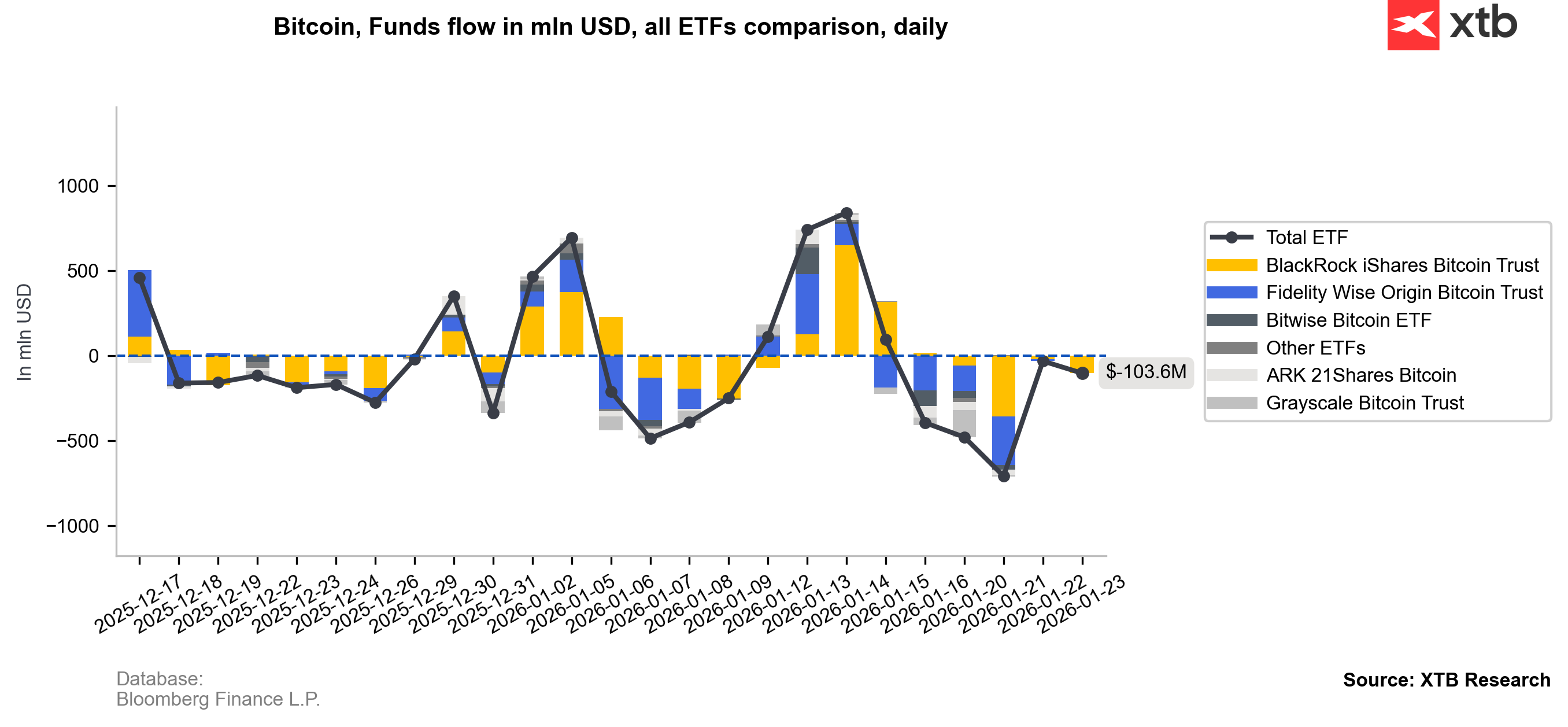

Bitcoin is sliding toward the $87,000 area today after liquidations totaling hundreds of millions of dollars, while ETFs recorded last week the largest weekly outflow since mid-November 2025 — $1.73bn in total. This marks a sharp reversal from the week ending January 17, when crypto funds saw more than $2.17bn in inflows. This time, Ethereum alone posted around $630m in outflows (the second-largest weekly outflow on record).

So far, the main exceptions have been ETFs linked to Solana (about +$17m) and Chainlink (nearly +$4m). A clear “risk-off” tone dominates: the breadth of outflows suggests investor confidence has not fully recovered from earlier shocks, while the macro backdrop continues to weigh on the sector. According to CoinShares, the bulk of the selling pressure came from US-based investors. Fragile sentiment has persisted since the October 2025 “flash crash.”

The declines have been driven by, among other factors:

-

Weaker expectations for Fed rate cuts: markets are pricing a very low probability of a cut (around 3% according to the CME FedWatch tool).

-

Lack of a sustained rebound after the October drawdown, keeping trend-following and risk-managed strategies cautious.

-

Disappointment with the “debasement hedge” narrative: despite large deficits and rising government debt, crypto has not convincingly reclaimed its role as protection against currency debasement, prompting some investors to cut exposure in the near term.

The market is still searching for a catalyst — and failing to find one. Unless macro expectations shift, price momentum improves, or crypto rebuilds a strong narrative, pressure on fund flows may persist, increasing the risk of a deeper bear phase.

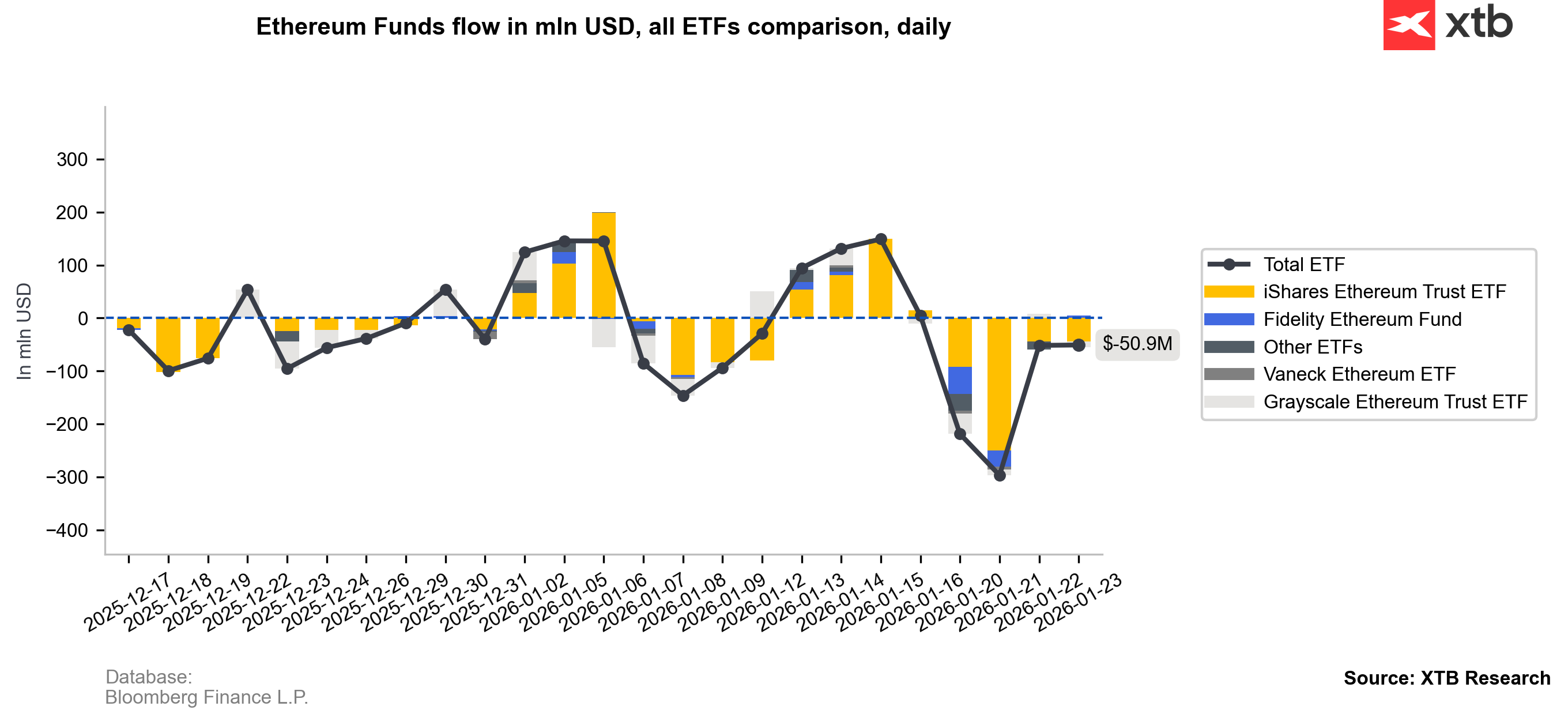

ETF flows

Looking at recent crypto fund flows, the last five sessions show clearly negative flows into ETH, suggesting reduced fund activity and fading retail demand — not only for Ethereum, but also for Bitcoin.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

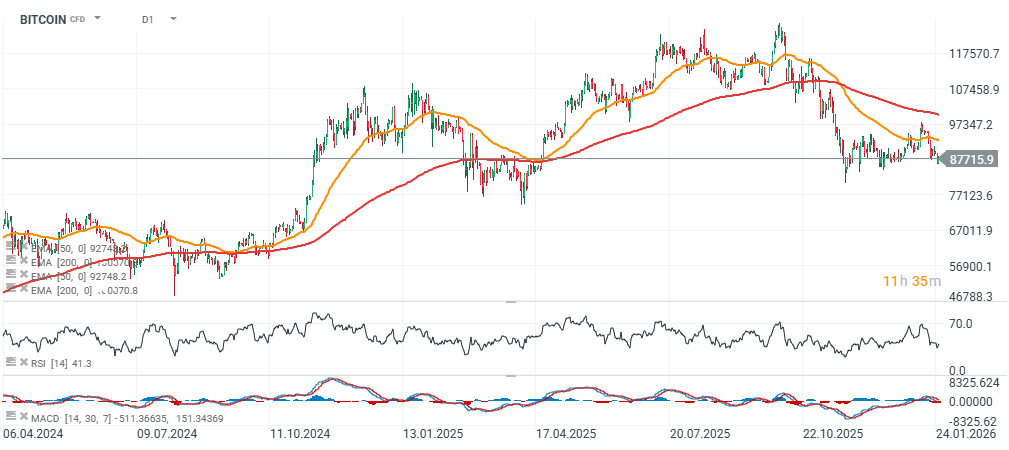

Bitcoin and Ethereum chart (D1 interval)

Bitcoin is now down more than 30% from its all-time high, while Ethereum is down over 50%. BTC’s RSI stands at 41, still relatively far from the “oversold” levels typically seen after major capitulation events; Ethereum shows a similar setup — despite the steep decline, there are still no clear signs of capitulation.

Key on-chain reference levels for Bitcoin currently include $96.5k (short-term holders’ cost basis), $87.5k (active investors’ mean), and two major cyclical benchmarks: $81k (True Market Mean) and $56k (Realized Price). True Market Mean is a more “realistic” market-wide average level that often reflects the actively traded portion of supply, while Realized Price is the average cost basis of the entire BTC market — a classic cycle benchmark. Historically, Bitcoin has traded below Realized Price during major bear markets, including in 2020 and 2022.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.