- European bourses finished deeply in green

- Wall Street rallies for a second day

- US oil inventories fell unexpectedly

European indices rose sharply today, with DAX adding1.57%, CAC40 rose 1.46% and the FTSE100 finished 1.01% higher as signs of easing tensions in Ukraine lifted market sentiment. Automakers were among the best performers. Volkswagen stock jumped over 6% after news of possible listing of its luxury brand Porsche AG. Also, technology sector climbed 2.9% as government bond prices eased and shares of banks edged up 0.8% to the highest since 2018, benefitting from prospects for higher interest rates.

Wall Street indices also moved higher on Wednesday following set of upbeat quarterly results and declining treasury yields. The 10-year U.S. Treasury yield retreated to 1.91% from levels last seen in 2019 ahead of tomorrow highly anticipated US inflation data. During today's session tech-stocks rose sharply, with Meta, Tesla and Microsoft up about 2% each, while Chipmaker AMD rose over 1% after an upgrade from Daiwa Capital Markets. On the data front, mortgage applications in the US dropped 8.1% last week, the biggest decline in almost a year as buyers started to pull back faced with rising mortgage rates.

Mixed moods prevail today in commodity markets amid weaker dollar. Gold broke above resistance at $1827.50, silver jumped to $23.30. WTI price rose after EIA report, which showed that oil stockpiles fell by 4.756 million barrels, following a 1.046 million drop in the previous period and compared with market forecasts of a 0.369-million-barrel. However buyers failed to uphold momentum and price pulled back later in the session. Meanwhile Brent dropped below $91.50. Major cryptocurrencies swing between gains and losses. Bitcoin is testing $44 000 while Ethereum price remains near $3200 level supported by upbeat comments from Well Fargo which sees potential in digital currencies.

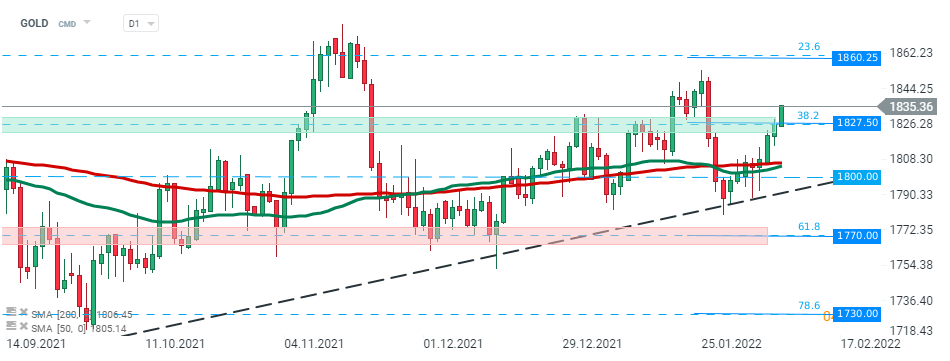

Gold price managed to break above major resistance at $1827.50 during today’s session which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2021. If current sentiment prevails, upward move may accelerate towards resistance at $1860.25 marked with 23.6% retracement. Source: xStation5

Gold price managed to break above major resistance at $1827.50 during today’s session which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2021. If current sentiment prevails, upward move may accelerate towards resistance at $1860.25 marked with 23.6% retracement. Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.