Global equities markets have been dominated by some mixed moods today. Some Asian indices finished the session lower while others added some gains like Shanghai Composite (+1.74%). However, one should keep in mind that coronavirus now seems to be more or less under control there. European indices were more consistent as most of them ended the day into the red. DAX lost 0.97% and CAC finished the session 1.24% lower. American equities have been fluctuating heavily. As upbeat moods dominated the market open, U.S. stocks suddenly turned negative. At press time all major indices from America are trading higher again, Nasdaq is leading the gains (+1.00%).

As declines on global stock markets seem to be justified amid the ongoing Covid-19 turmoil, American investors seem to run against the grain. Especially if one takes U.S infections spike into account. Untied States reported over 60,000 thousand new infected people which is the new daily record. Moreover, President Trump ramped up to get public schools to fully reopen this fall.

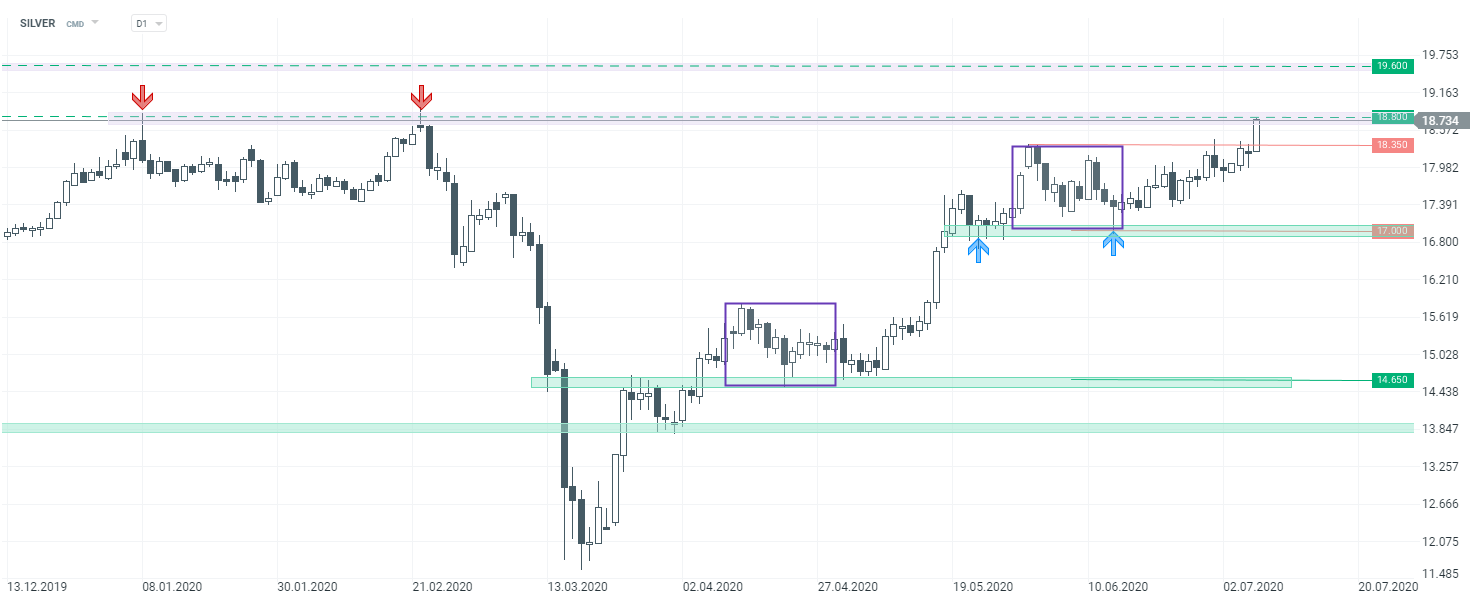

Silver prices are soaring once again, currently gains exceed 2.50%. As a result silver touched crucial resistance zone ($18.80). Moreover, after finally breaking above $1800 price level gold is surging as well. The yellow metal prices have reached levels last seen in 2011.

In terms of economic calendar, today’s trading day was rather light. The only event that might have shocked some market participants was EIA’s weekly report. The data showed unexpected crude oil inventories build-up while analysts estimated that stocks would diminish. Oil prices are currently gaining over 0.60%

Tomorrow one should be particularly interested in German trade balance as the reading surprised investors a month ago. Thursday means that the U.S. Department of Labor will release its jobless claims report. Apart from that, Canada will publish its housing starts and building permits for the month of June. With no distinct “market-moving” events ahead of us, one should still pay attention. Today’s EIA’s report shows that investors and traders should be prepared for any circumstances.

Silver has been trading in an upward trend in recent days. As investors clearly flee towards silver and gold amid the ongoing uncertainty, silver prices reached crucial resistance zone ($18.80). These levels were last seen before the pandemic began. Should the price break above now, one might focus on $19.60 resistance zone. Source: xStation5

Silver has been trading in an upward trend in recent days. As investors clearly flee towards silver and gold amid the ongoing uncertainty, silver prices reached crucial resistance zone ($18.80). These levels were last seen before the pandemic began. Should the price break above now, one might focus on $19.60 resistance zone. Source: xStation5

🚨Silver slides 1.5% - is the uptrend at risk?

Morning wrap (16.01.2026)

Natural gas tries to recover after EIA report 🔎

Divorce of Europe and the USA over Greenland

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.