- Wall Street erased much of the gains from the beginning of the session. The S&P500 gained 0.19%, the Dow Jones traded flat, and the Nadsaq rose 0.53%. Bank stocks failed to maintain their initial gains and resumed their downward movement, dampening investor sentiment overseas;

- The U.S. GDP reading was revised slightly downward to 2.6% versus 2.7% in the first release. Unemployment claims came in higher than expected at 198k vs. 195k expected. Core PCE inflation was revised slightly upward, to 4.4% vs. 4.3% previously;

- Comments by Susan Collins and Tom Barkin of the Fed put pressure on the USD. Barkin stressed that not every bank collapse is a 'second Lehman Brothers' although the impact of the current crisis on inflation and the economy is difficult to predict. Collins did not rule out that a possible extension of the banking crisis could have an impact on the Fed's monetary policy, which currently does not expect rate cuts in 2023;

- Rating agencies Moody's, S&P Global and Fitch Ratigns have stressed that the banking crisis will affect tighter credit conditions. S&P warned of a possible hard landing for many economies;

- Gold quotations approached the $2,000 barrier. A weakening dollar and weaker macro readings, coupled with the uncertainty of US banks, supported a rebound in precious metals prices;

- Major stock indices from Europe had a solid session. Germany's DAX tested 2023 year's highs today. The German index gained 1.26% today, while France's CAC40 added 1.06% and London's FTSE100 closed 0.74 higher. German inflation fell sharply from 8.7% to 7.4%, missing expectations by just 0.1%;

- Sentiment in Europe was supported by a disinflationary trend, easing concerns around Deutsche Bank and excellent financial results from textile giant H&M. The company posted a profit against a loss expected by analysts. The financial report signaled that the condition of consumers in Europe is healthy. Shares of Adidas, Puma and Spanish clothing holding company Inditex gained on the report's wave;

- Looking at the forex market, US Dollare weakened during Thursday's session. The EURUSD tested March peaks,.The overall sentiment remains upward, and if will be maintained, an attack on the February high at 1,10 zone could be a possible scenario;

- Cryptocurrencies started the session with increases, which weren't maintained. In the evening hours, all major digital currencies are trading lower. Bitcoin slightly corrected this year's maximums, but after reaching new peaks, it quickly retreated. The BTC price created a bearish 'Shooting star' candlestick formation on the D1 interval.

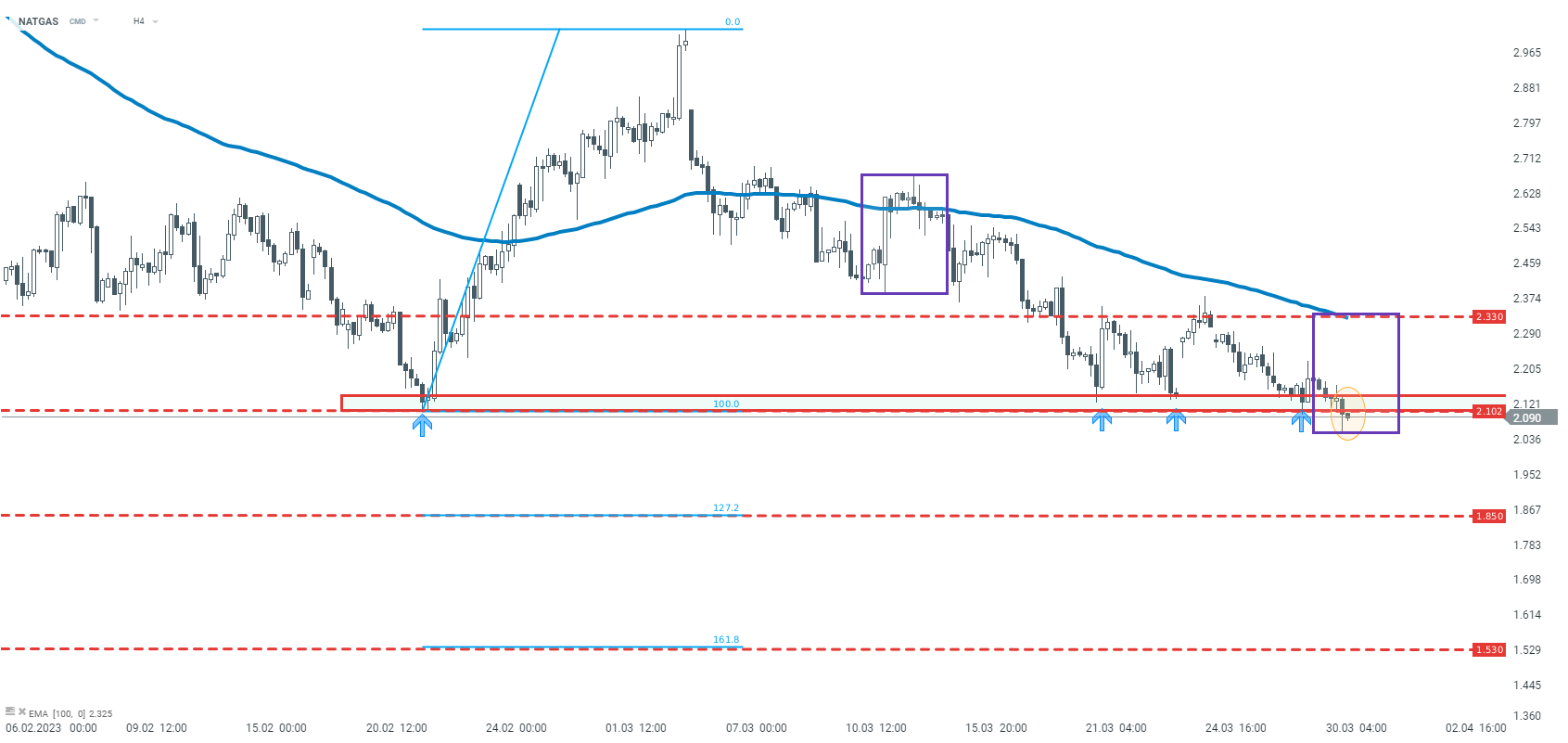

NATGAS is trading at the lowest levels this year. The price has broken below the key support at $2.1, stemming from recent lows. If the breakout is sustained, the downward movement could extend toward FIbonacci's levels, determined by the recent upward correction. In case of a pullback, the key resistance is the $2.33 level, where the upper limit of the 1:1 geometry and the EMA100 average fall. Source: xStation5

NATGAS is trading at the lowest levels this year. The price has broken below the key support at $2.1, stemming from recent lows. If the breakout is sustained, the downward movement could extend toward FIbonacci's levels, determined by the recent upward correction. In case of a pullback, the key resistance is the $2.33 level, where the upper limit of the 1:1 geometry and the EMA100 average fall. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.