-

Stock markets mostly higher

-

Oil prices advance amid OPEC+ meeting

-

Gold dips below $1900 an ounce

Global stock markets started June on a positive note. European indices finished the day higher with the German DAX (DE30) and EuroStoxx 600 reaching fresh all-time highs. US indices started the session higher, yet pared most gains. Meme stock mania in the US continues, but traders witnessed some interesting headlines as Mudrick Capital is said to have sold the entire stake that the fund had purchased at $27.12, saying that the stock is overvalued.

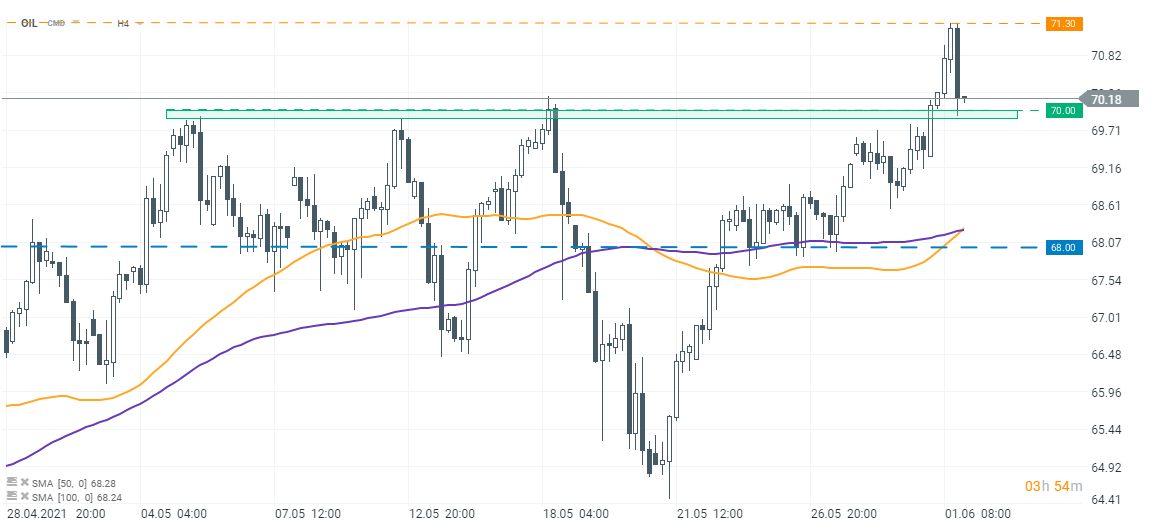

Oil markets were focused on key OPEC+ meeting that is taking place today. OPEC+ countries are most likely to reconfirm gradual production increase through July. Both WTI and Brent prices soared today, but pared some gains in the afternoon. Gold fell below $1900 an ounce for a while, but the price returned slightly above that threshold.

Today’s calendar was full of interesting macro releases. While OPEC+ discussed key issues for oil markets, investors also paid attention to numerous manufacturing PMI reports - most of them surprised to the upside. On the other hand, CPI report from the eurozone for May came in above expectations (2.0% YoY vs exp. 1.9% YoY). ISM Manufacturing from the US turned out to be better-than-expected as well as the headline index rose from 60.7 in April to 61.2 in May.

Tomorrow traders might expect higher AUD volatility as Australia will release its 1Q GDP report at 02:30 am BST. Apart form that, a retail sales report for April from Germany will be released in the morning European time, which might be helpful in assessing the sentiment among European consumers.

Brent prices (OIL) smashed through key $70 a barrel level today, reaching highest levels since early-March. However, oil suddenly dipped in the afternoon, paring some earlier gains. This does not change the fact that the prices are still trading higher on the day and remain above the $70 mark - key short-term support for now. Source: xStation5

Brent prices (OIL) smashed through key $70 a barrel level today, reaching highest levels since early-March. However, oil suddenly dipped in the afternoon, paring some earlier gains. This does not change the fact that the prices are still trading higher on the day and remain above the $70 mark - key short-term support for now. Source: xStation5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.