- BoE will slow the pace of its bond-buying

- US weekly jobless claims drop below 500k

- Gold price above $1800/oz

European indices finished todays’ session slightly higher as investors were not inclined to open new positions ahead of tomorrow’s highly anticipated NFP report. On the corporate front, several eurozone banks, including UniCredit and Societe Generale posted better than expected quarterly figures. On the monetary policy front, the Bank of England left interest rates and the size of its stimulus programme unchanged. The Central Bank said it would slow bond-buying to 3.4 billion pounds a week between May and August, down from its current pace of 4.4 billion pounds a week and raise 2021 GDP forecasts. Dax30 finished today’s session flat, CAC40 rose 0.3% and finished at 6,357 pts, a level not seen since the early 2000s. Meanwhile FTSE 100 rose 0.5% to 7,076 pts, its highest close since February 2020.

US stock indexes managed to erase early losses and are trading higher, with Dow Jones touching another intraday record after upbeat weekly jobless claims report which showed that the number of Americans filing new claims for unemployment benefits dropped to a new year low. Earlier major US drugmakers' shares came under pressure after President Joe Biden said he had backed a WTO waiver for COVID-19 vaccine intellectual property.

WTI crude fell more than 1.3% and is trading slightly below $64.75 a barrel, while Brent is trading nearly 1.2% lower around $68.10 a barrel. Elsewhere gold rose 1.5% to $ 1,815.00 / oz, while silver is trading 3.0 % higher, around $ 27.30 / oz amid weaker dollar and lower Treasury yields.

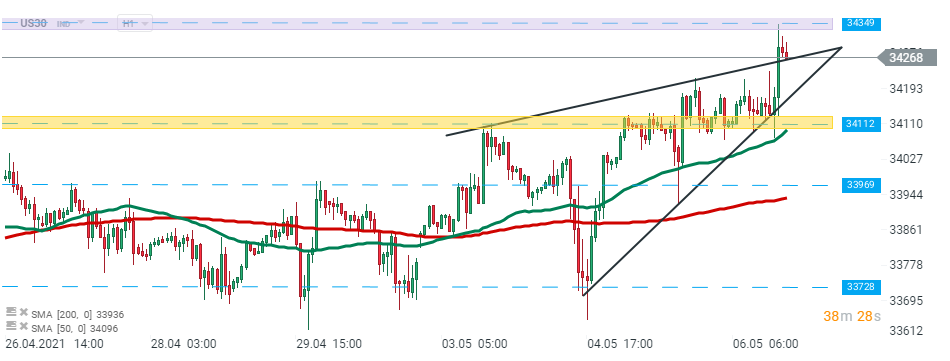

US30 rose sharply during today’s session after a strong claims report. Index broke above the upper limit of the triangle pattern and reached new all-time high at 34349 pts. However buyers failed to uphold momentum and the index pulled back slightly. However as long as price sits above major support at 34112 pts, buyers seem to be in advantage. Source: xStation5.

US30 rose sharply during today’s session after a strong claims report. Index broke above the upper limit of the triangle pattern and reached new all-time high at 34349 pts. However buyers failed to uphold momentum and the index pulled back slightly. However as long as price sits above major support at 34112 pts, buyers seem to be in advantage. Source: xStation5.

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

3 markets to watch next week (05.12.2025)

US100 gains after PCE data 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.