Today's key data from the American economy: the USA's Consumer Price Index (CPI) inflation data! A slight rebound in the main inflation is expected mainly due to the fading base effect. From the Fed's perspective, however, the core inflation will be crucial. Today's reading will provide a bit more certainty regarding the potential decision on interest rates in September. What are the expectations for today's data? How might EURUSD react?

-

The market consensus anticipates an increase in inflation to 3.3% YoY with a monthly increase of 0.2% MoM. Previously, for June, these figures were 3.0% YoY and 0.2% MoM, respectively.

-

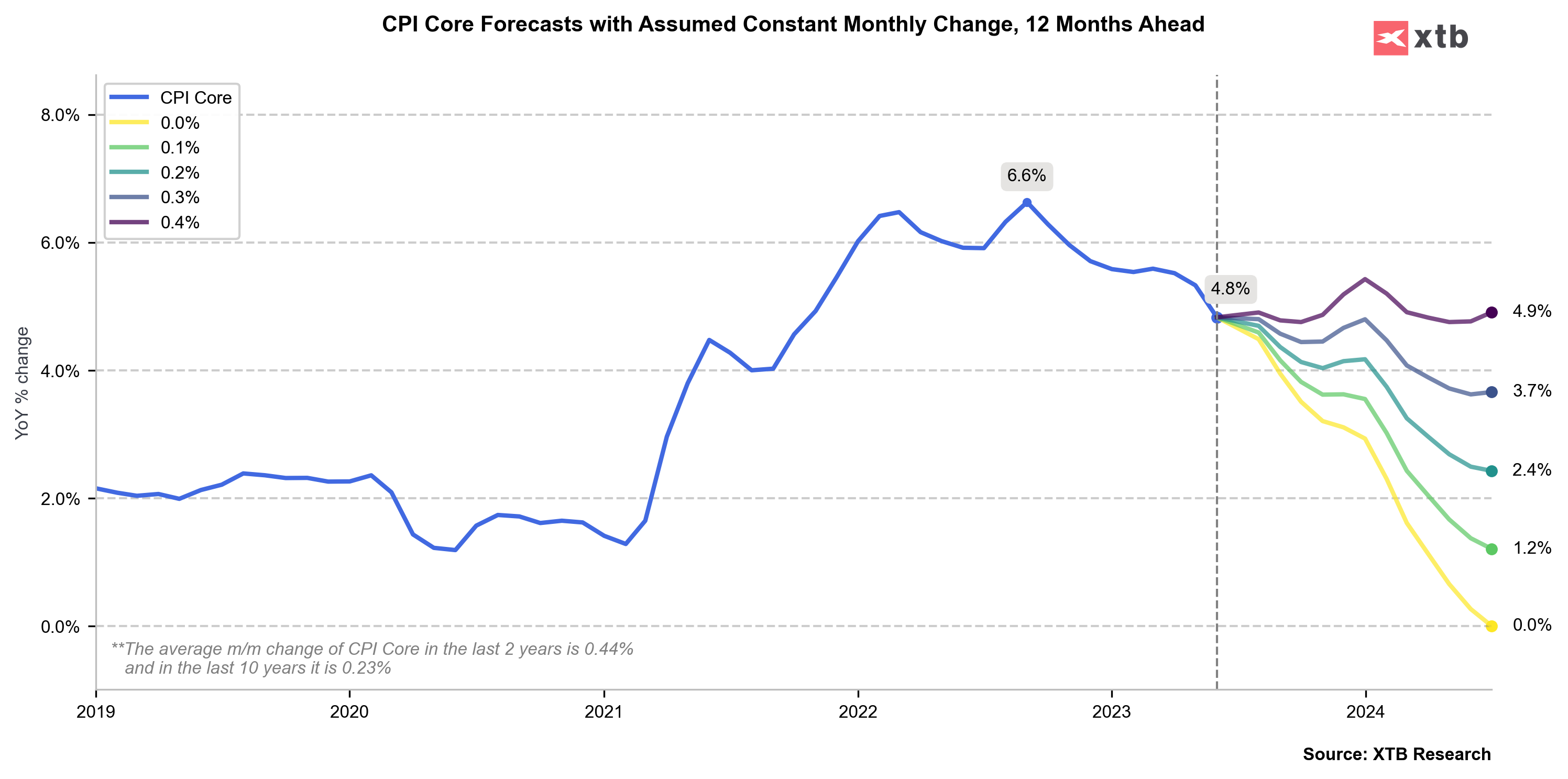

Core inflation is projected to come in at 4.7% YoY with a monthly increase of 0.2% MoM. The previous figures were 4.8% YoY and 0.2% MoM.

-

The 0.2% monthly growth aligns with the Federal Reserve's long-term inflation target (2025). This also represents the long-term average monthly inflation growth.

-

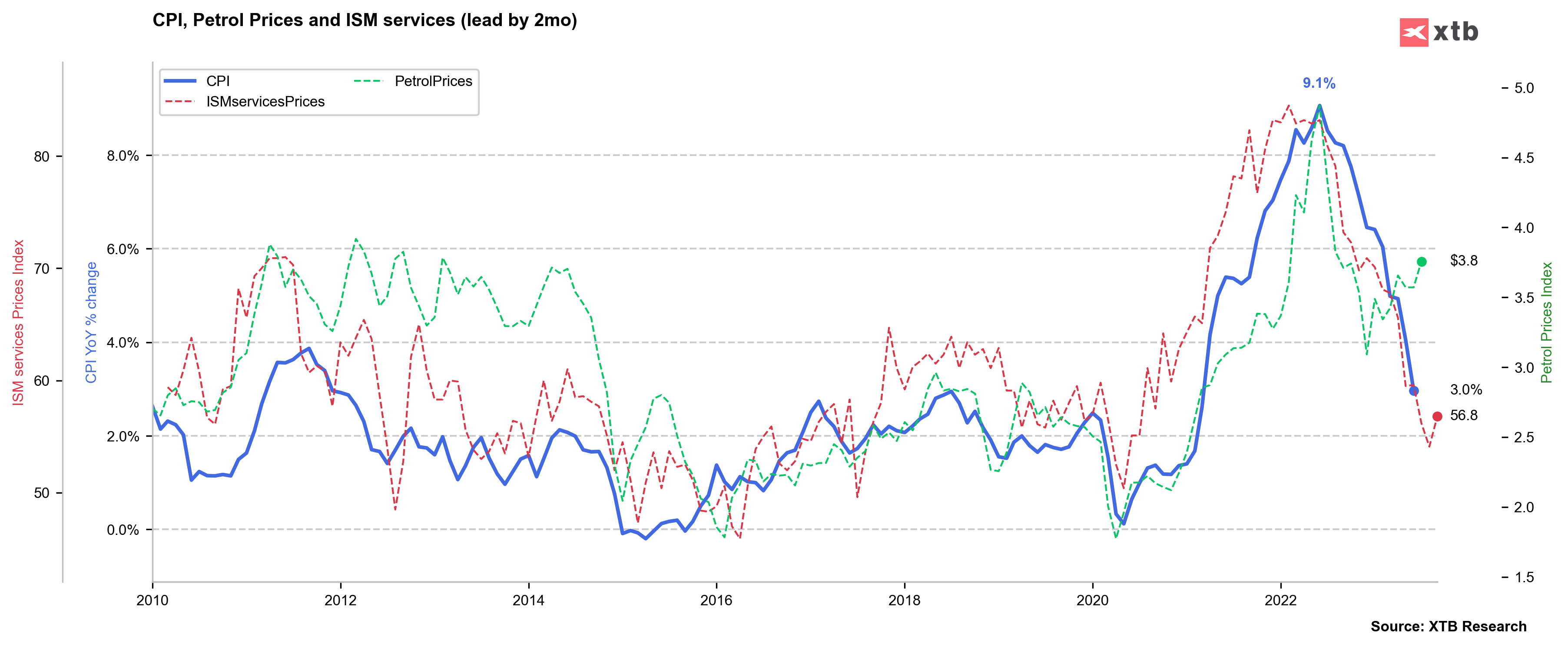

However, based on the significant rise in fuel prices in July, there might be a faster increase in monthly inflation to 0.3% MoM, as indicated by Bloomberg Economics. Alongside the increase in fuel prices by approximately 7% in July, energy bills have surged due to the heatwave, impacting electricity costs. Natural gas prices have also risen.

-

A similar energy cost situation might occur in August as well. According to Bloomberg Economics, energy costs in August could add 0.3 percentage points to monthly inflation!

-

On the other hand, Goldman Sachs points out a notable slowdown in inflation related to rent equivalence, used car prices, and non-housing service inflation.

The Fed places significant emphasis on core inflation. They understand the recent energy price rebounds are beyond their control. Hence, even with a potential rebound in the main CPI, the Fed's decision will hinge on core inflation. If the Fed observes progress toward its target in this regard and no detachment of inflation expectations is apparent, they might raise interest rates once more this year, particularly if the core inflation remains stable and the monthly increase exceeds 0.2%.

While everyone is focused on the sharp decline in the main CPI inflation, the Fed's attention is directed towards core inflation. The outlook for the coming months appears relatively favorable. With a monthly increase of about 0.2%, core inflation will continue to drop and only rebound slightly towards the end of the year.

On the other hand, the main inflation largely influences consumer inflation expectations. Recent energy price rebounds could complicate matters in the following months, and the situation might worsen by year-end if oil and fuel prices remain at or above current levels. This would have a positive impact on the annual contribution to inflation.

Market Reaction:

Undoubtedly, markets will initially scrutinize the main reading. A higher reading could boost the dollar while causing a retreat in Wall Street contracts. However, the sustainability of this movement will depend on core inflation. It's unlikely for surprises to occur in this aspect. Thus, considering expectations for core inflation, the market should lean towards more risk-taking behavior, moving away from the dollar and re-entering the stock market. This scenario might not unfold if the core CPI rises by more than 0.2% MoM or remains at 4.8% YoY.

EURUSD:

The EURUSD pair is breaking above the descending trendline and retesting the vicinity of the 1.1000 level. A short-term resistance zone lies around 1.1040. If inflation comes in lower than expected, especially with a decline in core inflation as predicted, EURUSD should attempt to breach the 1.1050 level. Conversely, if inflation surprises with stronger growth, EURUSD might quickly drop below 1.10 and head towards the ascending trendline formed after the local lows in early July and early August. Source: xStation5.

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.