- Mixed moods in Europe

- US CPI inflation highest since 1982

- Increased volatility on Wall Street

- 10-year Treasury yield above 2.0%

European indices finished today’s session in mixed moods, with DAX up 0.2% while CAC fell 0.41% as investors weighed another set of quarterly results against mounting inflation concerns. The European Commission revised its 2022 inflation forecast to 3.5% from 2.2% after which government bond yields jumped to multi-year highs. This in turn put downward pressure on the technology sector. On the other hand, travel and leisure equities along with chemicals shares were among the biggest gainers on the European indexes. On the corporate front, strong earnings results from AstaZeneca, Societe Generale, Zurich Insurance and Siemens offset downbeat updates from Credit Suisse and Unilever. Shares of Germany-based food delivery firm Delivery Hero plummeted over 30% after the company released disappointing earnings outlook.

Major Wall Street indices swing wildly during today's session as US inflation reading came in above expectations at the highest in four decades. Indexes managed to erase most of the early losses after the start of the cash session, however later comments from FED Bullard which favors a 100 basis point increase by July 1 renewed pressure on stocks. On the earnings front, Walt Disney added nearly 6% after reporting solid quarterly results and subscriber growth. Also Uber Coca-Cola posted better-than-expected quarterly figures while Twitter performance disappointed investors.

Commodities also swing between gains and losses amid weaker dollar and rising yields. The US 10-year Treasury jumped above 2.00% while the yield on the 2-year Treasury bond, the most sensitive duration to interest rates, increased 10 basis points to 1.45% after CPI release. Gold is flat around $1833, while silver rose over 1% and is testing $23.50 level. WTI price at one point rose over 2% during today’s session, however buyers failed to uphold momentum and most of the gains have been erased. Nevertheless WTI is still trading above $90.00 per barrel, while Brent is trading around $91.60. Indecisiveness can be spotted also on the cryptocurrencies markets. Early in the session Bitcoin price jumped above $45 000 following news that Russia decided to regulate cryptocurrencies instead of ban them and BlackRock reportedly plans to offer crypto trading. However moods worsened later and Bitcoin returned below the aforementioned level while Ethereum fell below $3200.

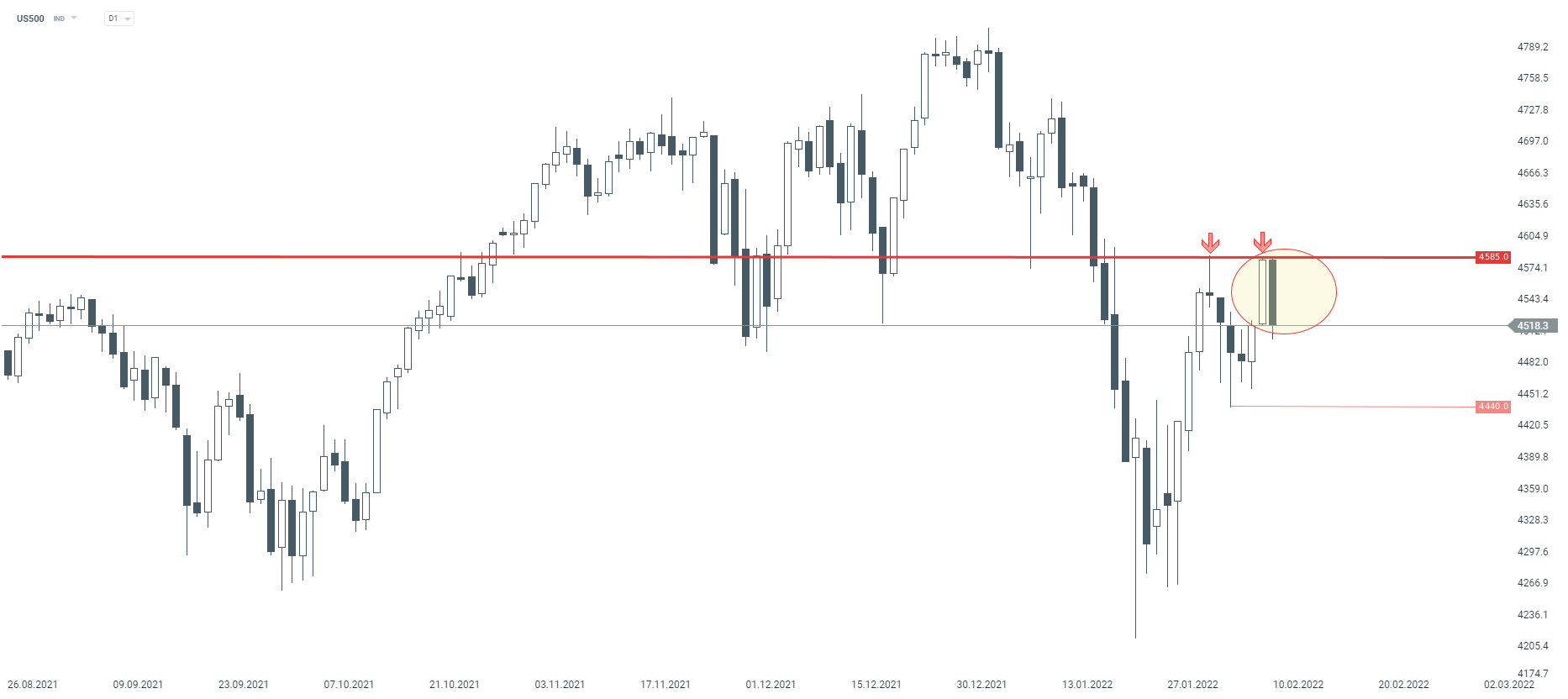

US stock indices came under selling pressure following Bullard's hawkish comments, with the US500 likely to form a local double-top formation and bearish engulfing pattern on D1 interval. Source: xStation5

US stock indices came under selling pressure following Bullard's hawkish comments, with the US500 likely to form a local double-top formation and bearish engulfing pattern on D1 interval. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.