Cryptocurrency prices are falling at Monday’s market open, tracking weakness in US index futures, with US100 down nearly 1 percent ahead of the ISM Manufacturing data scheduled for release at 16:00. Bitcoin is testing the 85,000 USD area and is trading almost 5 percent lower. Ethereum has retreated to 2,800 USD, losing nearly 10 percent from the peak of the latest rebound.

- On-chain data suggests that the market may be repeating the scenario seen in late 2021 and early 2022, when the broader crypto market entered a bear phase and hit its lows roughly 13 months after the initial sell-off in November 2021. If such a pattern were to repeat, it would imply that a meaningful recovery in the crypto market might not arrive until November 2026.

- In theory, Bitcoin could fall well below key on-chain levels in the 81,000 USD region, potentially dropping as low as 55,000 USD. If the price falls below 80,000 USD, this scenario will need to be considered a serious risk. However, if BTC finds the strength to return above 90,000 USD and, critically, 100,000 USD, the dominant scenario remains a continuation of the bull market.

Charts (Bitcoin and Ethereum), D1 interval

Bitcoin and Ethereum would currently need to rise almost 30 percent to test the 200-day EMA (red line) for both cryptocurrencies. In practice, this means that the combined market capitalisation of the two assets would need to increase by roughly 700 billion dollars (effectively several hundred billion dollars of net positive inflows into the crypto market) for this scenario to materialise. Without a sustained improvement in sentiment on Wall Street, the crypto market may struggle to regain momentum, while profit-taking among large holders and persistent demand for hedging via derivatives (options and futures) continues to make this scenario more difficult to achieve.

Source: xStation5

Source: xStation5

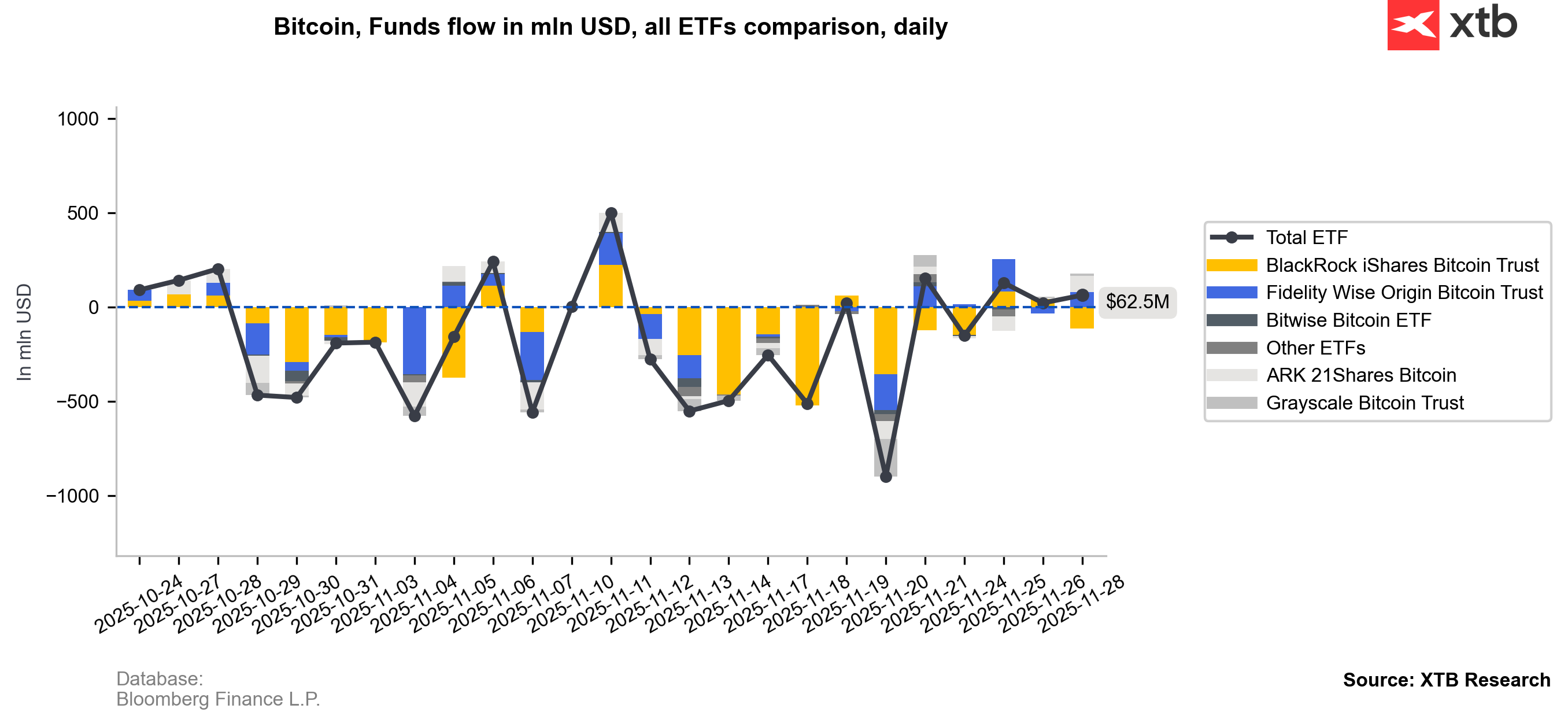

Net inflows into Bitcoin ETFs have recently been positive, but the scale of these inflows can be considered minimal compared to demand during the previous two deeper corrections, when the market was much more aggressive in buying the dips. This may also be a sign of demand exhaustion.

Source: Bloomberg Finance L.P.

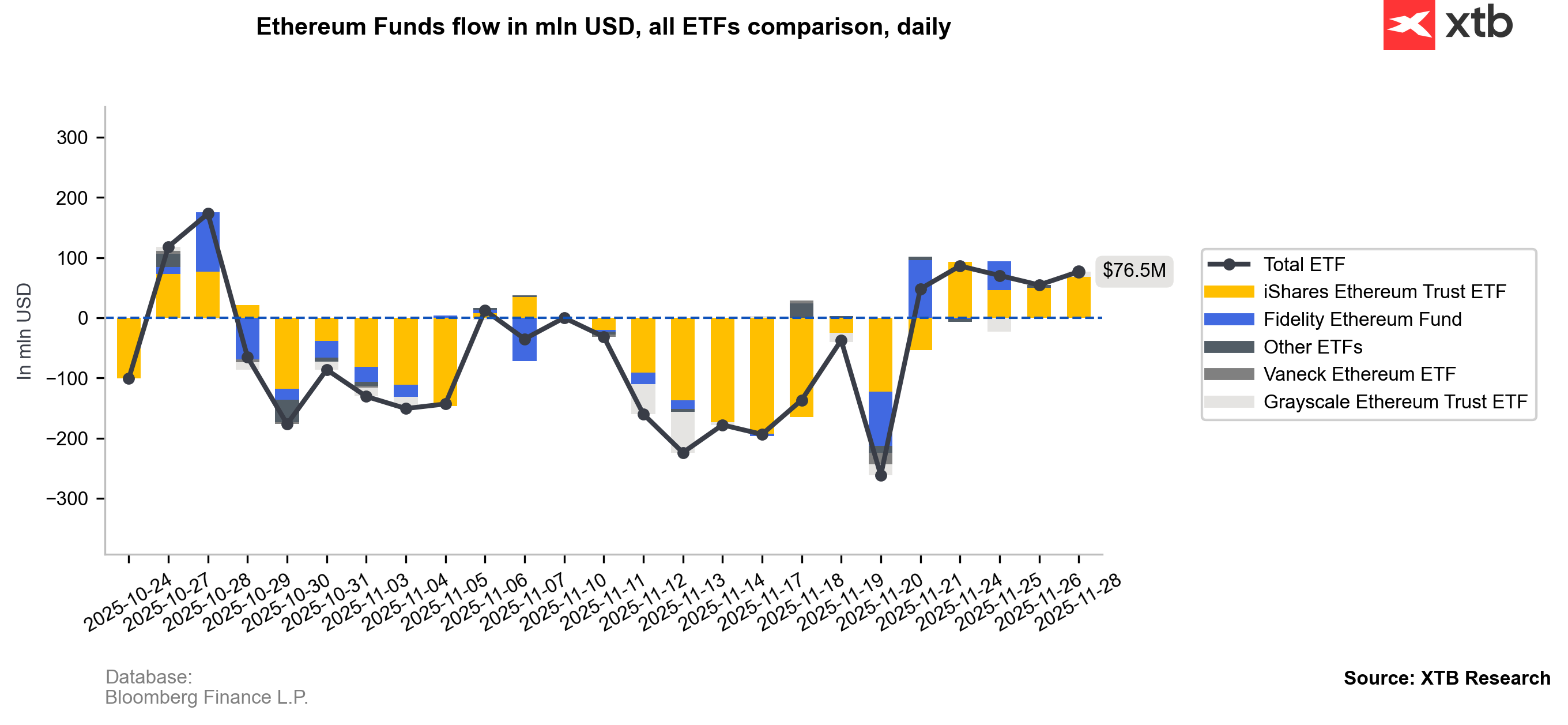

Ethereum inflows have been stronger, yet they still do not offset the market impact of the disastrous November, when over 1 billion USD worth of shares were redeemed from US spot ETFs.

Source: Bloomberg Finance L.P.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.