-

European markets finish the day little-changed

-

Gold slowly approaching the $1900 mark

-

Portugal’s 10-year yield turns negative

Tuesday’s session on global stock markets was dominated by some mixed moods in the first part of the day. European indices were mostly falling, but somehow managed to cut losses and finished little-changed. DAX closed 0.06% higher, while FTSE 100 added 0.05%. CAC 40 fell 0.23%. American equities opened lower but at press time one might spot some minor gains on the US stock exchange with Russell 2000 outperforming its peers. S&P 500 climbed to fresh all-time highs at press time

Gold prices have been slowly approaching the $1900 mark, but silver lags behind today. EURUSD stays above 1.2100 level. Moves on oil markets are rather minor during today’s session. Some pointed out an interesting situation on bond markets as Portugal’s 10-year yield fell below 0% for the first time in history, which shows the impact of ECB’s monetary policy and its massive asset purchase programmes.

Today’s economic calendar was pretty light. Japan released revised 3Q GDP data, which turned out to be better-than-expected (5.3% QoQ vs expected 5.0% QoQ). ZEW headline index for December came in above expectations as well. Preliminary data for 3Q showed that euro area’s GDP rose 12.5% YoY (vs exp. 12.6%).

Tomorrow markets will pay attention to German trade balance data and Bank of Canada’s interest rate decision. Apart from that, EIA will release its crude oil inventories figures, which will be crucial for oil traders. Obviously markets will monitor the developments in terms of EU stimulus talks and post-Brexit trade negotiations

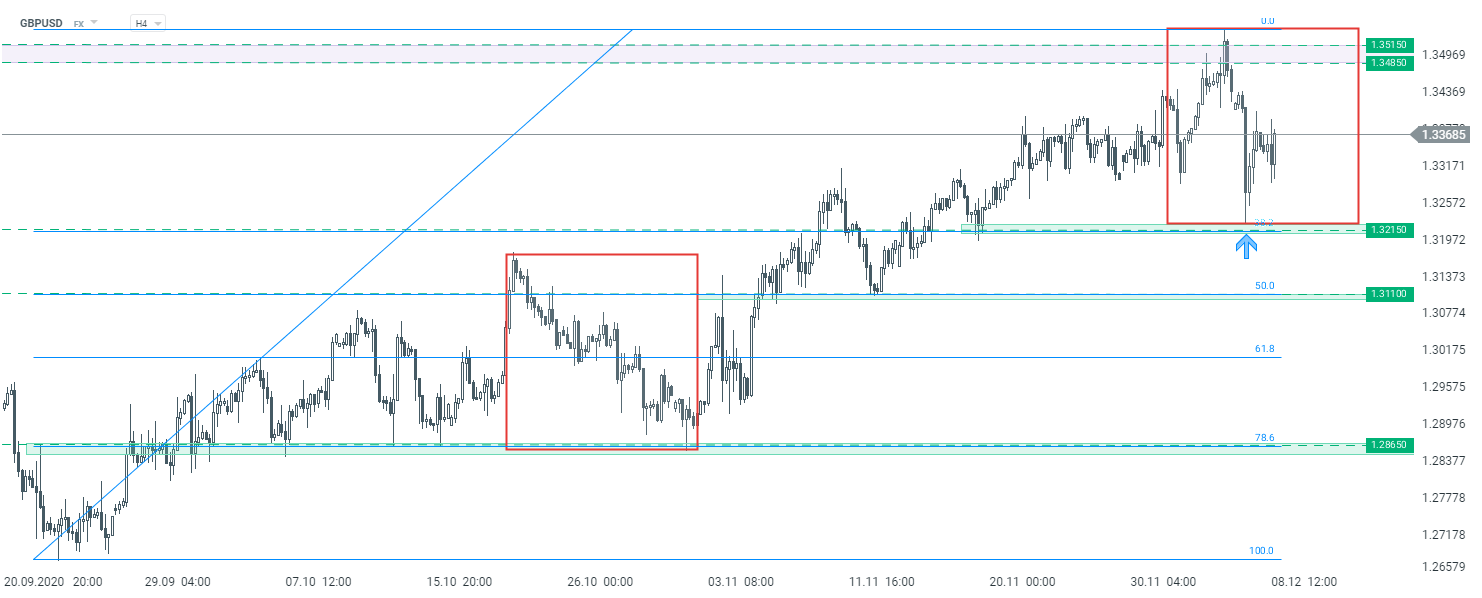

Despite yesterday’s sell-off, GBPUSD managed to bounce off key support at 1.3215 (38.2% Fibo retracement and lower limit of 1:1 structure). Should the currency pair stay above it, the potential attack on 1.3485-1.3515 resistance area may be on the cards. Source: xStation5

BoJ maintains rates despite hawkish shift in outlook. What next for the USDJPY?

Morning wrap (23.01.2026)

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

BREAKING: EURUSD reacts 🗽US jobless claims lower than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.