Cocoa (COCOA) futures on ICE are up more than 7% today, as reports of extreme weather (droughts and heavy rains) in Africa, combined with supply concerns, have triggered a significant wave of short covering, forcing traders (especially the commercials) who had been betting on price declines to exit their positions.

- Cocoa deliveries from Ivory Coast in the ongoing 2024/2025 season fell 2% y/y as of August 10. The pace of shipments from this key producing country has been slowing — now showing a 6% y/y increase compared with a 35% y/y rise back in December. ICE-monitored port inventories have dropped to a nearly two-month low at 2.283 million bags.

- The world’s two largest cocoa producers, Ghana and Ivory Coast, are facing drought conditions, despite heavy rains in some parts of West Africa (Nigeria, Cameroon). So far, downpours have been recorded in certain areas, including Cameroon, but their intensity has threatened bean quality as farmers have been unable to properly dry the harvest.

- Farmers in Ivory Coast, cited by Bloomberg, said that despite challenging weather, they are seeing improved conditions for so-called cherelles for the upcoming 2025–2026 season. In contrast, growers in Ghana report cherelle withering, while in Nigeria, heavy rains have disrupted industrial-scale bean drying. Conditions are somewhat better in the country’s southwest.

- Lindt & Spruengli (LISN.CH) in July cut its margin forecast due to a larger-than-expected decline in first-half 2025 chocolate sales. The world’s largest contract chocolate maker, Barry Callebaut (BARN.CH), also lowered its sales volume outlook again last month, citing persistently high cocoa prices (reporting nearly a 10% drop for March–May — the steepest quarterly decline in a decade).

Demand concerns are not weighing on futures, as the market expects a structural cocoa shortage to persist for longer. A lasting resolution to cocoa tree disease issues may require long-term, advanced technological solutions such as CRISPR gene-editing therapy (already being tested by Mars). Cameroon’s National Institute of Research and Development is working on weather-resistant hybrid cocoa varieties. Weather risk continues to reinforce a bullish market outlook.

COCOA (D1 interval)

Cocoa prices are testing the upper boundary of the “line of least resistance,” with strong support emerging around USD 7,700–8,000 per tonne. The next significant levels are in the USD 9,500–10,000 per tonne range, where the last rally stalled. It appears that a flat or slightly weaker cocoa demand profile is insufficient to cool the market given the challenging supply backdrop in key regions. A sharp drop in order volumes would likely be needed to bring about a sustained normalization in prices.

Source: xStation5

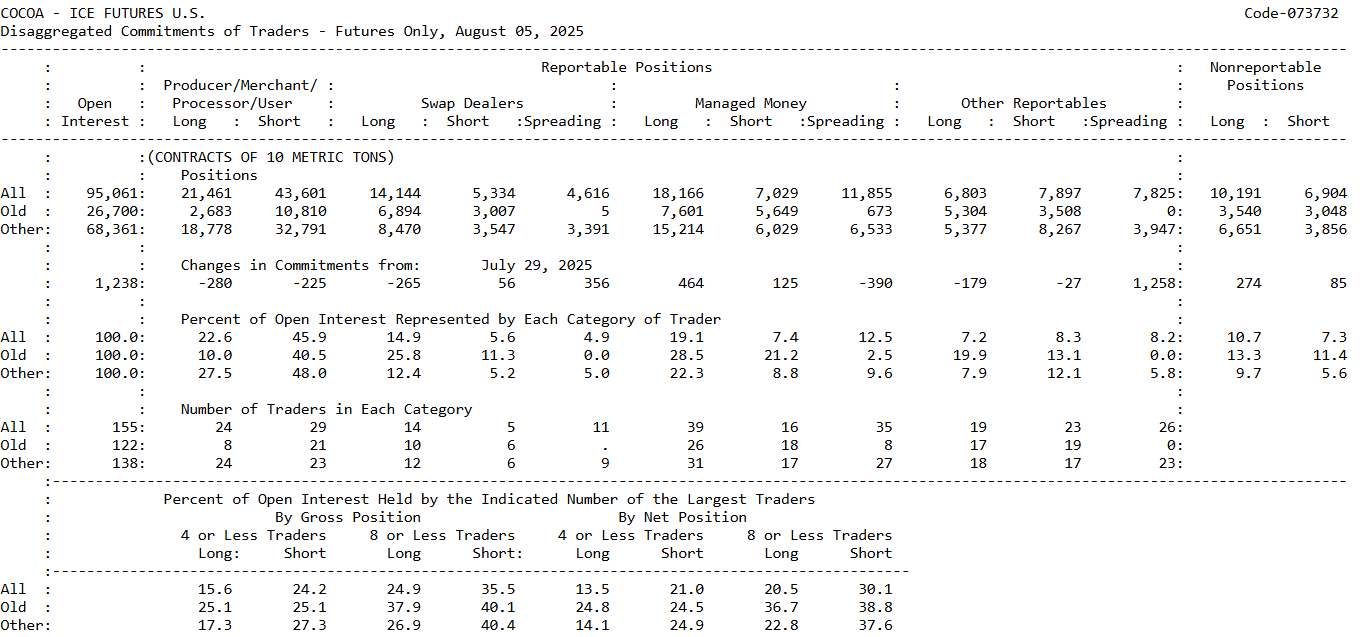

Key observations from the CoT report (data as of August 5)

Commitment of Traders (CFTC data) shows that producers/merchants and other commercial entities directly involved in cocoa hedging expect prices to fall, viewing current levels as attractive for selling.

- Large speculators — the so-called Managed Money category — expect prices to rise and are positioned in direct opposition to commercials, who have been under heavy pressure today. Speculators increased their long positions by 464 contracts last week, while adding only 125 to shorts. On the other side, commercial participants on ICE reduced both long and short positions, yet remain firmly net short.

- The largest speculators control around 25% of all cocoa short positions (held by four anonymous entities), compared with 15–17% on the long side — suggesting that major institutions are the dominant short sellers.

- Commercials are hedging future production against price declines, while speculators are betting on the continuation of the upward trend. Today’s cocoa rally likely reflects the liquidation of large commercial short positions and is boosting profits on the speculative long side.

![]()

Source: CFTC

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.