- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

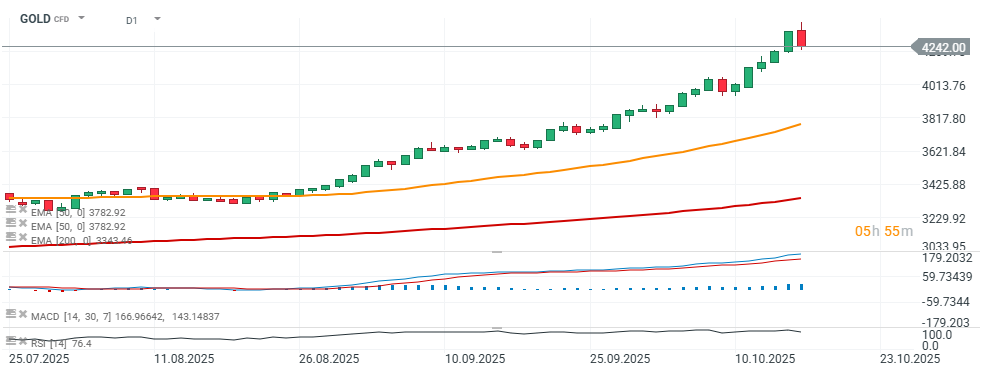

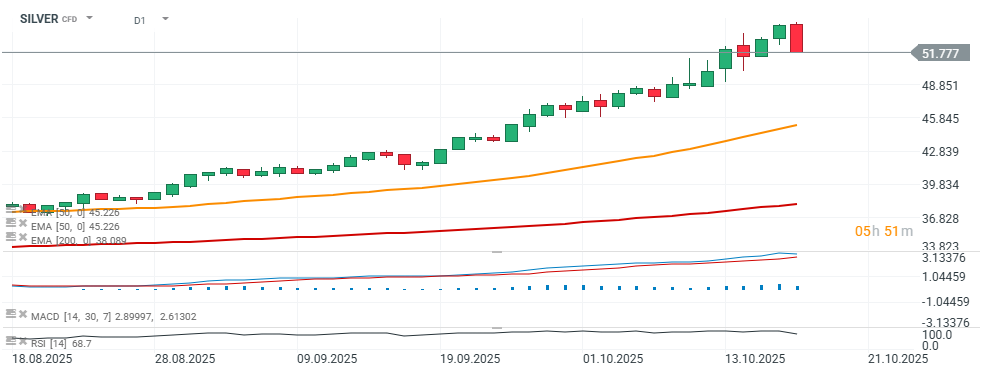

Precious metals fell as the U.S. dollar strengthened, following President Donald Trump’s remark that a “full-scale” tariff on China would be unsustainable in the long term. For a moment, gold appeared ready to extend its biggest rally since the 2008 collapse of Lehman Brothers, but prices later retreated as Trump adopted a calmer tone on trade policy. The announcement of a meeting between the U.S. president and Chinese leader Xi helped ease market sentiment and reduce demand for safe-haven assets.

Source: xStation5

Even so, the metal has gained more than 60% this year, driven by geopolitical tensions, central bank purchases, and expectations of U.S. interest rate cuts. Standard Chartered forecasts an average gold price of $4,488 in 2026, while HSBC sees $5,000 as a realistic target. Physical demand in Asia remains strong, with Indian spot gold premiums reaching decade highs.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.