-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

-

European indices open Friday with cautious gains; DE40 up 0.05%.

-

Siemens and MTU Aero Engines are the weakest DAX names; Mercedes-Benz and Continental lead the advance.

-

Brenntag shares come under pressure after a UBS downgrade; ArcelorMittal falls following a rating change and commentary from Goldman Sachs.

European indices opened with cautious gains, locally partly supported by hopes of an easing in France’s political crisis. Volatility may pick up around 16:00 when U.S. University of Michigan data on consumer sentiment and inflation expectations are released.

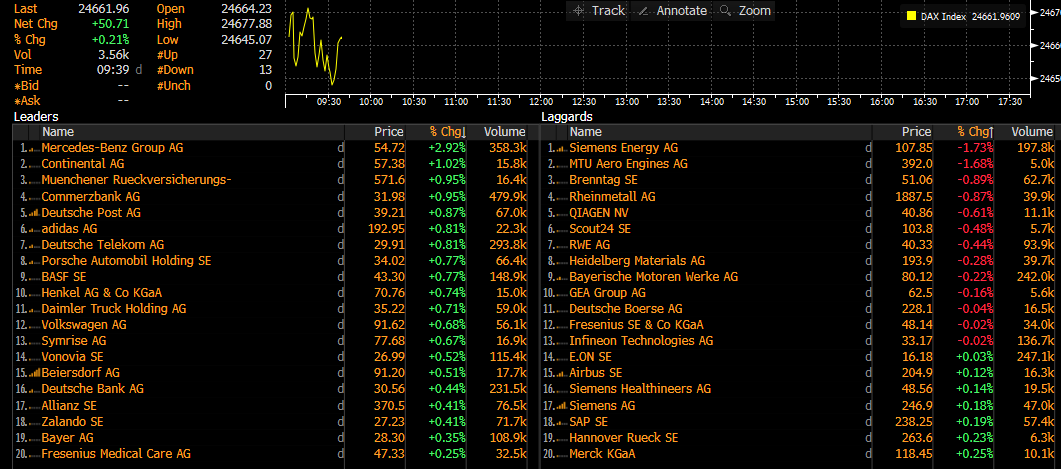

DE40 (H1 interval)

The German DAX (DE40) futures contract is oscillating around 24,750 points and testing the 50-period EMA (orange line) on the hourly chart, additionally supported by prior price reactions from early July.

Source: xStation5

Most active stocks in the German DAX. Source: Bloomberg Finance L.P.

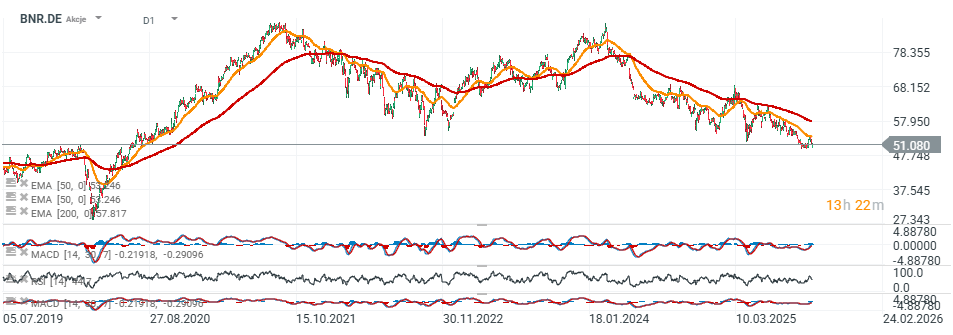

Brenntag cut by UBS

UBS downgrades Brenntag to “Sell” and cuts the target price to €45 (from €56), citing a deterioration in the outlook. Shares are down almost 4% today.

- Weak end-market demand and overcapacity in the chemical industry are expected to pressure volumes and margins for chemical distributors at least through H1 2026, wrote analyst Nicole Manion.

- Earnings forecasts for 2025–2027 have been lowered well below consensus, as UBS sees heightened risk to sales and profitability; the call suggests a longer downcycle than the market is currently pricing in.

Brenntag (D1)

Brenntag shares have been falling for some time and are hovering near levels last seen in August 2020. Even so, the chemical group’s P/E valuation remains in the high double digits.

Source: xStation5

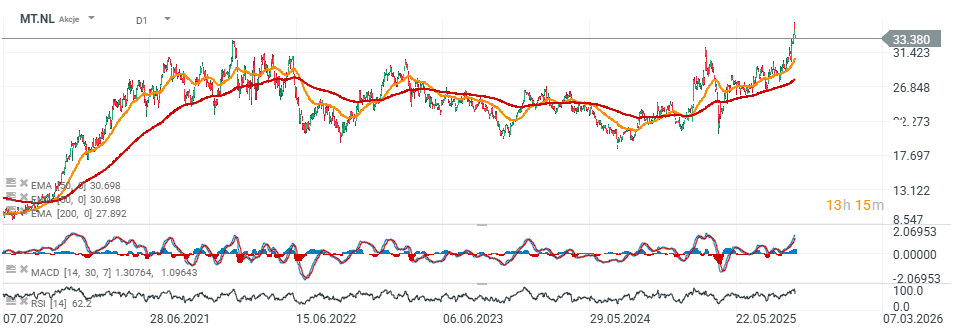

Steel giant under pressure

Goldman Sachs downgrades ArcelorMittal (MT) to “Neutral” from “Buy”, while raising the target price to €30 (from €29). As a result, the shares are down over 2% today, extending a pullback from multi-year highs.

- According to GS, the bullish thesis has largely played out: raw-material deflation supported margins and prospects for effective safeguards in key markets buoyed sentiment. After a ~55% gain since being added to the Buy list, the stock now looks fully valued.

- Risk-reward is balanced: upside depends on sustained cost tailwinds and consistent EU policy implementation; downside risks include a reversal in iron-ore/met coal or higher energy costs compressing spreads, weaker safeguard enforcement, tariff uncertainty, and risks to India JV profitability.

Arcelor Mittal (D1)

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.