Delta Air Lines (DAL.US) shares plunged over 4,0% on Friday after the airline maintained its full-year financial outlook despite upbeat quarterly profit, which were supported by robust travel demand.

-

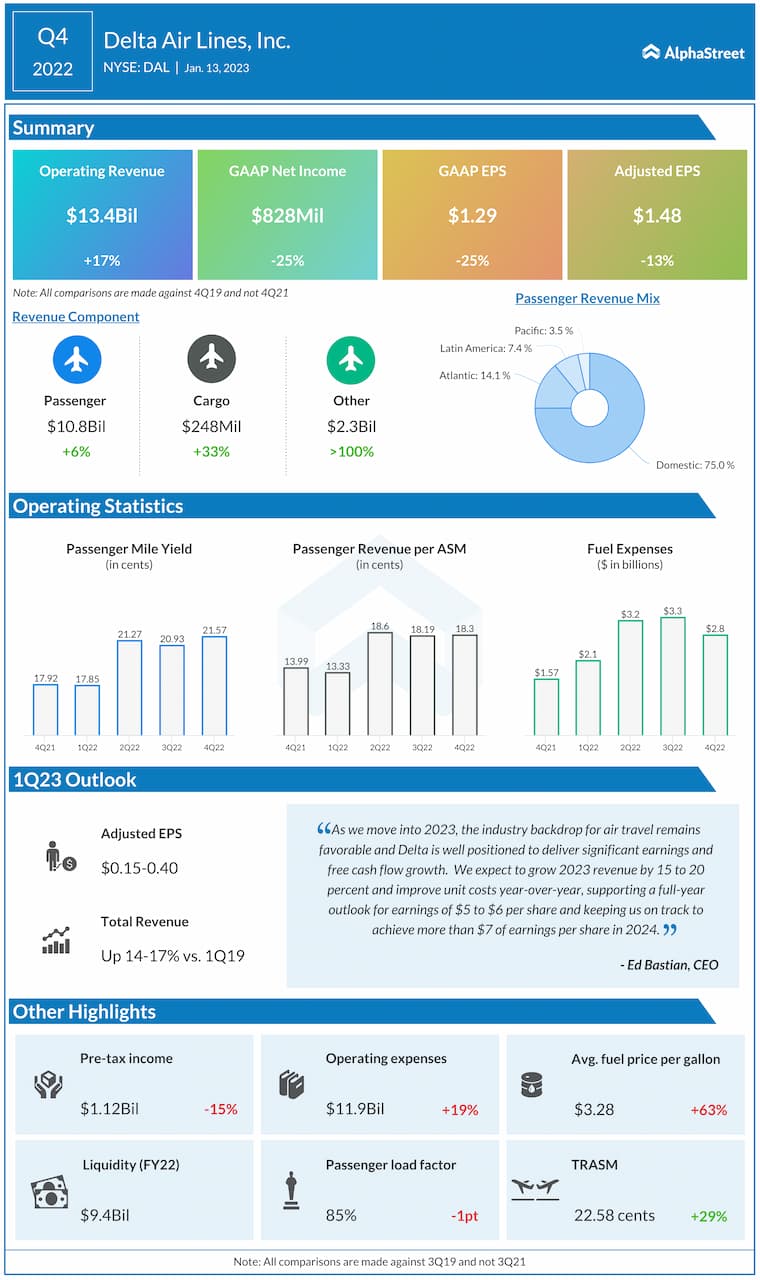

Company earned $1.48 per share versus a Refinitiv estimate of $1.33.

-

Revenue of $13.44 billion also topped market projections of $12.23 billion.

-

Company recorded operating cash flow of $6.2 billion for the year, ending 2022 with $9.4 billion in liquidity

-

Delta Air Lines maintained an outlook for "significant" growth in 2023, including EPS of $5-$6 and free cash flow of more than $2 billion.

-

Full year revenue is expected to increase in the region 15%-20%.

-

Company forecasts Q1 2023 earnings of 15 cents to 40 cents a share, well below FactSet analysts, which were expecting earnings of 59 cents a share.

Key quarterly highlights from Delta Airlines. Source: Alpha Street

Key quarterly highlights from Delta Airlines. Source: Alpha Street

-

"As we move into 2023, the industry backdrop for air travel remains favorable and Delta is well positioned to deliver significant earnings and free cash flow growth" CEO Ed Bastian said in a statement. Bastain also mentioned that Delta is aiming to achieve EPS of more than $7 in 2024.

-

On the other hand, CFO Dan Janki tempered expectations for the first quarter of 2023. "For the March quarter, we expect non-fuel unit costs to increase 3% to 4% year-over-year, including a full quarter impact from labor cost increases and finalizing the rebuild of our network for the peak summer period," he said.

-

Airline industry is still recovering from the pandemic shock, however recent data from Delta look optimistic. Solid demand in the final quarter of 2022 increased domestic total passenger revenue by 7.0% above pre-pandemic level. International passenger revenue jumped 5.0 % in Q4, compared with the fourth quarter of 2019. If demand remains robust in the upcoming quarters, airline stocks could potentially launch a bigger recovery move towards pre-pandemic highs.

Delta Air Lines (DAL.US) stock is still trading over 40.0% below 2020 highs, so there is definitely an upside potential, however earlier buyers will need to overcome resistance at $39.85, which coincides with 50.0% Fibonacci retracement of the downward wave launched in January 2020 and long-term downward trendline. Only breaking higher would point to a shift of market sentiment to more bullish. On the other hand, if sellers regain control, then nearest support to watch is located around $34.45 and coincides with 38.2% retracement, 50 SMA (green line) and 200 SMA (red line). Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.