-

Market pessimism in Europe, U.S. tries to rebound

-

EURUSD trading flat

-

The CBRT raises interest rates

European markets closed below the flatline today as coronavirus fears are still having enormous impact on investors’ sentiment - U.K. reported highest number of daily cases since the pandemic began (6,634 new infections). DAX finished the day 0.29% lower while CAC 40 lost 0.83%. FTSE 100 tumbled 1.30%, even though British Finance Minister announced a new emergency package of measures to contain unemployment.

U.S. indices started the day lower, yet American equities try to rebound. At press time all major indices are adding some gains with Nasdaq rising the most. In the second part of the day precious metals gain steam as well, earlier silver prices fell below the $22 mark today. EURUSD is trading more or less flat.

In terms of economic calendar, the SNB and Norges Bank decided to keep interest rates unchanged, but the CBRT unexpectedly raised repo rate by 200 basis points to 10.25% which caused Lira to surge. German Ifo Business Climate climbed to 93.4, the result was worse than expected though. U.S. initial jobless claims came in below expectations as another 870k workers filed new unemployment claims. On the other hand, new home sales in the U.S. climbed to highest level since 2006, exceeding 1 million threshold.

Tomorrow the U.S. will publish its durable goods orders report. In the evening oil traders might be interested in Baker Hughes rig count. Investors will certainly be focused on the newsflow as no other major events are planned for tomorrow.

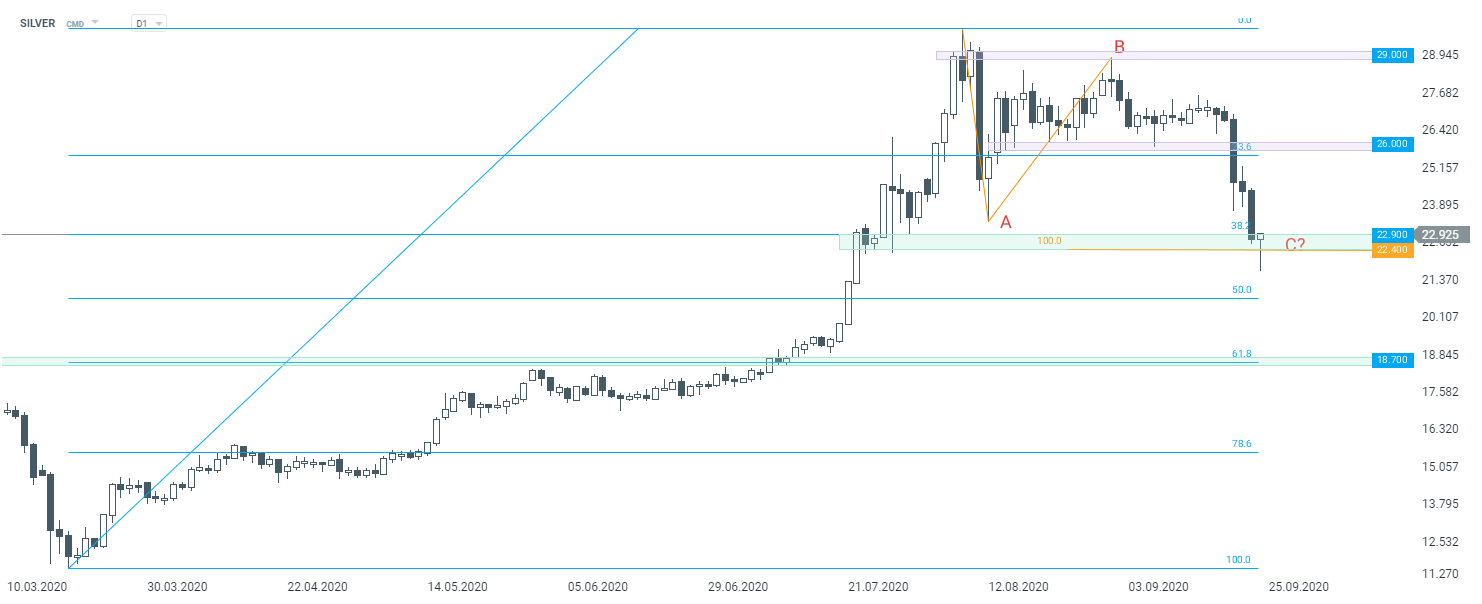

Silver started the day lower, yet one might spot a rebound in the second part of the day. There is a chance that a pin bar pattern will be formed on the daily chart (which should be perceived bullish). Source: xStation5

Silver started the day lower, yet one might spot a rebound in the second part of the day. There is a chance that a pin bar pattern will be formed on the daily chart (which should be perceived bullish). Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.