-

Stocks in Europe and US extend upward move

-

China asks local governments to prepare for Evergrande collapse

-

Rate decisions from CBRT, BoE and Norges Bank

-

Disappointing flash PMIs for September

-

Bitcoin gains on Twitter news

Stock markets around the world move higher on Thursday. Major benchmarks from Europe finished today's trading around 1% higher and indices from Wall Street are trading over 1% higher at press time. This is surprising given that flash PMIs for September from Europe and the United States disappointed today. Manufacturing and services indices were expected to drop but decline was bigger than expected, with supply bottlenecks and weakening demand being seen as prime reasons.

Today's performance of equity markets may suggest that Evergrande concerns eased. However, this is far from true, especially given news that arrived on the markets today. China urged the company to avoid near-term default on its USD bonds but at the same time asked local governments to prepare for the downfall of the Chinese developer and resulting consequences. In other news it was reported that the company's EV unit has halted payments to its staff and suppliers.

Big moves could have been spotted on the FX market today after the Central Bank of the Republic of Turkey, Bank of England and Norges Bank announced monetary policy decisions. The Norwegian central bank became the first one from a developed country to hike rates in post-Covid era. Norges Bank increased rates by 25 basis points and provided a boost for NOK. On the other hand, CBRT delivered an unexpected rate cut and has pushed lira to fresh record lows. When it comes to the Bank of England, rates were left unchanged but the announcement was viewed as a hawkish one and boosted odds for a rate hike at the beginning of 2022.

Bitcoin gained around $1,000 in the evening following the announcement from Twitter. US social media company said that users using an iOS app will be able to tip others with Bitcoin.

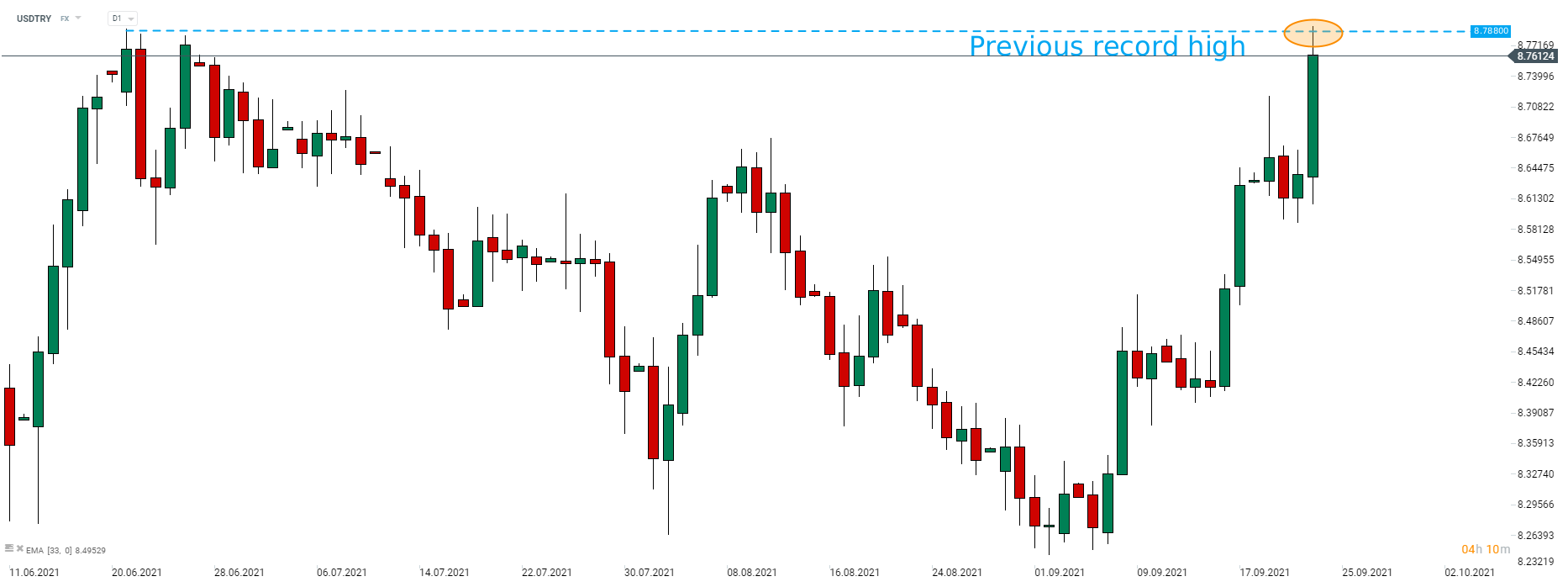

USDTRY trades around 1.5% higher on the day after CBRT delivered an unexpected rate cut. The pair has been trading lower before CBRT announcement and jumped almost over 2% afterwards. While USDTRY pulled back from daily highs, a new record high on the pair was reached. Source: xStation5

USDTRY trades around 1.5% higher on the day after CBRT delivered an unexpected rate cut. The pair has been trading lower before CBRT announcement and jumped almost over 2% afterwards. While USDTRY pulled back from daily highs, a new record high on the pair was reached. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.