- Gas prices in Europe and Asia are extremely high

- The energy crisis can provoke reactions throughout the whole global market

- Increased demand in Europe and Asia will cause a greater deficit in other markets

- Higher energy prices point to the prospects of high and rising inflation (not temporary as indicated by central banks)

The genesis of the current energy crisis should be sought in previous years in policies aimed at reducing huge emissions of carbon dioxide into the atmosphere. The world wanted to withdraw from the use of coal and looked towards low-emission energy sources such as gas or renewable energy sources. To all this, we add Brexit, which has a huge impact on the current crazy situation in Great Britain, the economic slowdown caused by the coronavirus, which led to only a temporary reduction in the demand for energy resources, and the key and least predictable factor - the weather.

Harsh winter

The previous winter led to a decline of the inventories levels of gas and other raw materials used for heat production, to the lowest levels in years. The coronavirus has led to a reduction in economic activity in many sectors, which has led to a reduction in the demand for energy production and thus reduced the flow of raw materials around the world. Therefore, gas and coal reserves in Europe or Asia, during the period of increased activity, did not manage to rebuild.

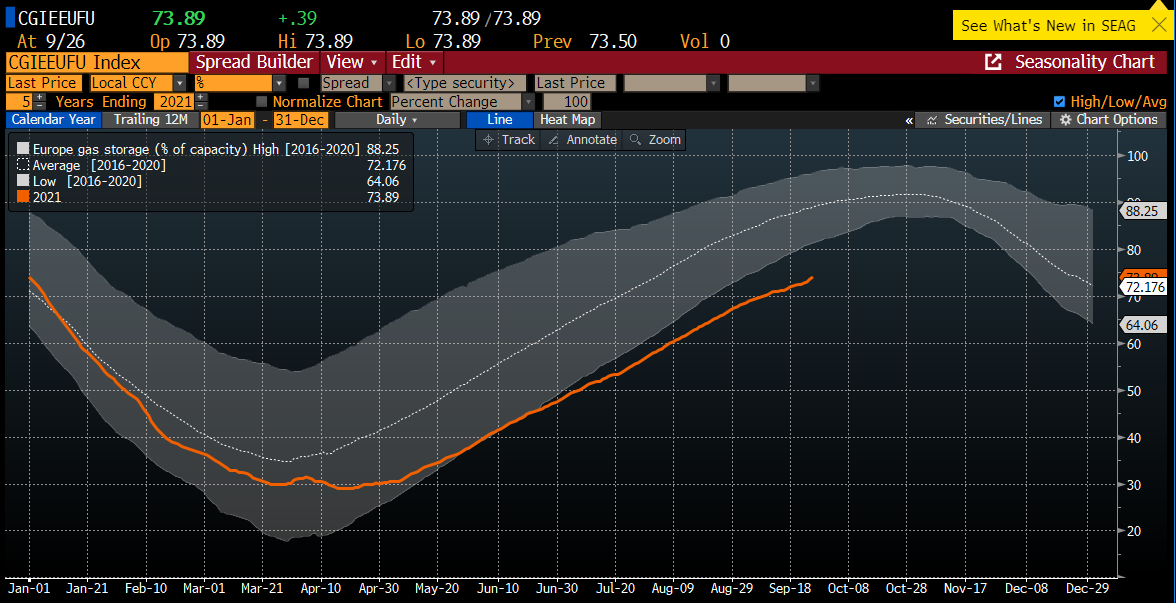

Gas storage utilization in Europe currently stands at only 74% with a 5-year average of 89%. According to the EIA, if the coming winter will be harsh, then some areas may face commodities shortages. This is currently the case in Great Britain, where inventories are depleted and the demand continues to increase. Source: Bloomberg

Gas storage utilization in Europe currently stands at only 74% with a 5-year average of 89%. According to the EIA, if the coming winter will be harsh, then some areas may face commodities shortages. This is currently the case in Great Britain, where inventories are depleted and the demand continues to increase. Source: Bloomberg

Climate policy

The strong drive to reduce carbon dioxide emissions, mainly in Europe, but also increasingly seen in Asia, has led to a bias towards renewable energy production. Rising prices of carbon dioxide emission permits led to the abandonment of coal in favor of gas and renewable energy sources. Renewable sources, however, are dependent on the weather - there is no wind in the UK, while in Norway the low water level has led to an increased demand for conventional energy sources. Thus, the prices of not only gas, which currently is scarce on the market (due to earlier consumption and supply problems), are rising, but also coal. High energy prices are the result of the spiral related to the prices of emission permits and high prices of energy commodities.

Over the past months, the prices of energy commodities have increased by as much as several hundred percent. This is the effect of shortages, artificially limiting supply, but most of all, of dynamically rebounding demand. Energy prices will affect virtually every aspect of the economy. Source: Bloomberg

What does this mean for the financial markets?

Of course, it will largely depend on the weather forecast and the weather itself. Nevertheless, rising energy prices are pushing up bond yields. This is the effect of the expectation of higher inflation in connection with the constantly rising prices, but also the withdrawal of funds from bonds investments in favor of strongly rising commodity prices.

The correlation between the price of oil and bond yields peaked since October 2020. High oil prices reflect expectations of high inflation, the prospect of higher rates and a reduction in the attractiveness of government bonds. Source: Bloomberg

The correlation between the price of oil and bond yields peaked since October 2020. High oil prices reflect expectations of high inflation, the prospect of higher rates and a reduction in the attractiveness of government bonds. Source: Bloomberg

High energy prices increase inflation expectations which lead to higher bond yields. This, in turn, has a huge impact on the dollar (upward prospects), gold (downward prospects) and equities, especially technology (rather downward prospects).

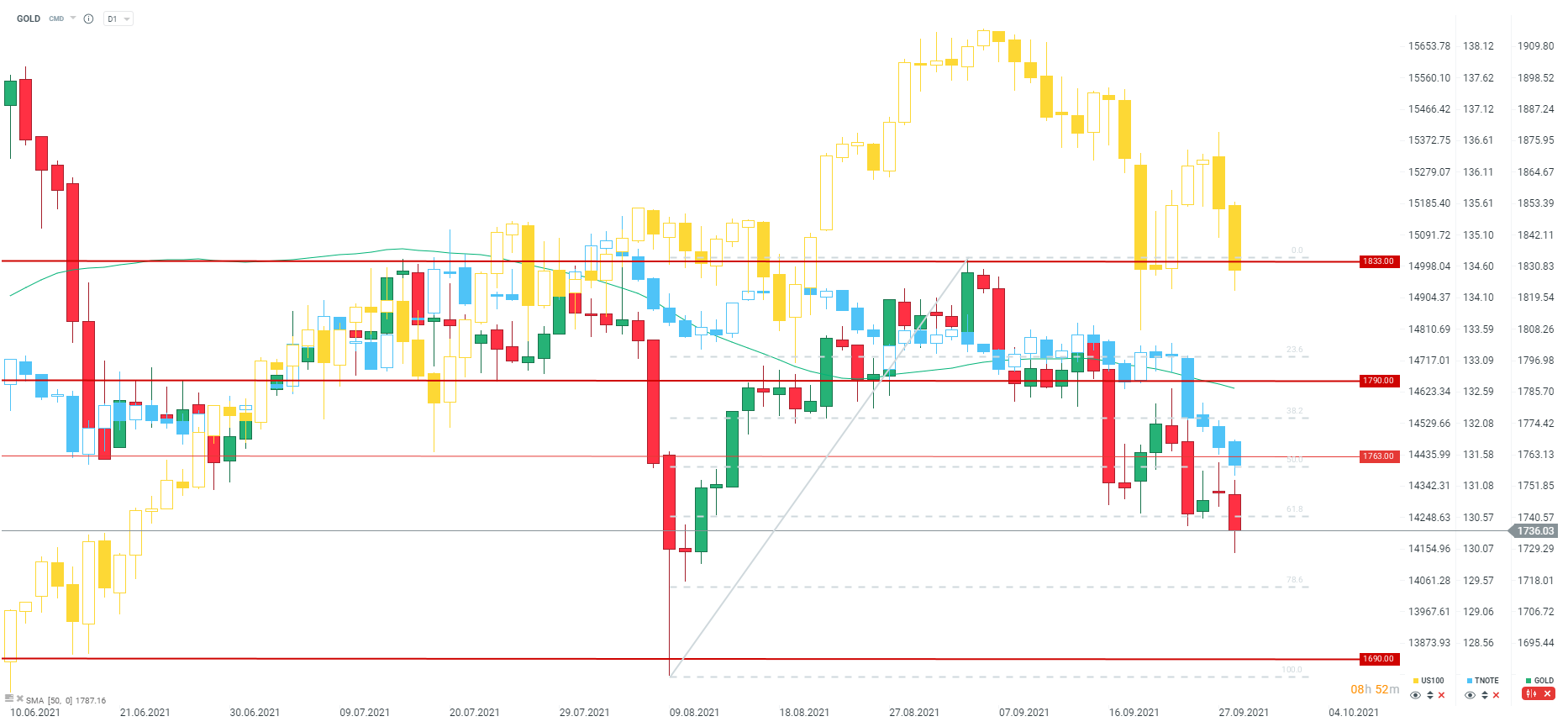

Rising bond yields (declining TNOTE prices - blue chart) are bad news for gold, but also for technology companies. Gold is trading at its lowest since early August, while Nasdaq (US100) broke below 15,000 points. Source: xStation5

Rising bond yields (declining TNOTE prices - blue chart) are bad news for gold, but also for technology companies. Gold is trading at its lowest since early August, while Nasdaq (US100) broke below 15,000 points. Source: xStation5

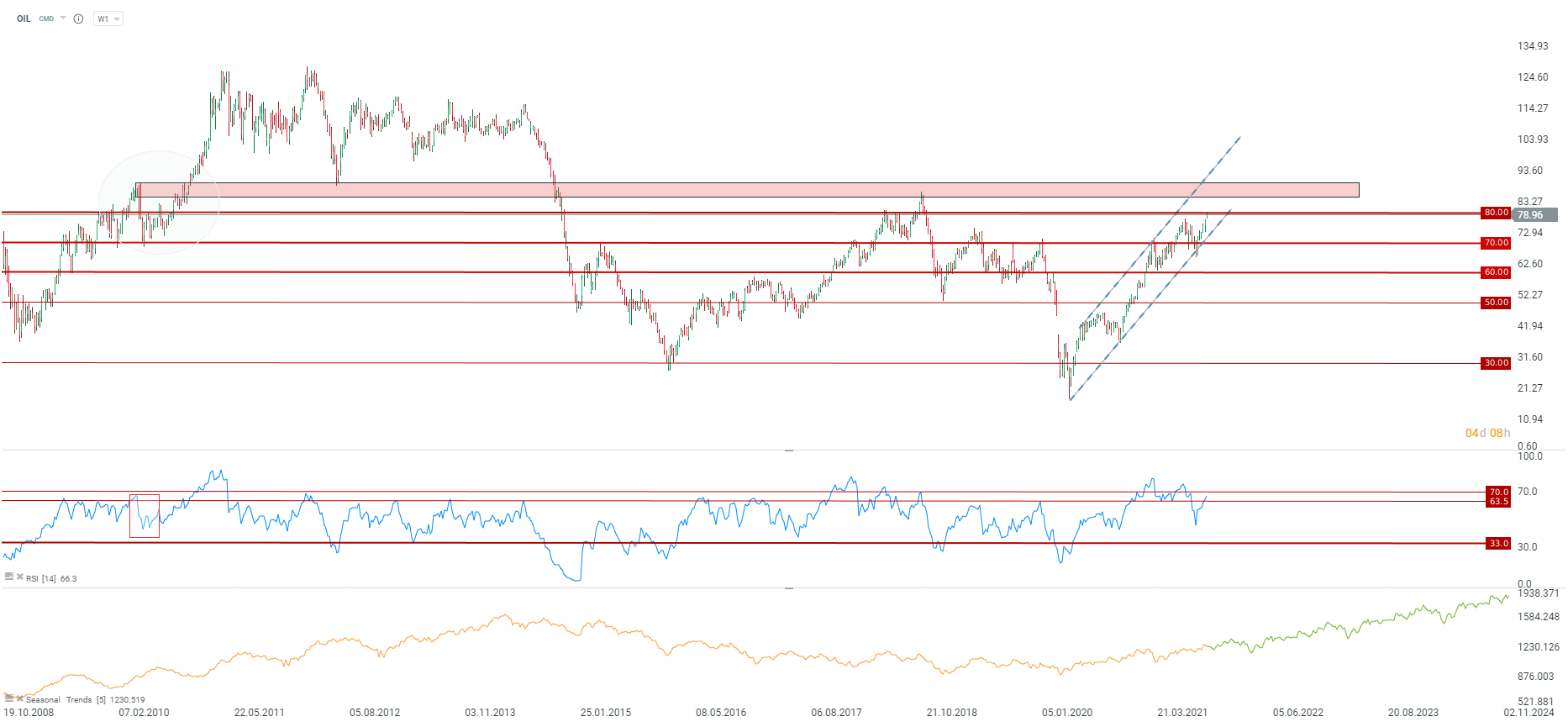

The energy crisis may push up oil prices even higher. The current situation is beginning to resemble 2010 and the second wave of growth in the oil market after the financial crisis. However, a lot may depend on the weather. Harsh winter also means increasing the demand for heating oil. The nearest strong resistance zone is located around $ 87-89 per barrel. The support is located at$ 70 and coincides with the lower limit of the ascending channel. Source: xStation5

The energy crisis may push up oil prices even higher. The current situation is beginning to resemble 2010 and the second wave of growth in the oil market after the financial crisis. However, a lot may depend on the weather. Harsh winter also means increasing the demand for heating oil. The nearest strong resistance zone is located around $ 87-89 per barrel. The support is located at$ 70 and coincides with the lower limit of the ascending channel. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.