Futures on Chinese Hang Seng China Enterprises Index (CHN.cash) are rising today above 6000 points after a very strong session in China. Fitch Ratings revised outlook on China economy to negative, with affirmed 'A+' rating. Another agency, Moody’s in December slapped a downgrade warning on China’s credit rating. Moody's cited the costs to bail out local governments and state firms, while controlling a property crisis. However, Fitch doesn't expect further deflation in the country, which may be seen as quite 'bullish', despite the lowered overall outlook. China’s factory output and retail sales topped forecasts in January-February period,

- Outlook revision reflects increasing risks to China's public finance The agency believes that fiscal policy is likely to play an important role in supporting growth in coming years

- Fitch forecasts general China government deficit to rise to 7.1% of GDP in 2024. What's more 2024 deficit will be highest since 8.6% of GDP deficit in 2020

- General government debt (local and central government debt) to rise to 61.3% of GDP in 2024 (54.0% 'A' median) from 56.1% in 2023. It's deterioration from 38.5% in 2019, when Chinese debt was well below the peer median, due primarily to sustained fiscal support to counter economic pressures.

- Debt as a share of revenue is forecast to be 234% in 2024, well above the 145% 'A' median. Fitch forecasts the debt ratio to rise to 64.2% in 2025 and nearly 70% by 2028 vs < 60% in our previous review

- The degree to which fiscal support reignites underlying GDP growth is a key uncertainty for our debt path. Risks from higher government debt are mitigated by a high domestic savings rate, which supports debt affordability and financing flexibility.

- China GDP growth to moderate to 4.5% in 2024, from 5.2% in 2023. Fitch doesn't forecast a prolonged period of deflation. Inflation outlook is set at 0.7% by end-2024 and 1.3% by end-2025

- According to Fich, the revision reflects increasing risks to China’s public finance outlook as the country contends with more uncertain economic prospects amid a transition away from property-reliant growth to a more 'sustainable' growth model, supported by government.

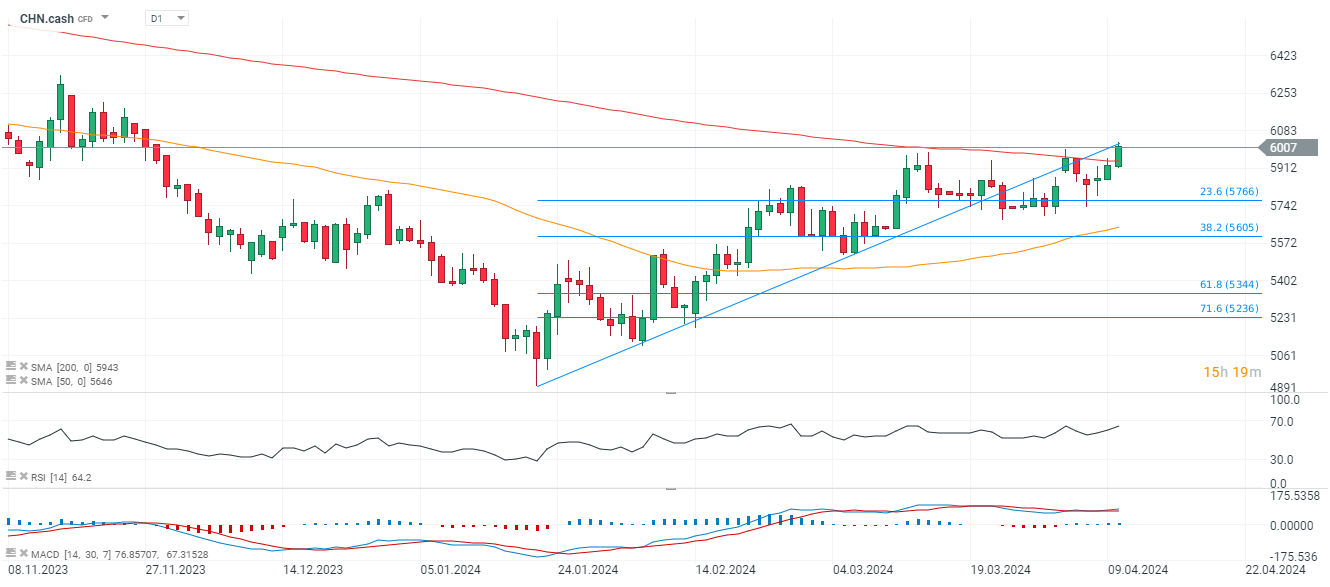

CHN.cash (D1)

Futures on Hang Seng Index (CHN.cash) increased today above major resistance level of SMA200 (red line) near 6000 points.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.