- Worse sentiment on the stock market

- US500 reached key short-term support

- USD strongest among the majors

- Investors await the Fed

Despite the positive start of the European session, the major indices closed lower, German DAX lost 0.05%, France's CAC 0.7%, UK's FTSE 100 0.8% and Spain's Ibex 0.45%. The beginning of the trading session on Wall Street did not go well and the main indexes also are trading lower.

Looking at the forex market, US dollar is the strongest of the majors. The USD is followed by the JPY and CHF. The AUD and NZD are the weakest. That combination is indicative of "risk off" flows. The potential Omicron acceleration could lead to some reevaluation of economic growth/stock indices/commodities growth. However, the risk of a new variant was ignored last week.

A meeting of the US Federal Reserve this week could boost the dollar further if the central bank decides to take a more hawkish stance on the unwinding of its bond-buying programme and the timing of interest rate rises. The Bank of Canada reaffirmed their 2% inflation target today. Macklem's commentary highlights that they are in no mood to keep rates particularly low, a sign that rate hikes are planned for the "middle quarters" of 2021, which is their guidance. CAD loses nearly 0.6% to USD today.

Crude oil came under pressure today. WTI and Brent are trading about 1% lower. Natgas also is below the baselline despite an attempt to rebound today. Gold, on the other hand, is trading up slightly, with silver gaining 0.65%.

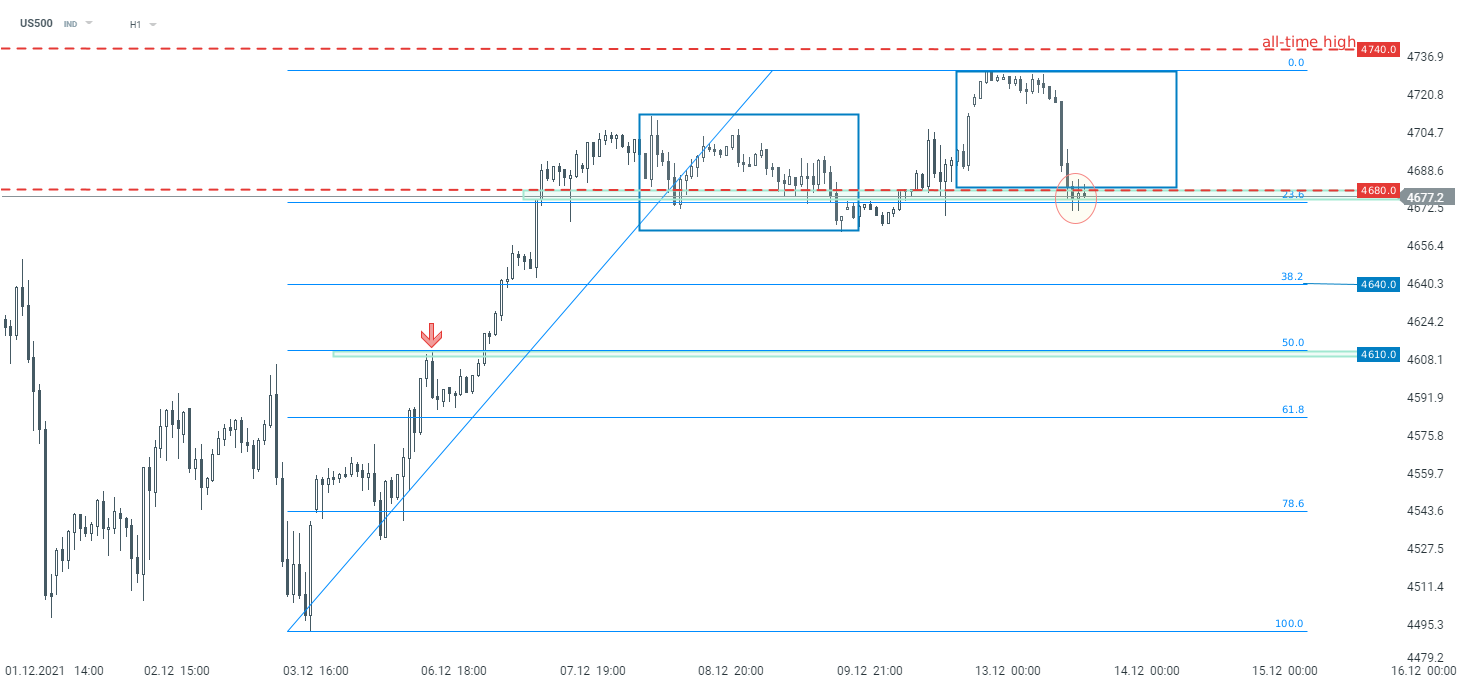

Despite the long term upward trend, the US500 did not manage to reach an all - time high today, and the downward correction started. The current downward correction stopped at the 4,680 pts support, which is marked with the lower limit of local 1:1 structure (blue rectangle) and 23,6% Fibonacci retracement of the recent upward move. If the current sentiment prevails, another attack on the all-time high at 4,740 pts is possible. However breaking below this support may lead to a trend reversal on US500.

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.