Market expectations: The January hurdle

Investors are bracing for January’s consumer price index (CPI) data, with the consensus expecting headline inflation to moderate to 2.5% year-on-year, down from 2.7% in December. On a monthly basis, prices are anticipated to rise by 0.3%, mirroring the previous month's pace. Core CPI—the Federal Reserve’s preferred gauge which strips out volatile food and energy costs—is projected to remain stubbornly resilient at 2.5% (down marginally from 2.6%), with a monthly increase of 0.3%.

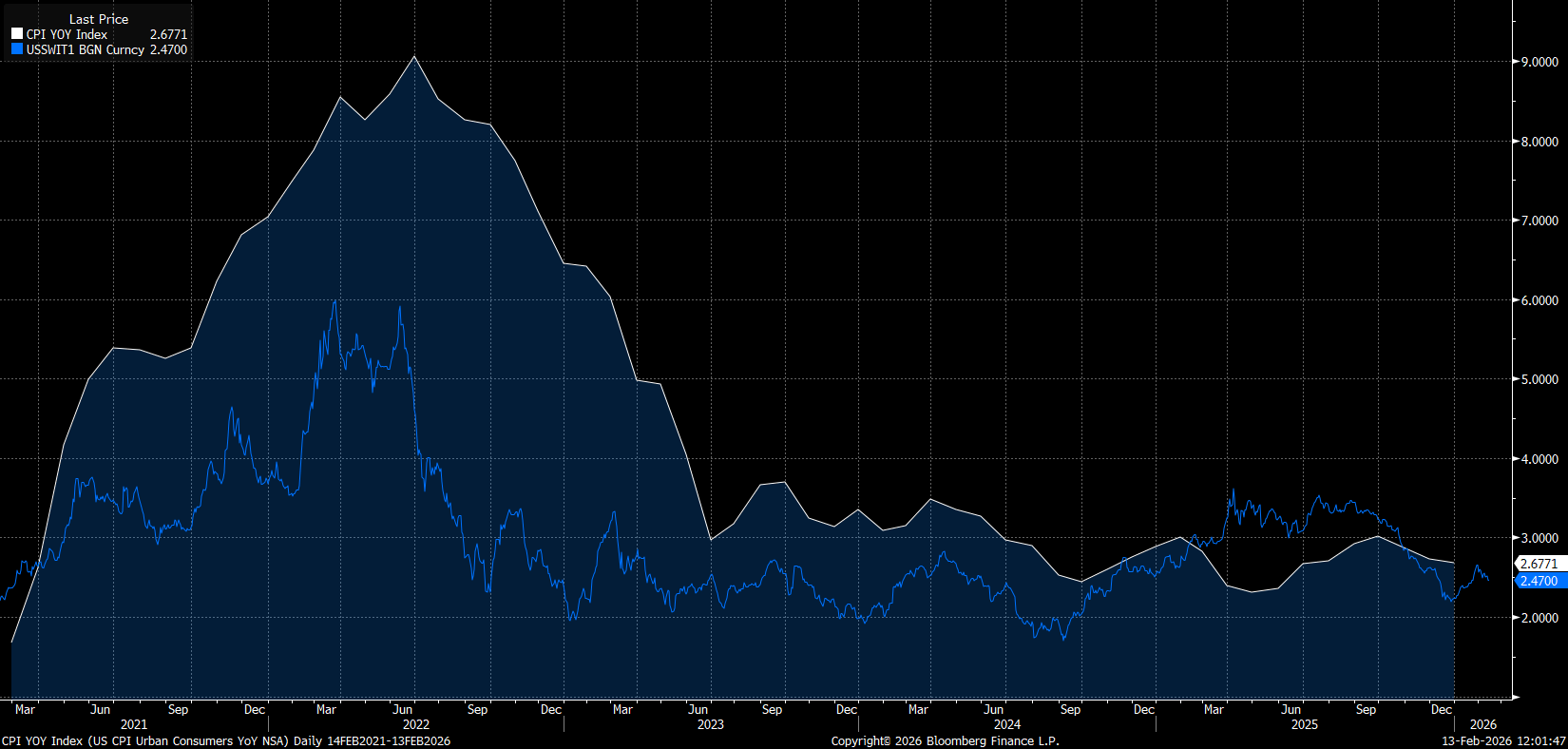

Institutional forecasts, however, show a widening divergence. Goldman Sachs analysts lean toward a more optimistic headline print of 2.4%, though they caution that tariff-related pressures in apparel, recreation, and household equipment could provide an upside tilt. Conversely, quantitative models from outfits such as XTech Macro suggest a sharper deceleration to 2.3% for the headline and 2.4% for core. While inflation swaps are currently pricing a result aligned with the 2.5–2.6% consensus, it is worth noting these same indicators significantly undershot the December reality. Should the swaps serve as a leading indicator, a print in the 2.2–2.3% range remains a tail-risk possibility.

Swap for the CPI indicates that the inflation may continue its downward move, even below current market consensus. Source: Bloomberg Finance LP

Swap for the CPI indicates that the inflation may continue its downward move, even below current market consensus. Source: Bloomberg Finance LP

The structural view: "Sticky" services persist

Beyond the headline numbers, the broader macroeconomic narrative remains fixated on "supercore" inflation—services excluding housing. This component, inextricably linked to a tight labor market, has historically proven resistant to deflationary forces.

Looking toward the remainder of 2026, the institutional outlook for a return to the 2% target is mixed:

-

Morningstar forecasts average inflation at 2.7%, citing a potential "tariff bump."

-

Nomura expects core PCE to settle at approximately 2.5% by year-end.

-

Academic research suggests a baseline core rate of 2.7%, arguing that a sustained move below 2% is unlikely without a more pronounced cooling of wage growth.

-

Goldman Sachs remains the outlier with a dovish tilt, forecasting core PCE at 2.1–2.2% by late 2026.

The takeaway for policymakers is complex. While falling fuel prices and cooling goods demand should pull the headline figure lower, the persistence of service-sector inflation—particularly in leisure—suggests the "last mile" of disinflation remains arduous. For the Fed, a visually pleasing 2.5% headline may be less comforting if the underlying service components remain unanchored.

The Fed’s dilemma: Between Powell and Warsh

Inflation remains the ultimate arbiter for a Fed grappling with an ambiguous labor market. Despite a headline non-farm payrolls (NFP) report that appeared robust, granular data suggests underlying fragilities. As it stands, December’s "dot plot" signaled only a solitary rate cut for the year.

The political and leadership transition further complicates the calculus. Jay Powell’s tenure concludes in April, and his January communications maintained a characteristically resolute, if not hawkish, tone. However, futures markets and major financial institutions are already pricing in two cuts for 2026—a scenario deemed attainable under the anticipated leadership of Kevin Warsh, provided inflation does not re-accelerate.

For the Fed to pivot toward the aggressive easing sought by the Trump administration, the economy would likely require a more significant catalyst: either a collapse in oil prices toward the $50 mark or a genuine fracturing of the labor market triggered by dollar volatility or a deepening correction on Wall Street.

Currency Markets: Dollar finds its footing

The EURUSD has retreated toward the 1.1860 level, decoupling from a continued slide in Treasury yields. The dollar’s current strength appears to be a function of "risk-off" sentiment following a sharp pullback in US equities and renewed protectionist rhetoric from the White House regarding trade tariffs.

Technically, the pair remains vulnerable. Should Wall Street’s slide deepen, a retreat to 1.1800 is on the cards. However, a "Goldilocks" CPI print in the 2.2–2.4% range could serve as the catalyst for a rebound, as it would likely reignite market bets for a rate cut not just in April, but perhaps as early as March.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.