-

European markets end the day mostly lower

-

US swing states still counting votes

-

NFP report above expectations

Even though the US presidential election took place on Tuesday, key American swings states are still counting votes. Still, Joe Biden is widely considered to have won the race as he now leads in Pennsylvania and Georgia. The drama is not over yet and financial markets will pay attention to US politics even after the final results, because President Trump might not want to concede straightaway.

European markets ended today’s session mostly lower after a few days of huge gains. DAX lost 0.70% while CAC 40 fell 0.46%. British FTSE 100 managed to end the day slightly higher. American stocks are trading below the flatline at press time with S&P 500 just a notch above the 3,500 pts mark.

Oil markets are under huge pressure again amid demand uncertainty. Brent prices came back below $40 a barrel. Precious metals tend to gain - silver prices are climbing towards $26 level while gold prices are swinging around $1,950 area.

The key macro event of the day was the release of NFP report. Data came in above expectations as the US economy added 638k jobs in October against expected 600k. Private nonfarm payrolls amounted to as much as 906k (vs exp. 690k). However, employment change in Canada turned out to be weaker than expected (83.6k vs expected 100k).

Markets will surely focus on US politics during the weekend as it remains key theme for financial markets. On Monday Canada will publish its housing starts data while Germany will release trade balance figures. Apart from that, US investors will pay attention to earnings season which is not over yet.

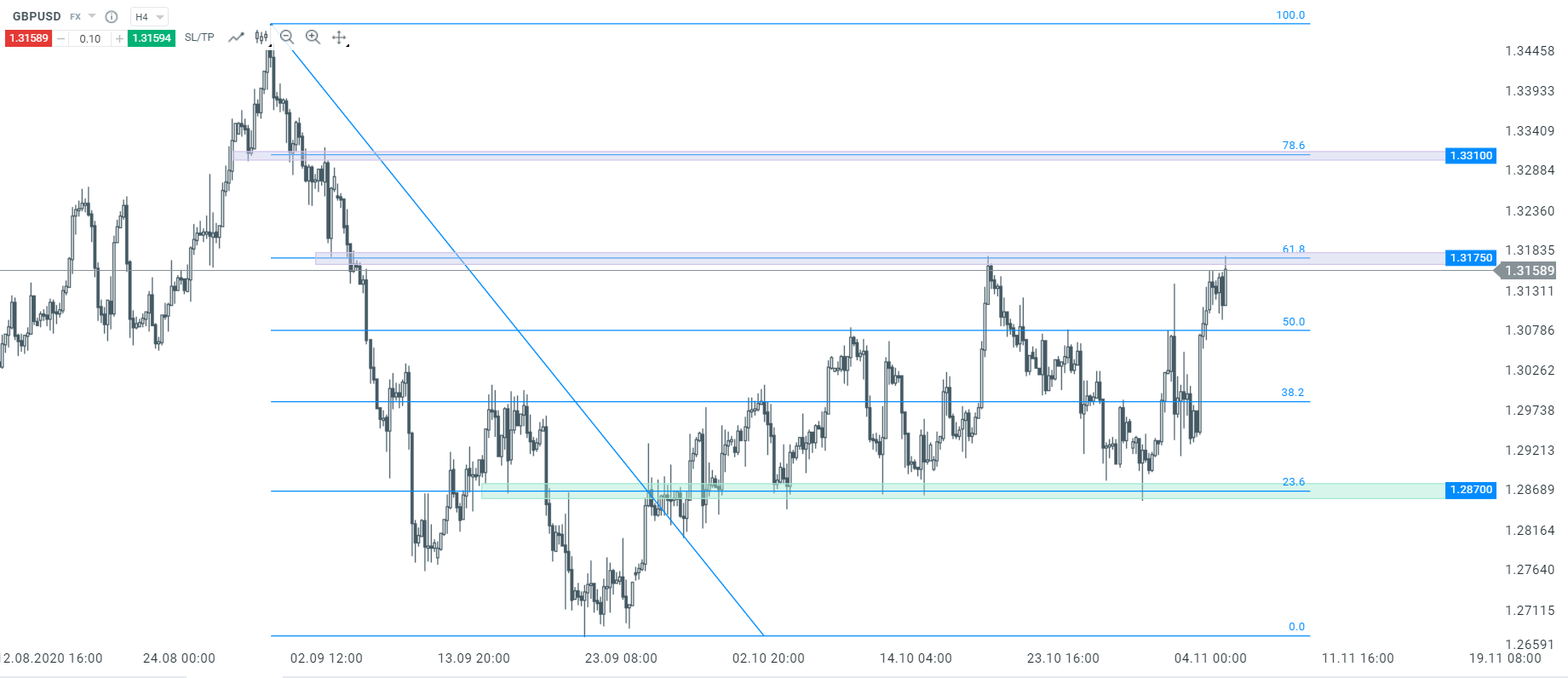

Looking at H4 time-frame, GBPUSD is currently testing key resistance area at 1.3175. It coincides with previous price reactions and 61.8% Fibo retracement of the recent downward move. Should the price break above this level, one might expect a move towards 1.3310. Source: xStation5

Looking at H4 time-frame, GBPUSD is currently testing key resistance area at 1.3175. It coincides with previous price reactions and 61.8% Fibo retracement of the recent downward move. Should the price break above this level, one might expect a move towards 1.3310. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.