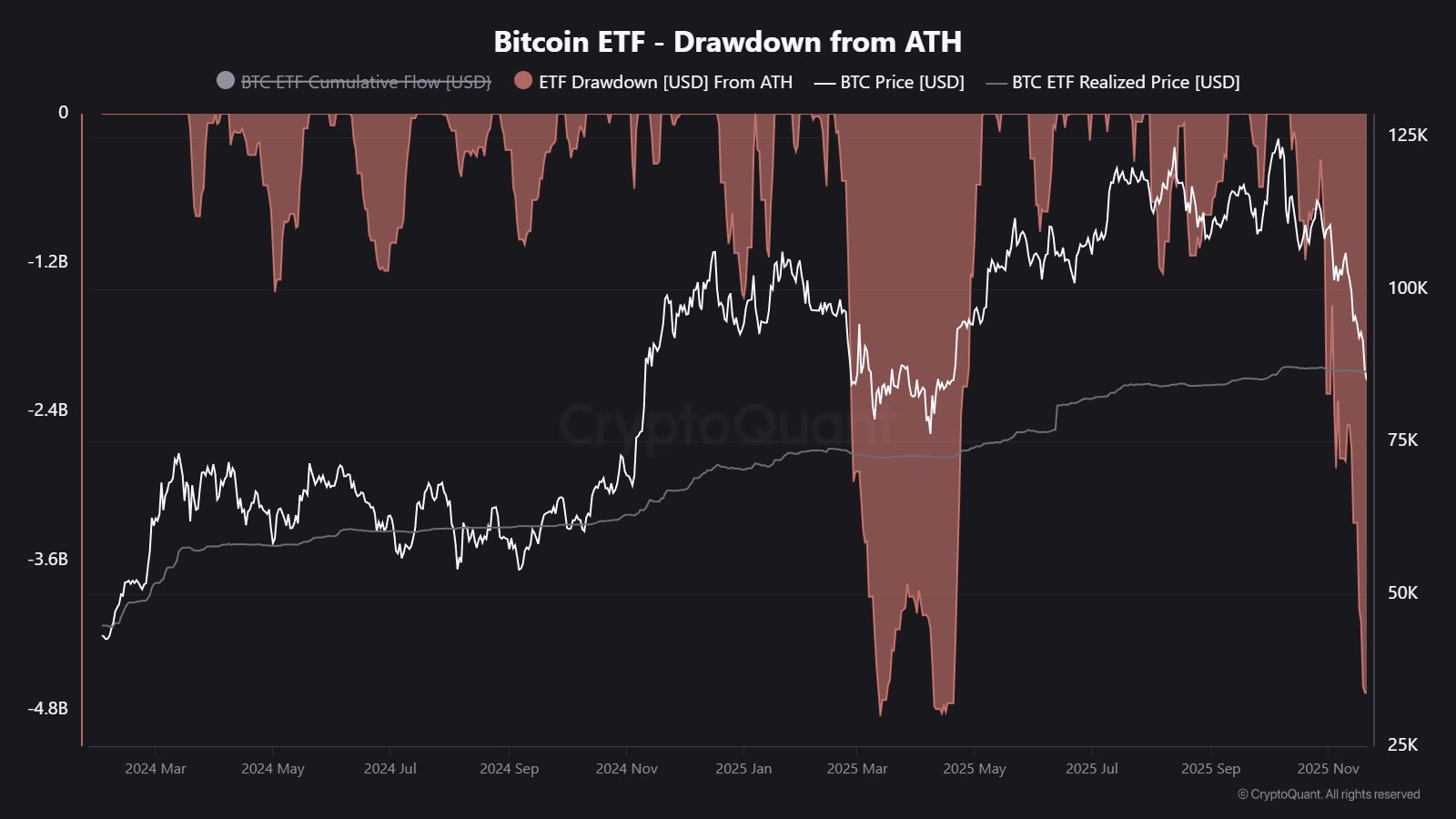

Cryptocurrencies are attempting to open the new week with modest, stabilizing gains after a very weak period during which BTC fell more than 30% from its recent highs. U.S. crypto ETFs remain the key monitoring tool for the market. Over the past four weeks, BTC-based funds have seen a record $4.35 billion in outflows. BlackRock’s IBIT alone recorded over $1.2 billion in net outflows last week, while the total trading volume of all funds exceeded $40 billion, suggesting significant institutional repositioning. A major driver for risk assets today is the sharp rise in expectations for a December rate cut—the market now assigns a 70% probability, compared with roughly 20% just a week ago.

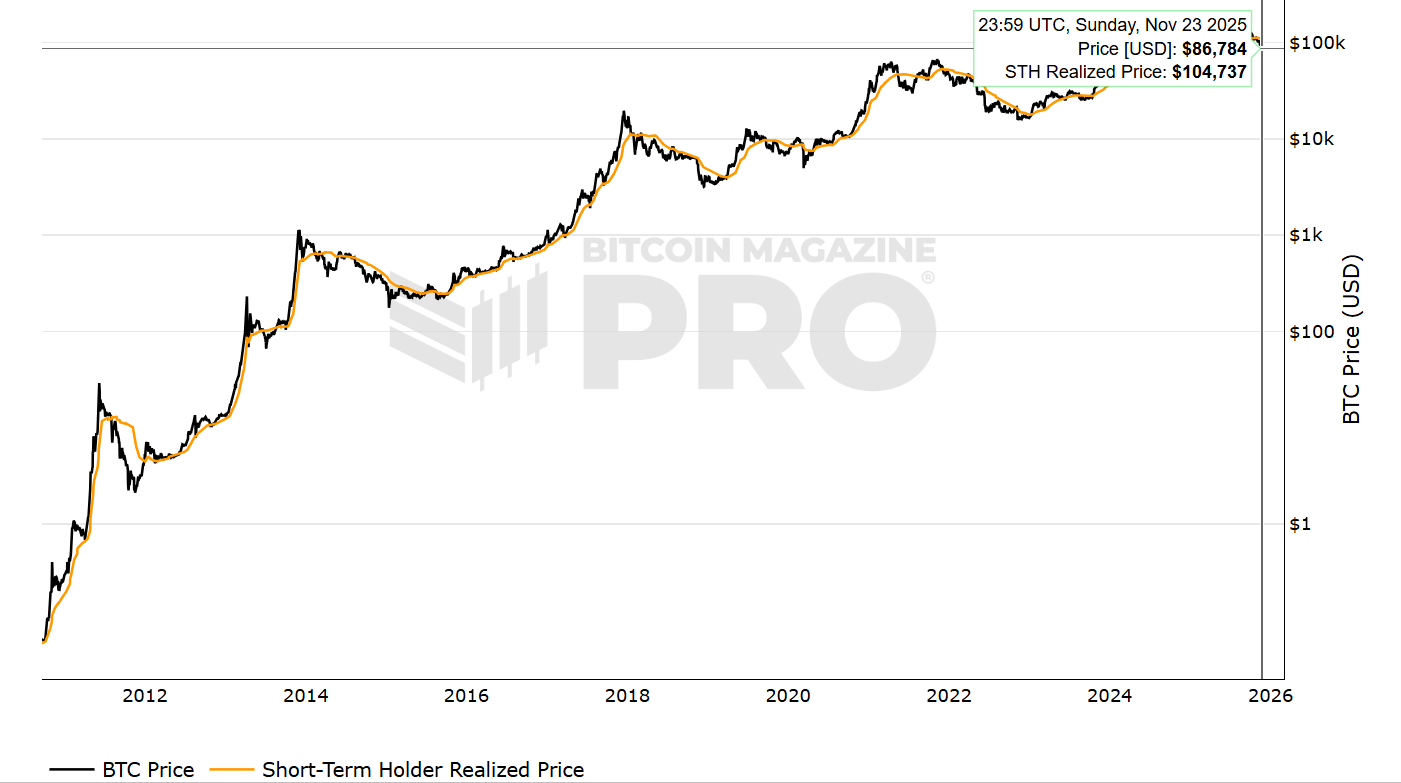

For now, as long as equity markets continue to rebound from recent declines, cryptocurrencies may follow a similar path. Similar-scale ETF outflows were seen in the spring during the Trump-tariff-driven sell-off. Source: CryptoQuant The average loss currently experienced by short-term investors is nearly 30%, a level historically associated either with Bitcoin entering a bear market or with bottom formations during deep corrections. Source: Bitcoin Magazine Pro

The average loss currently experienced by short-term investors is nearly 30%, a level historically associated either with Bitcoin entering a bear market or with bottom formations during deep corrections. Source: Bitcoin Magazine Pro

Bitcoin and Ethereum Charts

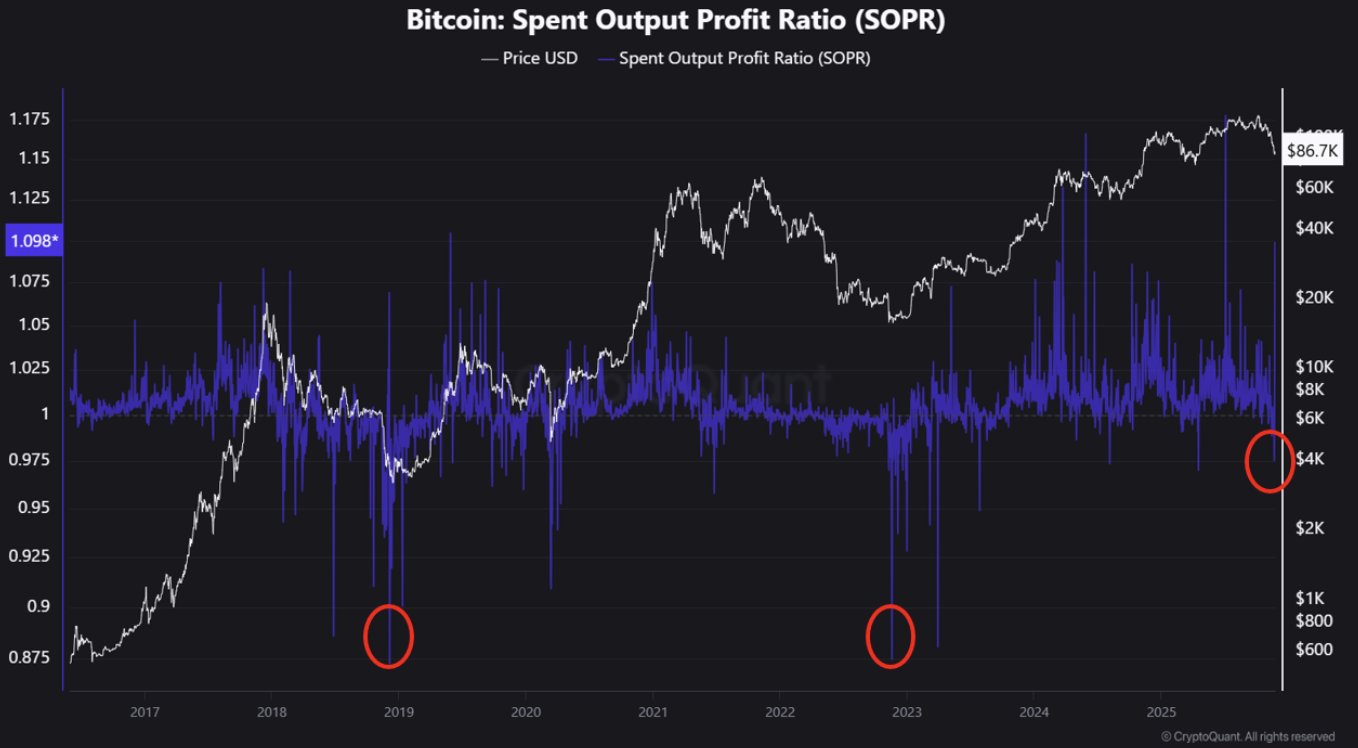

Looking back at the panic in April, Bitcoin’s peak-to-trough decline then—at its worst—was also around 30%, similar to now. However, that correction was less dramatic and more gradual. Today, BTC faces heavy profit-taking from the largest and oldest holders, while inflows from retail investors remain limited. Many retail traders lost capital during the October 10 crash, when hundreds of altcoins fell more than 50% within hours.

Source: xStation5

Ethereum still has a long way to go before reclaiming the $3,000 level. Both RSI and MACD point to extremely weak sentiment at the moment. Observing the EMA50 crossing below the EMA200 (“death cross”), we see that in the last four instances since 2021, this pattern twice marked a price bottom—but in the other two cases it preceded brief recoveries followed by another wave of declines.

Source: xStation5

A renewed drop below $80,000, according to CryptoQuant analysis, could increase the probability of a bear market and bring long-term pressure on Bitcoin’s Short-Term Holders, who have taken a significant hit in recent weeks.

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.