Credit Suisse (CSGN.CH) is trading over 10% lower today following the release of an earnings report for Q3 2022. The Swiss bank reported a massive net loss that was 8 times greater than the market expected. However, a bulk of this loss is a non-cash loss resulting from impairment charges related to strategic review. Let's take a closer look at the results of Credit Suisse!

Net loss 8 times bigger than expected!

Credit Suisse reported a net loss of 4.03 billion CHF for Q3 2022. This compares to a market forecast of 505 million CHF net loss. However, pre-tax loss amounted to "just" 342 million CHF and was smaller than the 491 million CHF loss expected by the market. Where did such a big net loss come from then? Bank took a 3.7 billion impairment charge on deferred tax assets related to a strategic review and said in a statement that it plans to radically restructure its investment bank. Bank expects restructuring charges between Q4 2022 - 2024 to amount to 2.9 billion CHF. Restructuring charges as well as software and real estate impairments are expected to amount to around 250 million CHF in the final quarter of 2022.

Media reports take their toll

Credit Suisse has been in the center of the market chatter in September as a bank that could potentially trigger the next 'Lehman moment'. Some media reports suggested that the Bank may be heading for a collapse that would send shockwaves not only across Swiss or European banking industry but also across the globe due to the size of the institution. It looks like those reports took their toll by spooking investors and deposit-holders as Credit Suisse noted that it saw significant deposit and AUM outflows in early October.

Capital needed for restructuring

While clients of the Credit Suisse were spooked by dismal media reports on the condition of the Bank, stakeholders do not seem to be as scared. The Bank will need to raise additional capital for restructuring and plans to raise around 4 billion CHF via new share issuance for qualified investors and new rights offering to existing investors. Saudi National Bank has already committed to provide 1.5 billion CHF of financing.

Share prices slumps over 10%

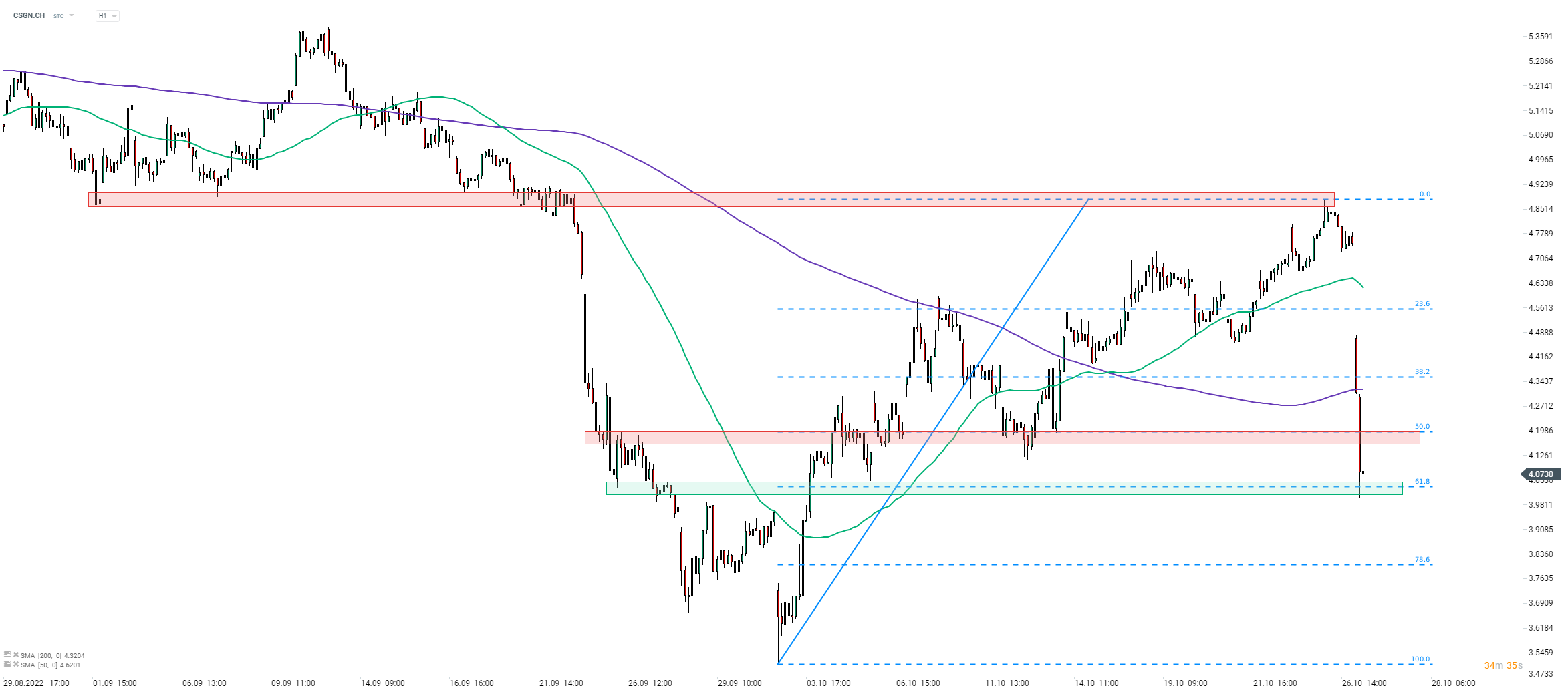

While the Bank has drawn restructuring plans and started to look for additional capital to boost its capital ratios, the market does not seem to be convinced. Share price of Credit Suisse dropped over 10% today with the stock erasing a big part of the recent recovery move. A sell-off has been halted at 61.8% retracement of a recent upward correction for now but another wave of selling cannot be ruled out. Note that this retracement can be found in the psychological 4.00 CHF price zone, what may additionally boost its significance.

Credit Suisse (CSGN.CH) at H1 interval. Source: xStation5

Credit Suisse (CSGN.CH) at H1 interval. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.