-

Upbeat economic data supports stock markets

-

Gold with some bigger swings

-

Markets awaiting tomorrow’s Fed policy announcement

Global stock markets continue to push higher due to solid economic reports which were published today. Major blue-chip indices from the Old Continent finished the day slightly higher. DAX added 0.18% while CAC 40 rose 0.32%. British FTSE 100 outperformed the rest and gained 1.32%. U.S. equities started the day in a positive territory as well with tech stocks leading early gains. Nasdaq is adding as much as 1.50% at press time.

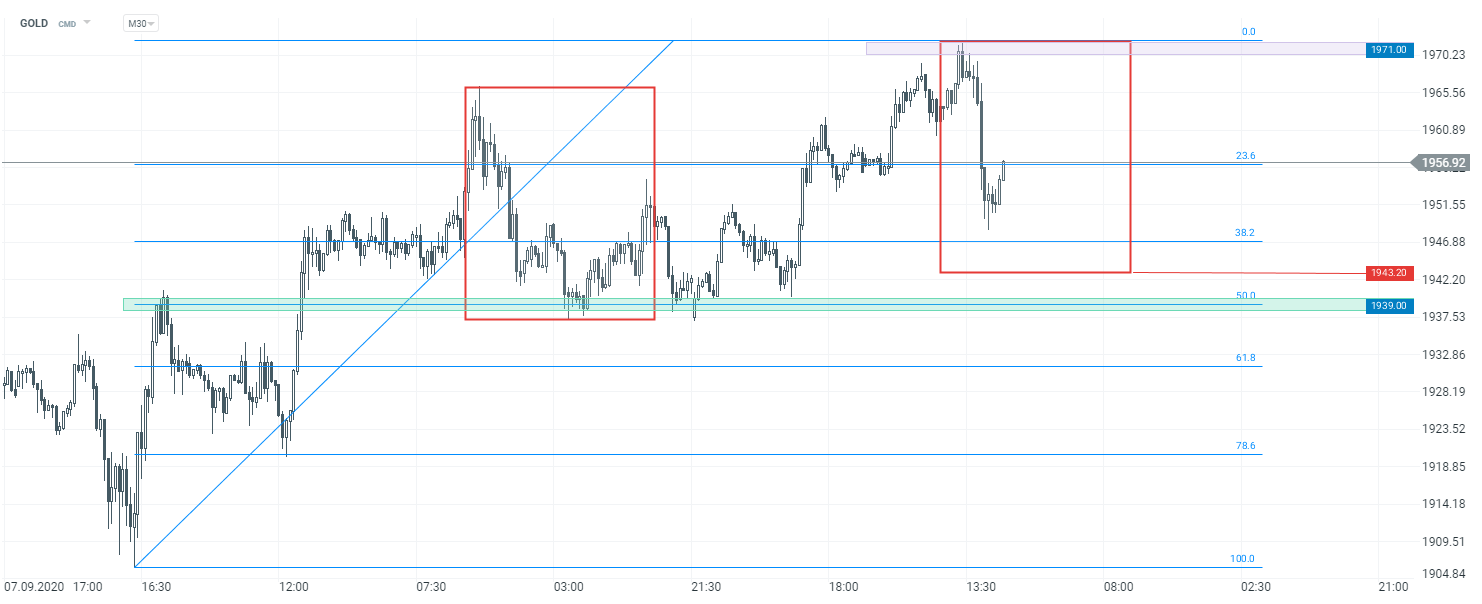

Oil prices tend to gain along with risk assets today. Brent prices returned above $40 per barrel while WTI is trading above the $38 mark. One could spot some bigger swings on precious metals markets. As gold prices approached the $1,971 mark, market bears managed to gain control and gold fell over $20.

Today’s calendar was pretty hectic. Crucial data from China managed to maintain upbeat moods as both Chinese industrial production and retail sales came in above market expectations. German ZEW indices did well too as the Economic Sentiment index rose in September to 77.4 pts (vs exp. 69.8 pts). Another surprise (in a positive sense) was NY Empire State Manufacturing Index as it climbed to 17.0 pts and nearly matched July’s post-Covid peak. However, the U.S. industrial production for the month of August came in below expectations (0.4% MoM vs exp. 1.0% MoM)

Tomorrow will be a big day for global financial markets due to some key events. First of all, investors will get to know the U.S. retail sales data for the month of August. Canada and UK will release their CPI reports while oil traders will focus on EIA’s crude oil data. Finally, the Fed will announce its interest rate decision and Powell’s conference will be in the spotlight as the monetary policy announcement may be regarded as the most important event of the day.

Gold started the day with upbeat moods, but in the afternoon one could have spotted a small correction. Should market bears remain in control, investors may focus on two supports levels. The first one can be found at $1,943 while the second one coincides with the $1,939 mark. Source: xStation5

Gold started the day with upbeat moods, but in the afternoon one could have spotted a small correction. Should market bears remain in control, investors may focus on two supports levels. The first one can be found at $1,943 while the second one coincides with the $1,939 mark. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.