- PPI matched the pace of deceleration of CPI in June. The inflation came out at 0.1% YoY which was significantly lower than 0.4% expected. Earlier it was 0.9% YoY. Producers' inflation indicates that CPI may continue a decrease in further months despite the fact that the June print had the highest “base”

- Lower inflation may change the Fed's view on further hikes although the July hike is rather a done deal

- EURUSD reached the vicinity of 1.12 after Daly presented a less hawkish stance. She said that 2 hikes are not guaranteed and previous remarks were the way to keep optionality open.

- Minutes from the June ECB meeting did not surprise the market. ECB members agreed that a June hike was needed and expect another hike in July. Moreover, the bankers indicated that due to persistent inflation, there is a chance to extend the hiking cycle beyond July.

- The start of the earnings season is encouraging as Delta Airlines showed record quarterly revenue and profits. Furthermore, Pepsico increased its full-year guidance.

- US100 gains more than 1% and it is only about 8% short of an all-time high. The earnings season started but the market will close watch banks' reports tomorrow

- TNOTE has continued its rebound which supports further gains in commodities, especially in precious metals. Gold was close to 1960 USD per ounce

- NATGAS falls nearly 3% as inventories are still rising and stay significantly above the 5-year average

- GBPUSD has broken the 1.30 resistance as the UK GDP print came out better than expected. The monthly GDP change in May was -0.1% versus -0.3% that was expected. Stronger GDP data may encourage BoE to raise interest rates further

- IEA said in a recent report that demand is set to rise by 2.2 mbd in 2023 and reach a record 102.1 mbd. IEA pointed out that the oil exports from Russia declined to the lowest since March 2021 and Saudi Arabia's output is set to hit a 2-year low close to 9mbd in July and August will put positive pressure on prices. WTI tested a vicinity of 77 USD/b today

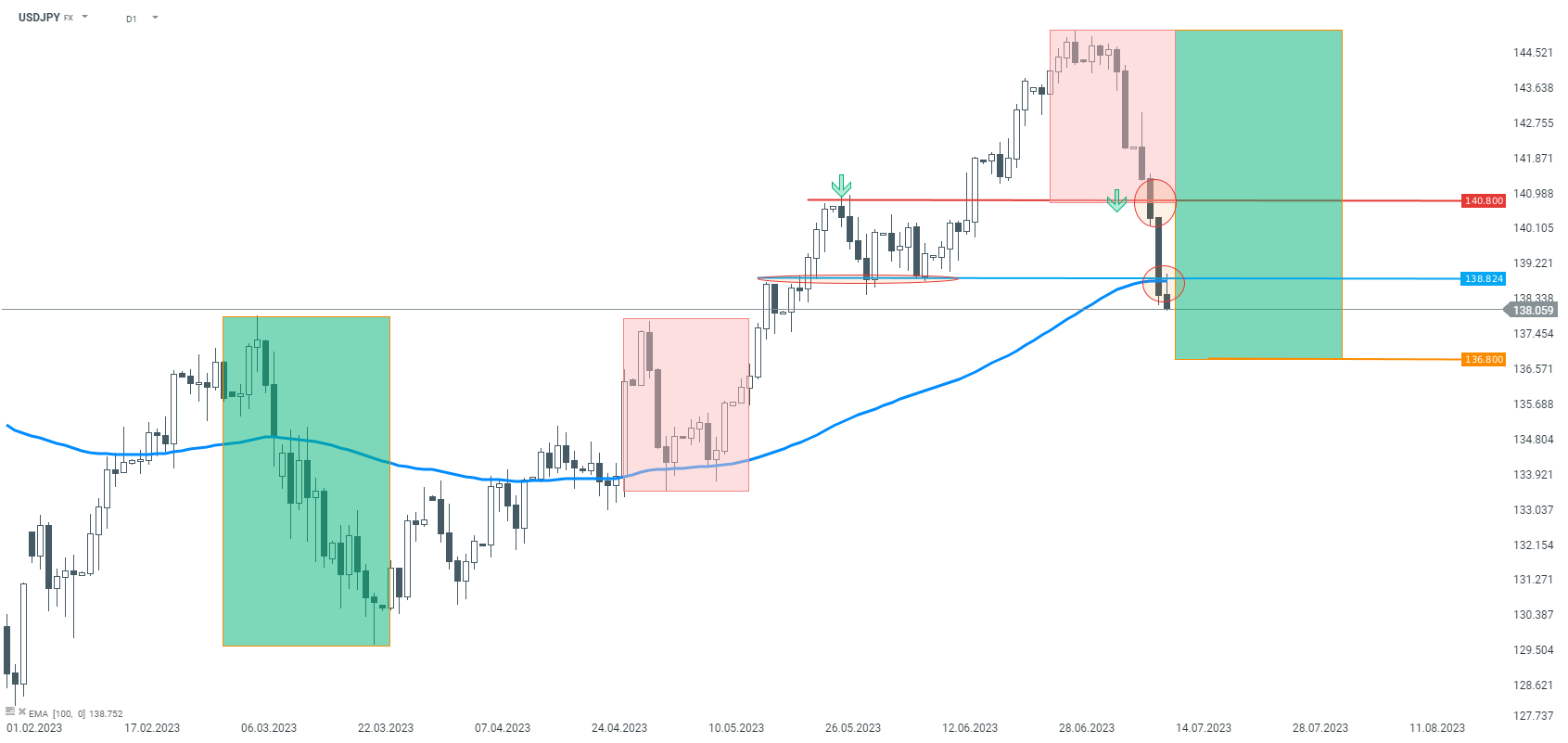

![]() USDJPY continues to decline. The pair broke support at 140.80 on Monday without much trouble, and today broke below the average EMA100. The next target for sellers may be the level of 136.80, resulting from the lower limit of the wide 1:1 structure. Source: xStation5

USDJPY continues to decline. The pair broke support at 140.80 on Monday without much trouble, and today broke below the average EMA100. The next target for sellers may be the level of 136.80, resulting from the lower limit of the wide 1:1 structure. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

USDJPY continues to decline. The pair broke support at 140.80 on Monday without much trouble, and today broke below the average EMA100. The next target for sellers may be the level of 136.80, resulting from the lower limit of the wide 1:1 structure. Source: xStation5

USDJPY continues to decline. The pair broke support at 140.80 on Monday without much trouble, and today broke below the average EMA100. The next target for sellers may be the level of 136.80, resulting from the lower limit of the wide 1:1 structure. Source: xStation5