-

Fed delivers first 50 basis point rate hike in 22 years

-

QT to begin in June at pace of $47.5 billion per month

-

Fed is not actively considering 75 basis point rate hikes

-

USD drops, gold gains after Powell's presser

-

EU inching closer to embargo on Russian oil, crude jumps 5%

-

European indices finish trading lower

-

ADP employment report shows 247k jobs gain in April (exp. 395k)

-

ISM services employment subindex drops into recession territory in April

-

Lyft and Uber Technologies drop after Q1 earnings disappoint

-

AMD gains as management remains bullish on PC demand

FOMC meeting was a key point in today's and this week's economic calendar. As expected, the US central bank delivered the first 50 basis point rate hike in 22 years and announced the beginning of quantitative tightening. Balance sheet run-off will begin in June at a monthly pace of $47.5 billion and increase to $95 billion after 3 months. Fed Chair Powell explained during the press conference that US central bankers are not actively considering a possibility of a 75 basis point rate hike but 50 basis point rate hikes are on table for the next couple of meetings.

The EU embargo on Russian oil was a big story of the day as well. While European Union members failed to agree on the definite shape of oil sanctions, decision may come this or next week. Embargo is expected to be gradual with some countries exempted from it. However, what looks massive is that it will target not only oil imports but also provide services to the Russian oil shipping sector, like for example maintenance or insurance. As Russia relies on foreing tanker fleet to ship its oil overseas, such measures may have a negative impact on Russian oil exports even beyond those to the EU. Both Brent and WTI gained more than 5% today.

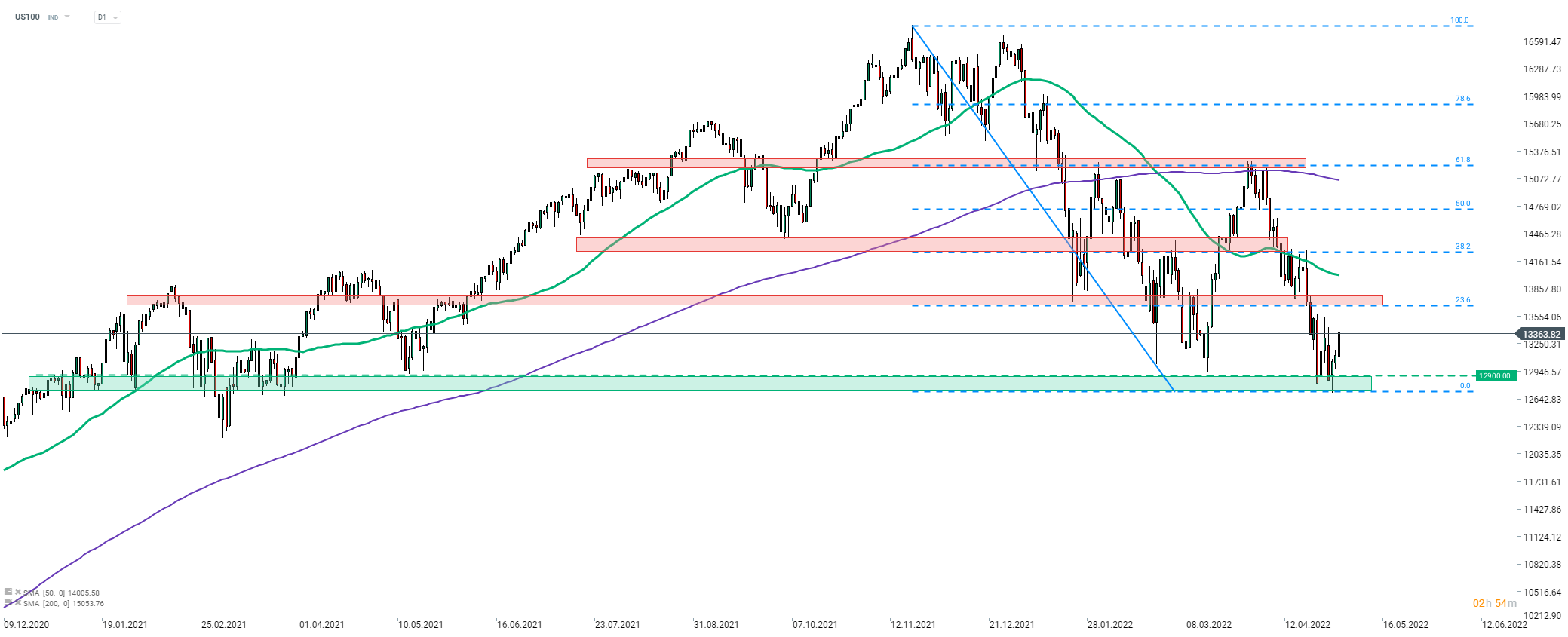

Nasdaq-100 (US100) continues recovery with help from Fed. Both a policy decision and Powell's presser were seen as less hawkish than expected. Source: xStation5

Nasdaq-100 (US100) continues recovery with help from Fed. Both a policy decision and Powell's presser were seen as less hawkish than expected. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.