- FOMC decided to keep rates unchanged in the 5.25-5.50% range. However, new set of forecasts turned out to be hawkish

- FOMC expects higher growth in 2023 and 2024 previously. While median rate forecast for end-2023 was left unchanged at 5.60% (one more 25 bp rate hike), forecast for 2024 was boosted from 4.6 to 5.1% (50 bp of rate cuts instead of 100 bp previously)

- Market reaction to FOMC decision and forecasts was hawkish - USD gained while stocks and gold dropped

- Wall Street indices are trading mixed - S&P 500 trades 0.3% lower, Nasdaq drops 0.6%, Russell 2000 trades flat and Dow Jones gains 0.3%

- European stock market indices finished today's trading higher - DAX gained 0.7%, FTSE 100 moved 0.9% higher, CAC40 jumped 0.7% and Dutch AEX traded 0.5% higher. Polish WIG20 was outperformer with 2.3% gain

- ECB Makhlouf said that in his opinion March 2024 is too early for a rate cut. Money markets currently see the first ECB rate cut by the end of Q2 2024

- UK Prime Minister Sunak said that he will not push for a ban on new Oil & Gas projects in the North Sea

- Bank of Canada minutes showed that further policy tightening remains an option given uncertain path of inflation

- EIA report showed a 2.14 million barrel drop in US oil inventories (exp. -2.5 mb) as well as 0.83 mb drop in gasoline inventories (exp. -0.2 mb) and 2.87 mb drop in distillate inventories (exp. -0.5 mb)

- UK headline CPI inflation decelerated from 6.8% to 6.7% YoY (exp. 7.0% YoY) while core CPI slowed from 6.9 to 6.2% YoY (exp. 6.8% YoY)

- Money markets now price in a less than 50% chance of Bank of England delivering a 25 basis point rate hike tomorrow, down from around 70% before CPI data release

- Japanese exports dropped 0.8% YoY in August (exp. -1.7% YoY) while imports were 17.8% YoY lower (exp. -19.4% YoY)

- Cryptocurrencies are trading mostly lower with Bitcoin and Dogecoin dropping 0.2%, Ethereum trading 0.8% lower and Litecoin plunging almost 4%

- Energy commodities are pulling back - oil drops 1.3% while US natural gas prices are down 3.5%

- AUD and USD are the best performing major currencies while GBP and JPY lag the most

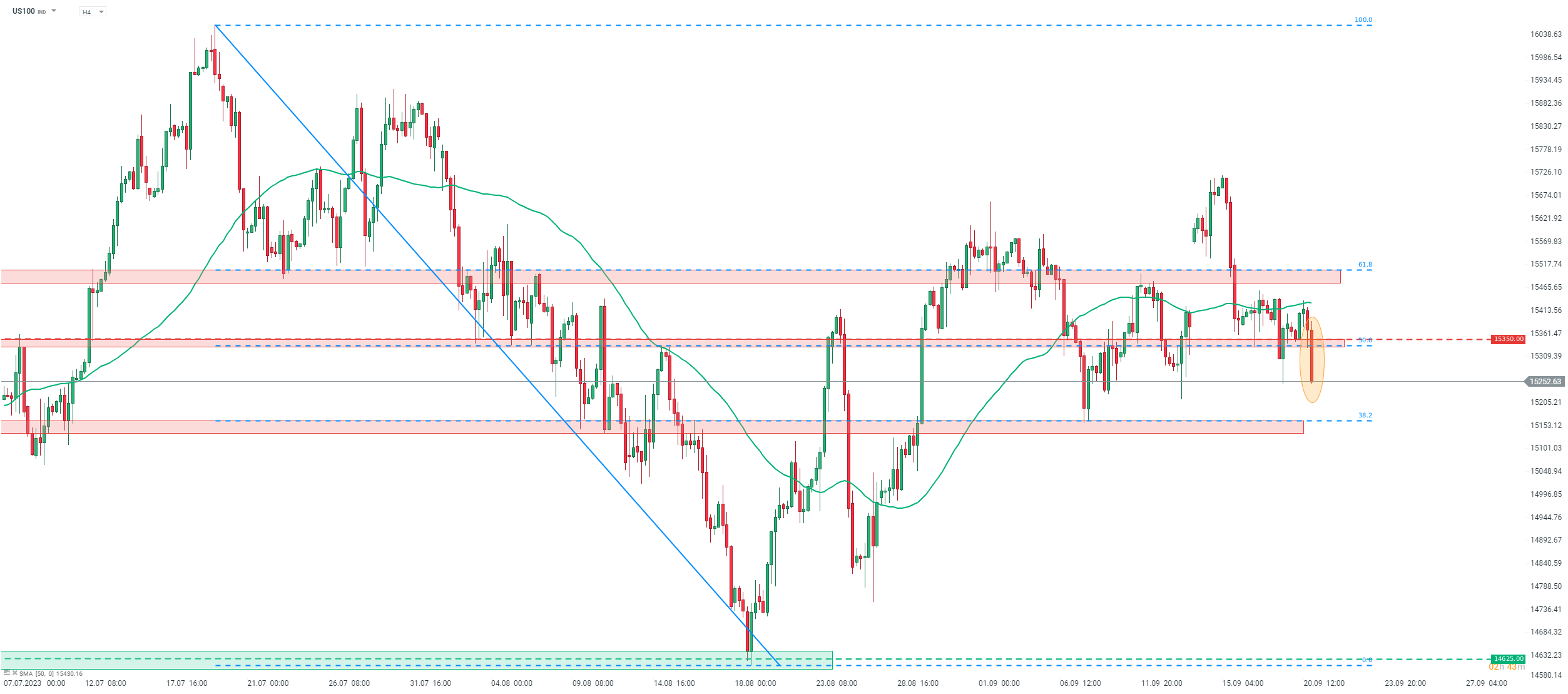

Hawkishness of Fed projections has triggered a sell-off in riskier assets like equities, especially tech shares. Nasdaq-100 futures (US100) are down 0.9% on the day and are testing daily lows. Source: xStation5

Hawkishness of Fed projections has triggered a sell-off in riskier assets like equities, especially tech shares. Nasdaq-100 futures (US100) are down 0.9% on the day and are testing daily lows. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.