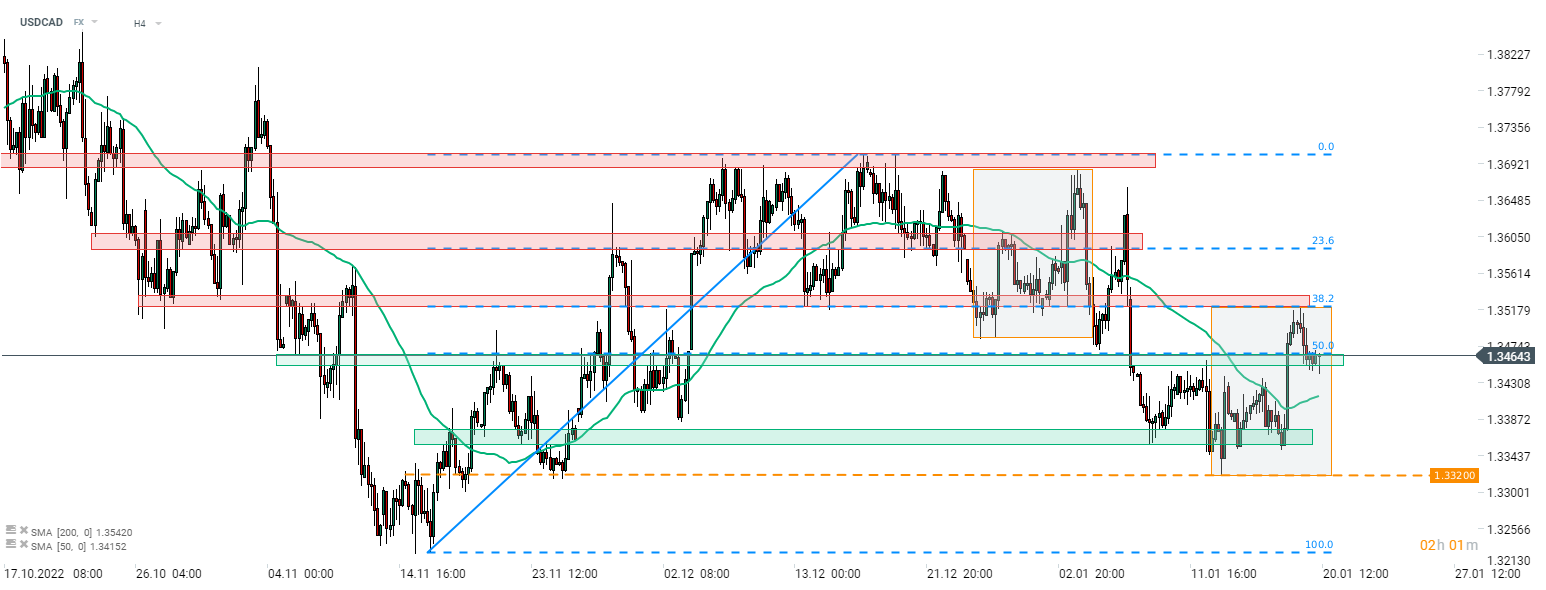

Taking a look at USDCAD chart at H4 interval, we can see that the pair has recently halted upward correction at the resistance zone ranging above 38.2% retracement (1.3525) and started to pull back. Note that the aforementioned zone also marks the upper limit of the Overbalance structure therefore failing to break above it and pulling back away from it signals that downtrend remains in play. The pair is currently testing a support zone marked with 50% retracement in the 1.3450 area. The first attempts to break below turned out to be a failure. Should bulls manage to defend the 1.3450 area, another upward correction may be launched. In such a scenario, the resistance zone at 38.2% retracement that halted recent advance will once again become a target for buyers.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.