Cryptocurrencies open the week with declines, as profit-taking continues across the market. Ethereum was hit particularly hard, retreating nearly 10% from last week’s multi-year highs. ETH dropped to $4,250, while Bitcoin hovers around $115,000. Markets are closely watching the outcome of Trump’s talks with Zelenskyy and upcoming economic data—especially from the U.S.—scheduled for release this week. On Friday, the Jackson Hole symposium will begin.

- Beyond Ethereum, Algorand and Avalanche are also down by 5–7%, though it is still difficult to speak of broad market panic.

- Over the past 24 hours, nearly $240 million in long positions have been liquidated out of a total of roughly $340 million.

- On-chain data from CryptoQuant points to profit-taking among so-called whales (addresses holding more than 10,000 BTC), with exchange inflows rising sharply.

- As BTC prices fell, open interest in options markets also climbed, which may indicate growing interest in “trend tracking” strategies and the buildup of significant short positions.

Looking at U.S. equity indices, we see relatively mild downward pressure before Wall Street opens. In the short term, the biggest risk for 'crypto bull market' seems to be hotter inflation numbers and more hawkish Fed. Also, no deal between Ukraine and Russia may be welcome as 'inflationary' due to a sanctions on Russian energy resources: oil and gas.

Bitcoin and Ethereum Charts (D1)

The BTC price has fallen below the 50-day EMA, though it is still uncertain whether it can reclaim this level today. Historically, the EMA50 (orange line) has been important for momentum. In bull markets, it has often acted as support, with prices tending to rebound above it.

Source: xStation5

Momentum indicators for Ethereum appear more overheated. In the event of a deeper correction, the $4,000 level could serve as the first key support. Resistance remains around $4,800—the peak from the 2021 bull run—reinforced by recent selling pressure.

Source: xStation5

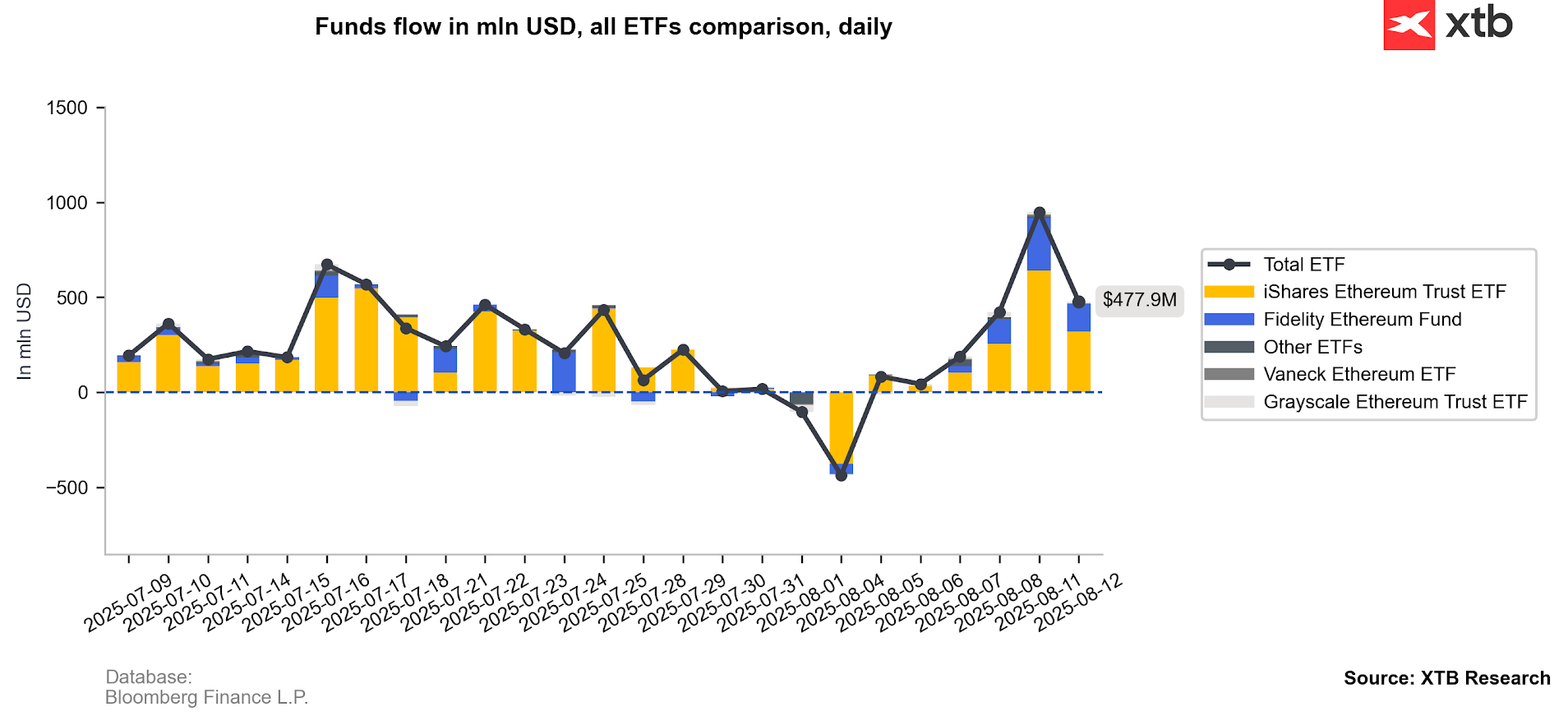

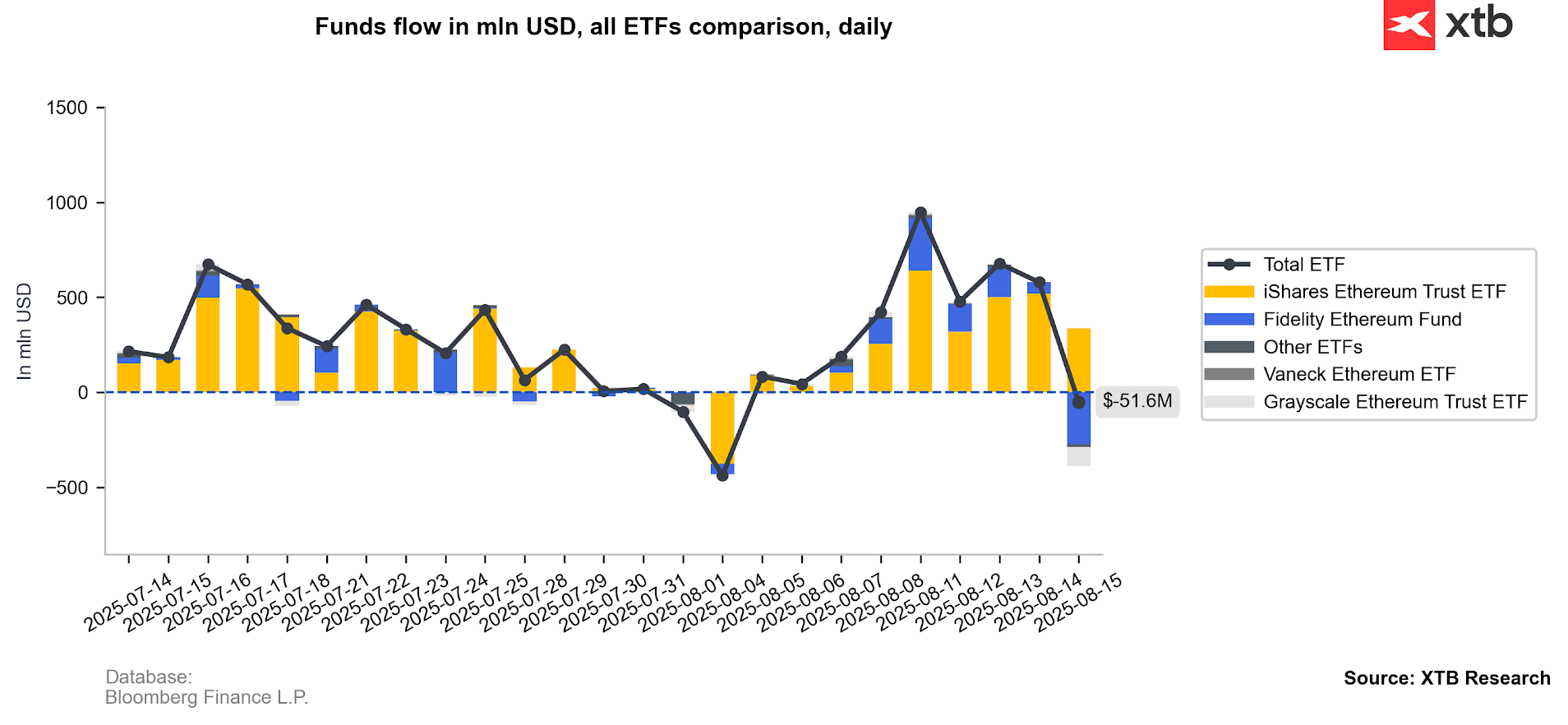

ETF Inflows

Bitcoin funds saw nearly $500 million in inflows last Friday. In contrast, Ethereum ETFs experienced outflows of over $50 million, suggesting profit-taking—likely from a single large entity, as the selling was concentrated almost exclusively in the Fidelity Ethereum Fund.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Crypto news: Bitcoin gains despite sell-off on global markets amid oil spike 📈

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.