-

Sell-off on global financial markets

-

Silver craters over 9%

-

U.S. dollar as “the winner” of the day

Global financial markets started the week amid continued coronavirus fears due to potential U.K. lockdown measures, which might have fuelled today’s rout. Banks were among top laggards as a report concerning suspicious transactions was released. The report suggests that some major banks might have been involved in money-laundering or other illegal activities. European stocks fell the most in over three months - DAX finished the day 4.37% lower while CAC 40 plunged 3.74%.

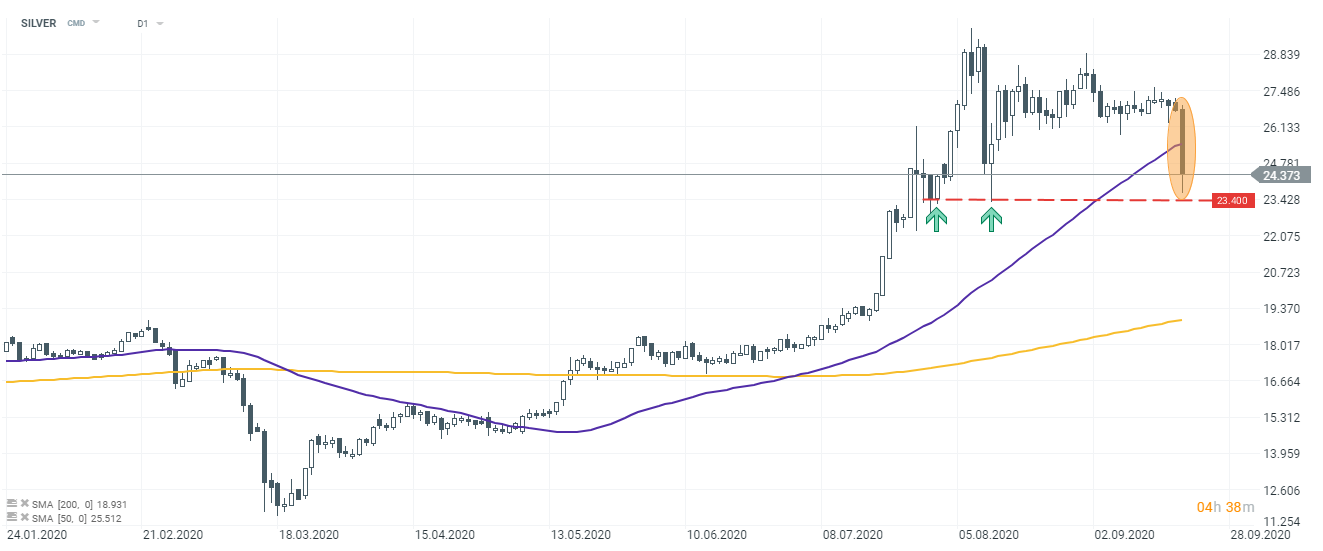

U.S. indices started the day in a pessimistic moods as well with tech stocks being the most resilient (Nasdaq is down around 1% at press time while S&P 500 is trading almost 2.50% lower). As today’s sell-off is widespread and affects various asset classes, precious metals plunge too. Gold prices tested $1,900 mark today and they seesaw around this crucial barrier now. The biggest declines might be spotted on silver markets as silver spot price craters over 9%. The U.S. dollar re-emerged as a haven currency with EURUSD gradually approaching the 1.1725 level. It is worth mentioning that despite higher volatility (VIX is up 11%), the U.S. bond market is barely moving. Ten-year Treasury yields remain in a range from 60 bps to 75 bps, which indicates that there is no evident fear in fixed income.

Tomorrow the RBNZ will release its rate statement while the Riksbank will announce its interest decision. At 3 pm BST the U.S will publish existing home sales data, which might give some insight into the country’s economic recovery. Apart from that, one might be particularly interested in several FOMC members speeches - Kaplan and Williams will speak at 11 pm BST today while Fed’s Chairman is supposed to start his speech at 3:30 pm BST tomorrow.

Silver plunges almost 10% today. One might view the $23.4 mark as the nearest support. Bulls did manage to regain control in this area twice following recent price surge. Source: xStation5

Silver plunges almost 10% today. One might view the $23.4 mark as the nearest support. Bulls did manage to regain control in this area twice following recent price surge. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.