- Upbeat sentiment in European and US equity markets

- AUDUSD rebound

- Crude oil continues its upward movement

- Bitcoin returns above $50 000

Today's session on the stock market was dictated by buyers. Good moods are explained by the decrease in fears about a new variant of the coronavirus, according to the latest reports Omicron is not as dangerous as initially thought. Already from the early morning hours we could observe increases on the stock market, which were extended after the entry of capital from overseas. The main European stock indices closed the day on a solid positive note, with the US indices also performing well. Germany's DAX strengthened 2.8%, erasing almost the entire panic sell-off of 26 November, while France's CAC40 gained 2.9% and the Euro Stoxx 50 added over 3.3%.

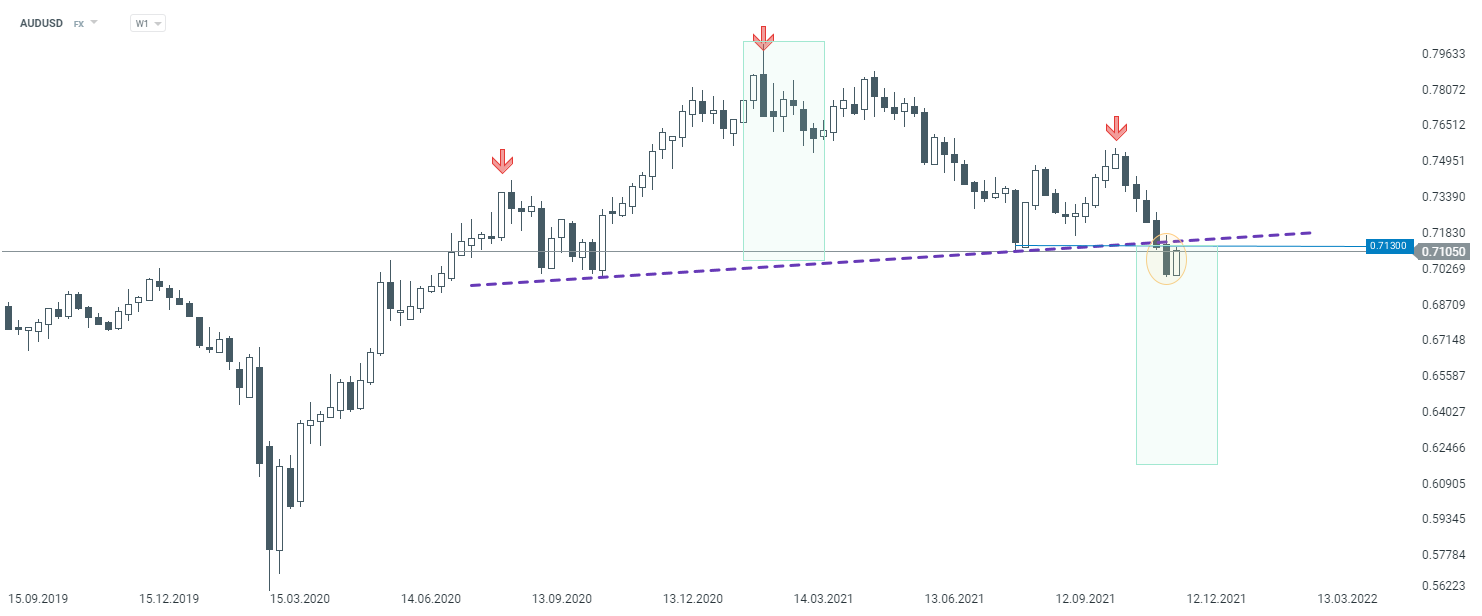

As for the forex market, most notable was the Australian dollar, which strengthened more than 0.8% against the US dollar. AUDUSD quotations have rebounded from several months' lows, but still remain in a downward trend. Today in the morning we learned about the RBA decision on interest rates, but the bank, as expected, left them at 0.1%, so the volatility at the time of publication was moderate. The Canadian currency also strengthened against the US on Tuesday, with movement on USDCAD reaching 0.7% in favour of CAD.

Looking at commodities, crude oil is doing well, with prices rising for another consecutive session. We will pay 2.6% more for a barrel of Brent than yesterday, while WTI is up over 3%. As for NATGAS, on Tuesday we saw a slight recovery from yesterday's sell-off. For now, however, it is far too little to talk about a change in sentiment.

On the cryptocurrency market, we are seeing a further attempt to rebound after the weekend plunge. Bitcoin managed to go above the round level of $50 000, but it is doing much worse than the second most popular cryptocurrency - Etehreum, which is slowly moving towards historical peaks.

Looking at the technical situation on the AUDUSD currency pair, we can see a broad formation derived from classical technical analysis - Head and Shoulders pattern. According to the book assumptions, the bottom breakout of the neckline argues for a change in sentiment to downward. This scenario will remain valid as long as the price stays below the level of 0.7130.

Despite the rebound, AUDUSD remains below the neckline of the broad Head and Shoulders pattern, W1 interval. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.