Global markets open Monday’s session in mixed moods. Wall Street futures are edging lower, while the CBOE Volatility Index (VIX) rises more than 1.5% after last week’s steep declines. The U.S. dollar is strengthening as investors once again digest the implications of Jackson Hole for the Federal Reserve’s monetary policy.

Profit-taking after Friday’s euphoric rally is dragging cryptocurrencies lower:

-

Bitcoin has fallen from around $118,000 before the weekend to just under $112,000 in Monday trading.

-

Ethereum is down more than 5%, slipping below $4,600 despite positive ETF inflows. The drop follows fresh all-time highs reached last week.

-

This week will bring several key U.S. economic releases, to which cryptocurrencies may prove sensitive.

-

According to Trump advisor Bailey, the “crypto bear market” is still “years ahead.” Despite positive commentary surrounding the sector, markets remain uncertain about future momentum. Periodic reports of Bitcoin sales by so-called “whales” add both direct selling pressure and uncertainty around the continuation of the broader crypto rally.

Bitcoin & Ethereum Charts (D1)

Bitcoin continues its medium-term uptrend but faces fresh obstacles. The price failed to break above the 50-day exponential moving average (EMA50, orange line), which now acts as key resistance. As a result, BTC is trading near the average purchase price of short-term holders (STH Realized Price), currently around $109,000. Thus, the $110,000 zone is the critical support level for today.

Source: xStation5

Ethereum is trading within a rising price channel, with the lower boundary near $4,100. A break below this level could trigger a deeper correction. For now, despite profit-taking after recent gains, the trend remains upward. Paradoxically, Bitcoin’s consolidation could support interest in Ethereum — but today, declines are visible across the entire risky-assets market.

Source: xStation5

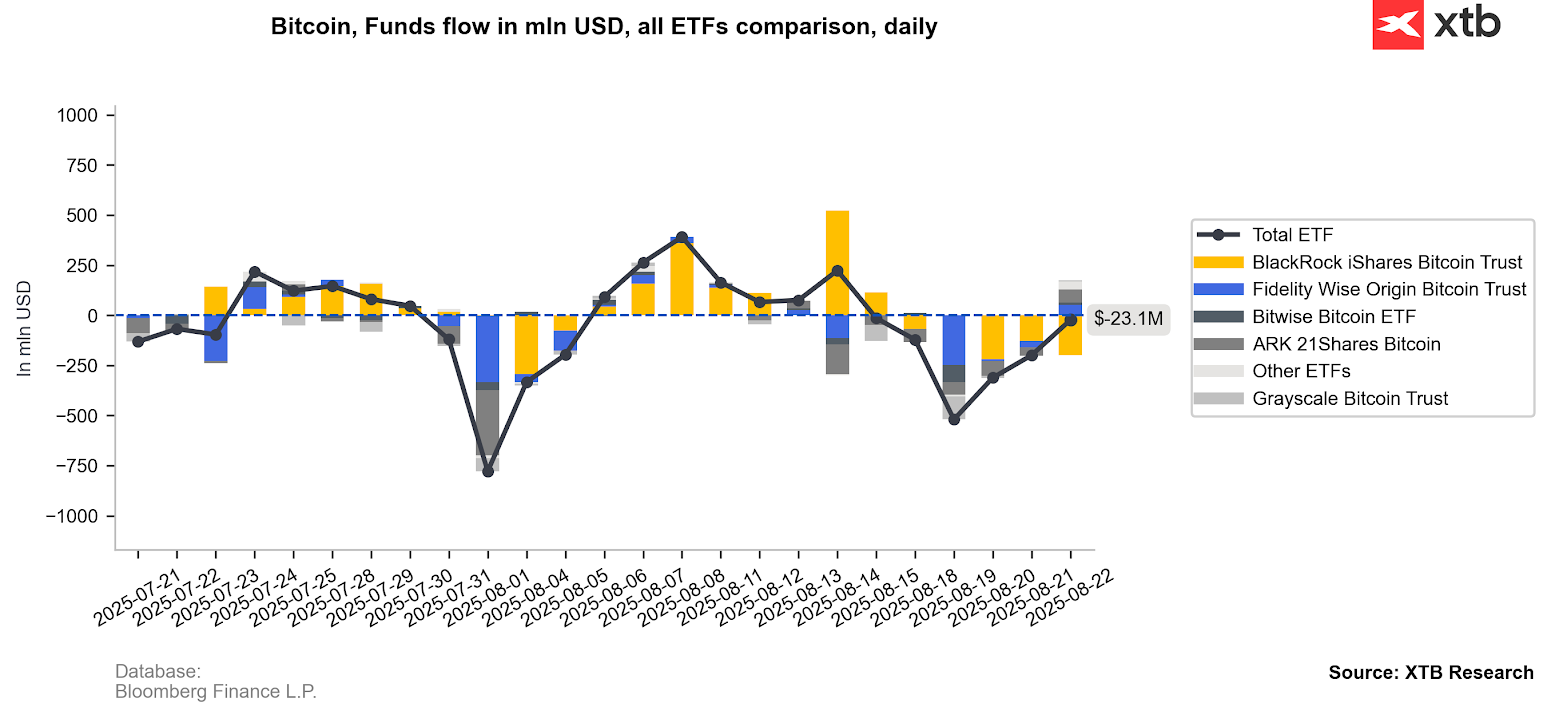

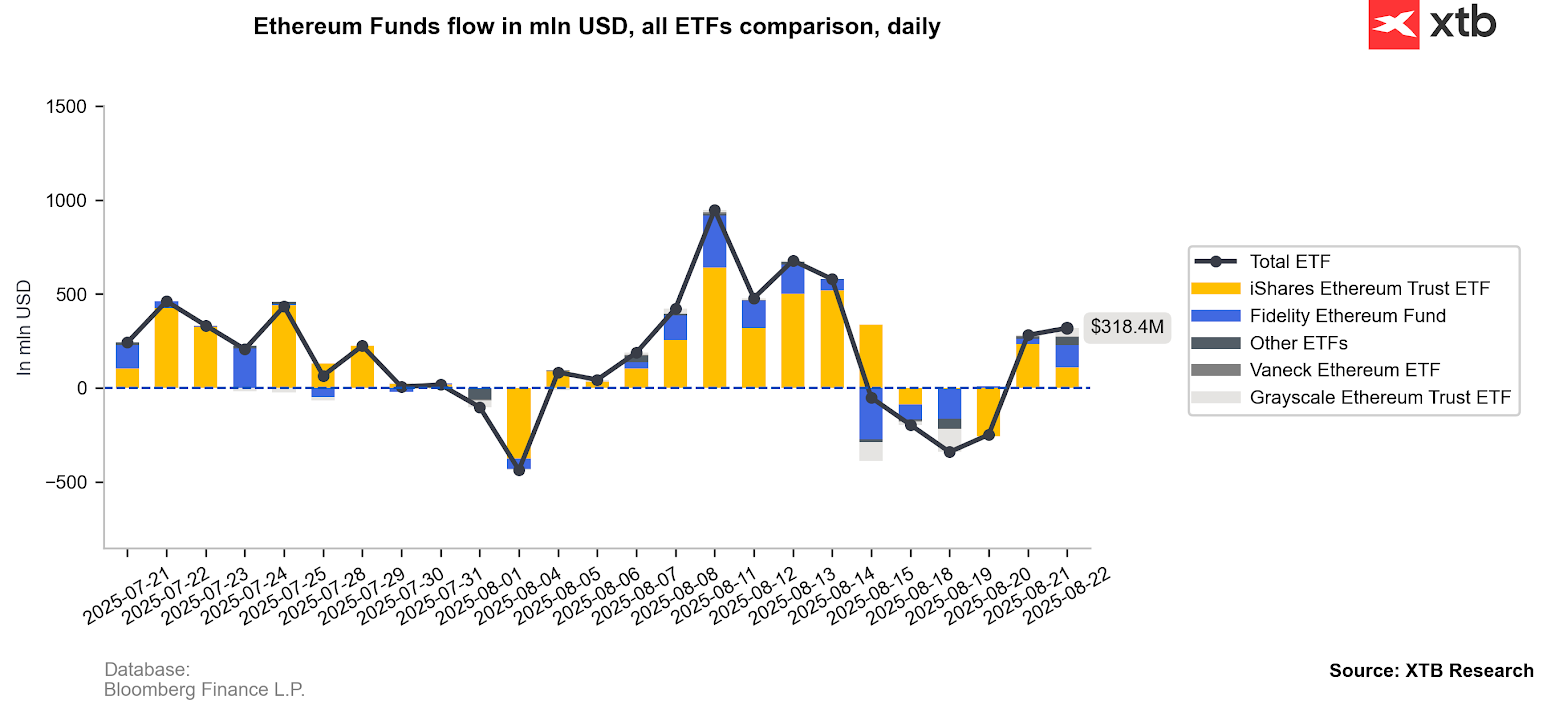

ETF Inflows into Bitcoin and Ethereum

ETF activity in Bitcoin accumulation has slowed markedly. Last Friday recorded net outflows of more than $20 million, with BlackRock emerging as the main seller in recent sessions. By contrast, Ethereum attracted over $300 million in net inflows during the last trading day of the week. At this stage of the market, investors appear more willing to take bolder positions in Ethereum, hoping for higher short-term returns. Bitcoin, meanwhile, continues to struggle with breaking sustainably above the $120,000 mark.

Source: Bloomberg Finance L.P, XTB Research

BREAKING: US100 reacts to weaker ADP report

BREAKING: EURUSD ticks higher after ADP data huge miss💡

Gold surges 2.5% after beating record from 2008 📈

Economic calendar: Alphabet's earnings in the spotlight 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.