The price of Bitcoin has unexpectedly risen above $20,500 in the last 7 hours. Ethereum also made gains, rising above $1,700 amid The Merge, which is coming up in just 5 days:

- US indices yesterday scored a successful session amid a weakening dollar. Today's session in Europe is also in a better mood, which is helping to maintain the demand sentiment in the crypto market;

- Analysts at investment firm Alliance Bernstein pointed to the change in Ethereum consensus as a key 'market driver' for the cryptocurrency market. Provided, of course, that it is successful;

- A report prepared at the request of Joe Biden in March of this year indicates that cryptocurrency mining could hinder the White House's fight against climate change. According to analysts in the report, we can learn, among other things, that cryptocurrencies now consume about as much energy as all private computers or all residential lighting;

- Coinbase investors are suing the Treasury Department for overstepping its authority in connection with sanctions issued on the Tornado Cash smart contract built on the Ethereum blockchain, which helped maintain the anonymity of transaction participants. Civil and criminal sanctions have been in effect in the US since August 8 for failing to comply with the ban on Tornado Cash.

According to WenMerge, which analyzes Ethereum's on-chain data in real time, there are only four days left before the difficulty bomb goes off. Merge is expected to take place a day later. Source: WenMerge

According to WenMerge, which analyzes Ethereum's on-chain data in real time, there are only four days left before the difficulty bomb goes off. Merge is expected to take place a day later. Source: WenMerge The Fear and Greed Index, a sort of component barometer of cryptocurrency market sentiment prior to the start of Bitcoin's rally that night, indicated 'Extreme fear,' which potentially still gives plenty of room for upward movement in the event of a prolonged improvement in risk sentiment. Source: alternative.me

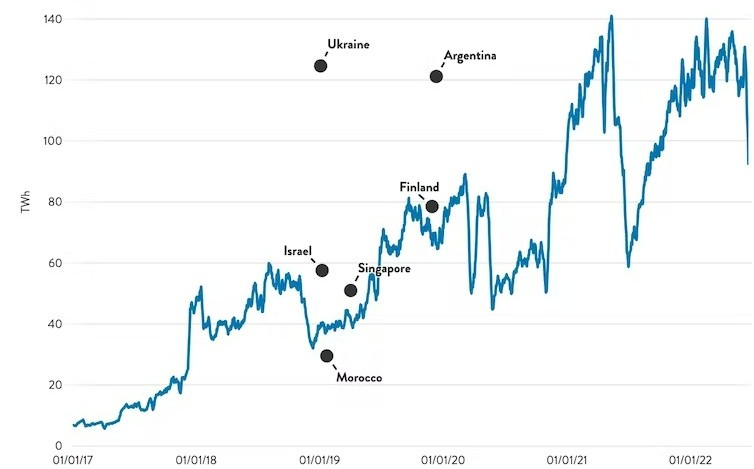

The Fear and Greed Index, a sort of component barometer of cryptocurrency market sentiment prior to the start of Bitcoin's rally that night, indicated 'Extreme fear,' which potentially still gives plenty of room for upward movement in the event of a prolonged improvement in risk sentiment. Source: alternative.me Bitcoin's consumption has dropped noticeably which is directly related to the declining activity of miners. At the same time, it still remains at a very high level, tokens using the Proof of Work consensus (diggers and miners approving a transaction as a result of computing power competition) may find themselves subject to strict regulation in the future, however, they do not fit into the organic institutional narrative of ESG (Enviromental, Social and Governance) by which institutional demand may decline. Source: CoinShares

Bitcoin's consumption has dropped noticeably which is directly related to the declining activity of miners. At the same time, it still remains at a very high level, tokens using the Proof of Work consensus (diggers and miners approving a transaction as a result of computing power competition) may find themselves subject to strict regulation in the future, however, they do not fit into the organic institutional narrative of ESG (Enviromental, Social and Governance) by which institutional demand may decline. Source: CoinShares Ethereum chart, H4 interval. The 200-session average, the SMA 200, may prove to be the most significant element on the chart. The previous ascent above this average, on July 15, initiated a rally of nearly 100%. The rally in Ether's price after 'The merge' would indicate potentially growing institutional interest in the cryptocurrency, which will become a deflationary asset once the difficulty bomb is triggered. However, a worrying signal comes from the RSI, which indicates overbought, previously levels above 70 indicated an impending correction. On the other hand, however, analyzing the case of the breakthrough of the 200 SMA from mid-July, we see that an increase in the RSI is natural when demand breaks through key resistance zones and can hold at these levels for an extended period of time. The first significant resistance may turn out to be around the 23.6 Fibonacci retracement, which coincides with the local peak from the end of July this year. A potential drop below $1,600 could initiate another wave of panic even in the area of $1,300, where the entire trend initiated by the aforementioned ascent above the 200-session average on July 15 would be erased. Source: xStation5

Ethereum chart, H4 interval. The 200-session average, the SMA 200, may prove to be the most significant element on the chart. The previous ascent above this average, on July 15, initiated a rally of nearly 100%. The rally in Ether's price after 'The merge' would indicate potentially growing institutional interest in the cryptocurrency, which will become a deflationary asset once the difficulty bomb is triggered. However, a worrying signal comes from the RSI, which indicates overbought, previously levels above 70 indicated an impending correction. On the other hand, however, analyzing the case of the breakthrough of the 200 SMA from mid-July, we see that an increase in the RSI is natural when demand breaks through key resistance zones and can hold at these levels for an extended period of time. The first significant resistance may turn out to be around the 23.6 Fibonacci retracement, which coincides with the local peak from the end of July this year. A potential drop below $1,600 could initiate another wave of panic even in the area of $1,300, where the entire trend initiated by the aforementioned ascent above the 200-session average on July 15 would be erased. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.