- US core PCE inflation surges at fastest pace in 30 years

- Amazon shares drag Wall Street lower

- FED Bullard believes that tapering should start this fall

The US core PCE inflation, excluding food and energy, fell to 0.4% m / m in June, from a 0.5% increase in the previous month and below market expectations of 0.6%. However, the annual rate the Fed uses as its headline indicator for inflation rose to 3.5% in June from 3.4% in the previous month. Today's reading fell below analysts' estimates at 3.7%, but this is a level not seen for 30 years. Fed members reiterate that price pressure is a temporary phenomenon due to fiscal stimulus, supply constraints and rising commodity prices. The Fed is probably happy with the data as they may confirm the thesis that the price increase may be temporary and justify keeping the current policy unchanged.

Nevertheless, the US dollar held firm today. The EURUSD pair fell significantly below 1.1900, which is related to Bullard's statement, who not only expects the QE program to be tapped in the fall, but also sees the prospects of interest rate increases next year. Bullard indicates that the labor market will behave much better than expected, which should give a chance for a change in monetary policy. Given such harsh words, market movements were limited.

We saw mixed sentiment on Wall Street. Investors were not very optimistic about Amazon's quarterly report, which showed a smaller increase in sales than in the previous quarter, which suggests declining consumer interest. Robinhood shares have come under pressure today as well, which shows that investors are unsure about the company's future.

Coffee has lost more than 8% since yesterday's close, falling below 180 cents a pound. The first reports of subsequent frosts indicate their limited impact on coffee crops. Lower temperatures are also expected to persist during the weekend, but only in some areas of Minas Gerais, which is mainly responsible for the production of Arabica.

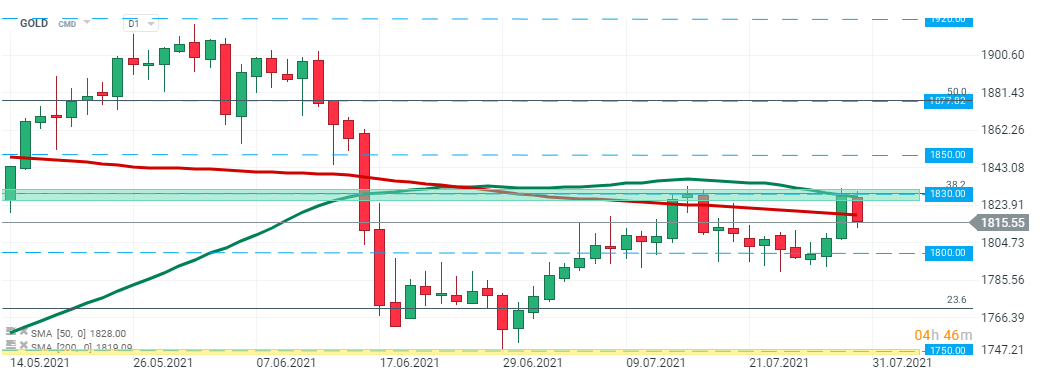

Gold prices rose sharply during yesterday's session however buyers failed to break above major resistance at $1830 and price pulled back. This level is marked with 50 SMA (green line) and 38.2 Fibonacci retracement of the downward wave from August 2020. If current sentiment prevails then support at $1800 may be at risk. Source: xStation5

Gold prices rose sharply during yesterday's session however buyers failed to break above major resistance at $1830 and price pulled back. This level is marked with 50 SMA (green line) and 38.2 Fibonacci retracement of the downward wave from August 2020. If current sentiment prevails then support at $1800 may be at risk. Source: xStation5

Daily summary: Wall Street tries to stop the sell-off 📌Gold down 1.8%, Bitcoin loses 4.5%

Wheat drops amid higher than expected WASDE report

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.