Cryptocurrencies are making another attempt to rebound today after the recent sell-off. Bitcoin is slowly returning toward the $90,000 area, while Ethereum has managed to break above the psychologically important $3,000 level. In recent days, it was silver that captured the attention of the entire speculative market, in a sense “stealing” that role from Bitcoin. Today, however, the metal’s price plunged sharply from a record high of $82 to just under $75 amid widespread profit-taking, partly accelerated by the CME raising margin requirements.

At the same time, the silver case—whose market capitalization is around $4.5 trillion compared with roughly $1.8 trillion for Bitcoin—also shows that a move toward $200,000 could theoretically be realistic in 2026 if the trend shifts, despite the market’s sheer size. Silver has risen by more than 100% since the beginning of June 2025 alone, which may fuel bullish imagination—especially if Bitcoin enters the new year in a much better mood. For now, the largest cryptocurrency is still trading about 30% below its all-time high, while Ethereum, despite solid network fundamentals, remains roughly 45% below record levels.

Will Bitcoin become the “second silver” in 2026?

Could Bitcoin, much like in 2020, return to the spotlight in 2026 and start approaching the kind of performance silver delivered in 2025? From a macro perspective, the pattern so far has typically been that precious metals (safe havens) move first, and only then does Bitcoin follow. Capital tends to start defensively and only later rotates into risk assets.

After the March 2020 crash (COVID), the key driver was the liquidity impulse: the Fed “flooded” markets with liquidity, but that liquidity did not flow into crypto immediately—it first sought safety. Gold and silver were the first to move. Gold rose from around $1,450 to $2,075 by August 2020, while silver jumped from about $12 to $29 over the same period.

Meanwhile, BTC spent roughly five months consolidating between $9,000 and $12,000—similar to the current sideways trend.

The turning point came when metals were setting records: once gold and silver reached local peaks (August 2020), capital began rotating toward risk, triggering the next stage of the cycle.

The rotation effect in 2020/2021: BTC surged from roughly $12,000 to $64,800 by May 2021 (about +550%), while the total crypto market cap grew around eightfold.

Today, gold is sitting at record highs near $4,550, and silver around $80. If this framework holds, interest in metals could fade in 2026—potentially in favor of BTC.

An additional element in the narrative is another major liquidation event on October 10th (somewhat comparable to March 2020). Typically, after such a “shock,” BTC often spends months rebuilding structure before transitioning into a clearer trend. So what might differentiate 2026 from 2020? In the previous cycle, liquidity alone dominated; this time, a more supportive “structural package” could join in, including:

-

potential renewed liquidity injections and expected rate cuts,

-

possible regulatory relief / exemptions for banks,

-

more crypto-friendly regulation in the U.S.,

-

scenarios involving checks distributed to citizens as part of U.S. fiscal policy,

-

continued expansion of spot crypto ETFs,

-

easier access for the largest asset managers, including Fidelity and BlackRock,

-

potentially more crypto-friendly leadership at the Fed.

The fact that gold and silver moved first is not a bearish signal for crypto. Bitcoin and the broader crypto market typically move only after metals cool off / pause. The current price action in Bitcoin—and its weak relative performance versus silver and gold—does not necessarily imply the start of a bear market.

That said, it’s worth noting that the concept of Bitcoin’s four-year cycles suggests a different scenario and could point to similarities with 2022 rather than 2020. However, four-year cycles may not work with the same strength as before, given that: over 90% of all BTC is already in circulation, spot ETFs are operating in the U.S., and in 2026 the Fed will likely still be cutting rates (rather than hiking them, as in 2022). The regulatory environment in the U.S. is also more crypto-friendly today, and broad “deregulation” could support fundamentals.

Bitcoin and Ethereum charts (D1)

Looking at the charts of both cryptocurrencies, the RSI has moved to or above 50, while a MACD moving-average crossover increases the likelihood of further upside. For Bitcoin, the key resistance zone is around $94,000, where price has already been rejected multiple times. For Ethereum, the key level is $3,500. Key supports sit near $86,000 for BTC and around $2,800 for ETH.

PlanB pointed out that Bitcoin’s correlation with equities and precious metals has been declining, which historically preceded price increases and may suggest a gradual “bottoming” process. Of course, it’s worth remembering that history does not have to repeat itself.

Source: xStation5

Source: xStation5

BCMI, on-chain demand, and ETF flows

The BCMI indicator for the broader crypto market fell sharply, pointing to rising bear-market risk.

Source: CryptoQuant

On-chain metrics still indicate a deeply negative demand environment for Bitcoin.

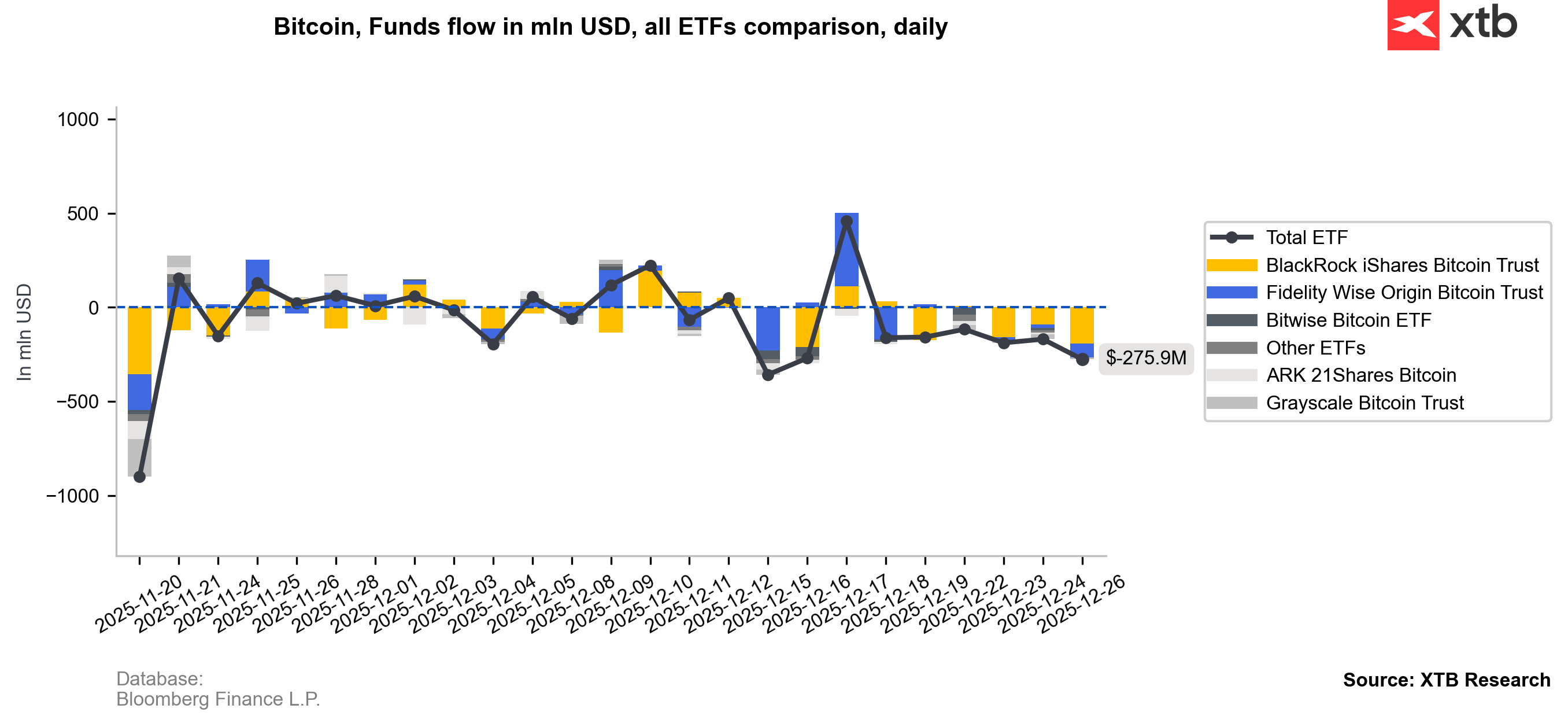

ETF inflows have declined

The balance of the last 10 sessions is deeply negative for both of the largest cryptocurrencies, while net outflows from Bitcoin ETFs in the most recent session turned out to be the largest in a long time, coming in at -$275 million. Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.