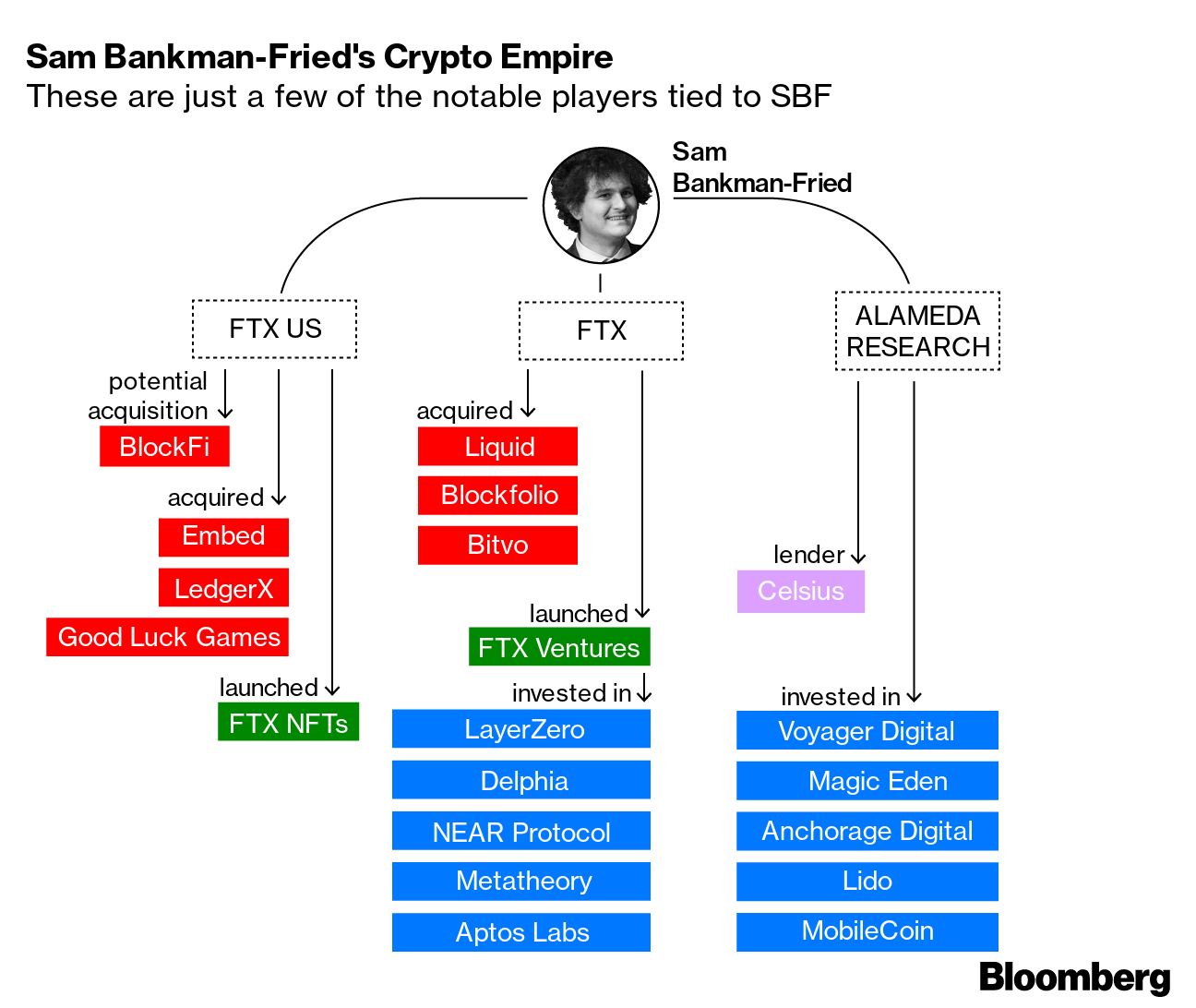

The cryptocurrency market has been spooked by a systemic threat from FTX, after a Coindesk report pointed to security vulnerabilities at Alameda Research, a major investment fund affiliated with Sam Bankman-Fried's cryptocurrency exchange. On the wave of the report, Binance decided to sell all of the FTX exchange's nearly $2.1 billion worth of token reserves. Bitcoin fell below $20,000 and Ethereum traded below $1,500. Investors were frightened by the risk of a 'second Luna scenario':

What did the Coindesk report show?

Chanpenga Zhao's exchange already published information on Alameda Research's reserves disclosed by Coindesk on November 3. Let's emphasize - Alameda and FTX are connected vessels, owned by Sam Bankman-Fried. According to the exchange, the biggest risk is that Alameda Research holds most of its reserves in poorly liquid altcoins, and the largest share of Alameda's assets is held by the FTT exchange token itself, created by FTX. The collateral structure thus appears fragile and prone to spikes in volatility, as there is no hard collateral in the form of a significant % of cash or US Treasury bills;

The collapse of Alameda Research could spill over to the entire cryptocurrency industry. According to Coindesk, the private financial document is likely only a slice of the broader picture of Alameda Research's operations. According to the document, Alameda has $14.6 billion in assets and $8 billion in liabilities. The fund bet on the FTT token expecting the success of the FTX exchange, which is probably why it has such a large share of collateral. This, however, opens the door to systemic risk. As the FTX exchange develops, the FTT token should gain in value. But what if the exchange stops growing rapidly or slows down?

As of June 30, 2022, Alameda had assets of $3.66 billion in FTT, $2.16 billion in leveraged FTT positions, $3.37 billion in other cryptocurrencies (including $292 million in Solana, $863 million in Solana's staking pool), $2 billion in 'equity securities, and cash of $134 million. Liabilities were dominated by $7.4 billion in loans and $292 million in 'blocked' FTT tokens. It can be said that Alameda holds the future of FTT in its own hands with the impossibility of not having a valuation impact on the assets it holds in the face of the liquidation of the reserve.

Contagion risk still alive?

- The market, after the dramatic events of May and June this year for the industry (Luna/Terra, Celsius Network, Three Arrows Capital, Voyager, etc.), remains extremely sensitive to news of possible bankruptcy or possible liquidity problems of the largest cryptocurrency players. Investors taught by history have recognized that the collapse of large entities despite favorable press or popularity is possible;

- The head of the Binance exchange, Chanpeng Zhao (identified as CZ), refused an offer from Alameda Research CEO Caroline Alisson, who suggested that the fund would buy back all the nearly $2.1 billion worth of tokens from Binance at a price of $22. However, Binance intends to liquidate them on the 'open market'. In this way, the exchange is stopping 'Alamede' from possibly 'improving its image,' but the exact reasons for the refusal are not known;

- According to CZ, with Binance, the FTX exchange was said to be involved in keeping the industry's unfavorable talks with outside parties secret from competitors. Bankman-Fried himself was quick to address Binance's comments and referred to CZ's posts as false rumors, and indicated that FTX will continue to process withdrawals and has sufficient funds to cover all of the exchange's customer resources;

- FTX is one of the fastest-growing cryptocurrency exchanges to date and the world's second-largest cryptocurrency entity in terms of daily user trading volume. Speculation in the industry continues unabated around a possible planned image blow from Binance aimed at slowing down competition.

If the panic over FTX continues, it could end up with rising withdrawals from the exchange's users and a consequent further sell-off of the FTX exchange token. By comparison, when the U.S. financial system collapsed during the crisis of the 1920s, the banks that went bankrupt more than once had adequate safeguards and controlled risks. Despite this, they were unable to stop panic among customers withdrawing funds en masse, and collapsed as a result. Other, often less secure institutions often prospered longer . This shows that in periods of panic the crowd tends to abandon rational behavior and choices. This seems to be the main threat to FTX at the moment and has the potential to spawn systemic risk.

Innvestment fund of cryptocurrency billionaire Sam Bankman-Fried (referred to as SBF), Alameda Research holds significant positions in the Lido protocol, which is the largest Ethereum 2.0 staking pool. The popular SBF this summer wanted to rebuild confidence in the crypto industry by acquiring the assets of collapsed cryptocurrency entities like Celsius, BlockFi and Voyager Digital and compensating the victims. FTX was expected to consolidate the cryptocurrency industry by agreeing to centralization and regulation, and SBF itself pointed to the need for transparent regulation in the industry to guard against risks from rogue entities and a lack of safeguards against risks. According to OpenSecrets data, the SBF contributed $39 million to fund this year's election campaign 'midterms' in the US. Source: Bloomberg ProtocolmLido holds nearly 4 million staked Ethereum 2.0 tokens, more than the combined reserves of major entities like Binance, Coinbase and Kraken. Source: Glassnode

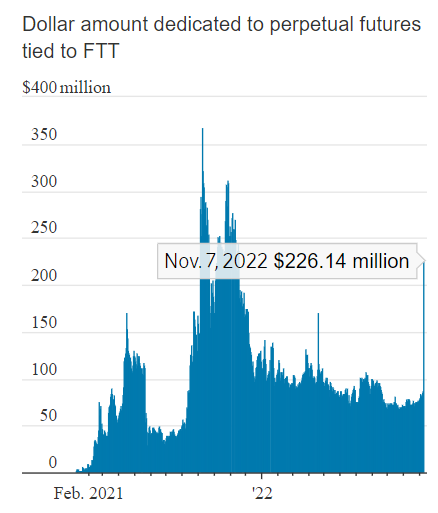

ProtocolmLido holds nearly 4 million staked Ethereum 2.0 tokens, more than the combined reserves of major entities like Binance, Coinbase and Kraken. Source: Glassnode The dollar-denominated trading volume of futures contracts associated with the FTX exchange token has already jumped to $226 million on Sunday. Source: Coinglass

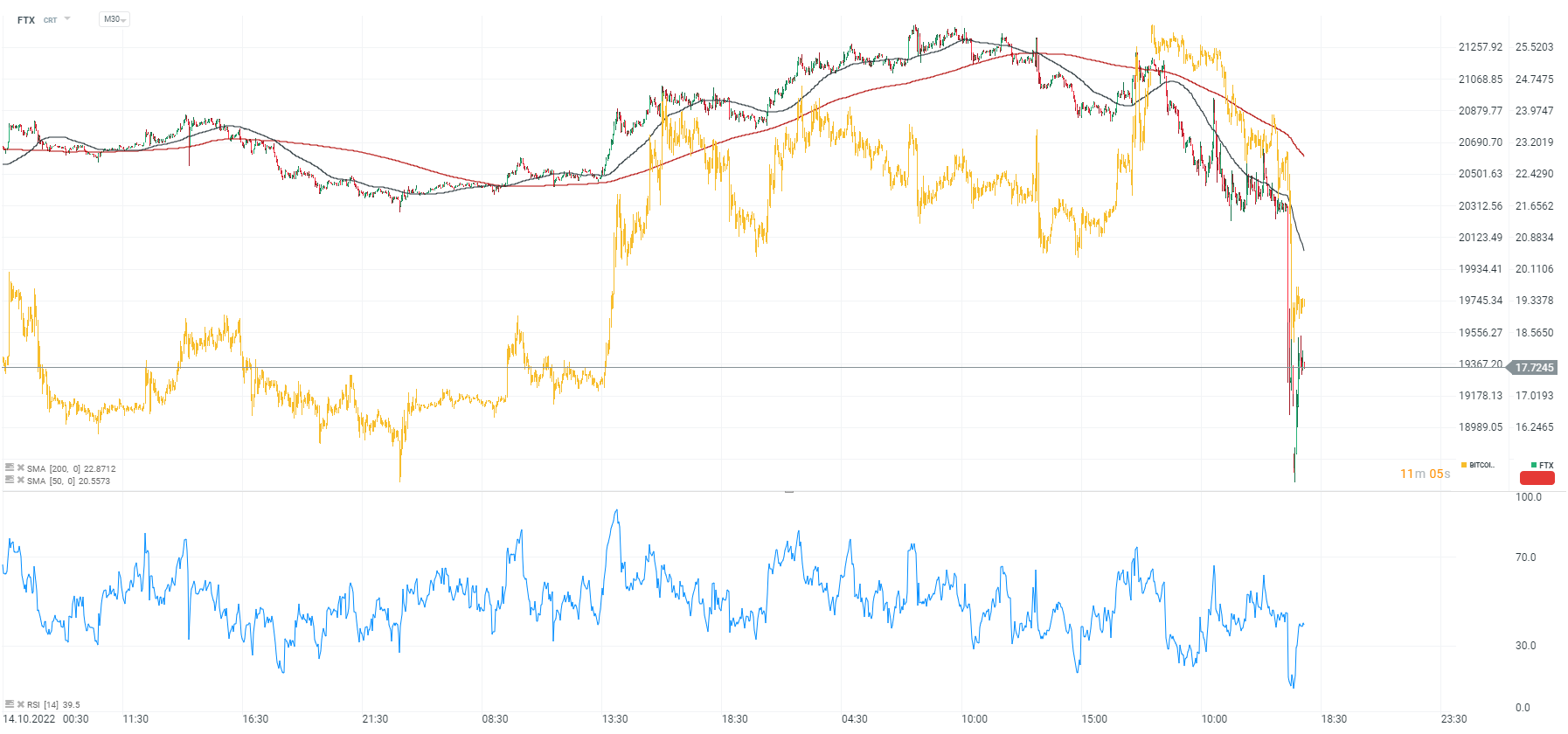

The dollar-denominated trading volume of futures contracts associated with the FTX exchange token has already jumped to $226 million on Sunday. Source: Coinglass FTX chart, M30 interval. The FTX cryptocurrency's big move brought with it a wave of liquidation that spilled over into the broader cryptocurrency market. The token was unable to hold at $22 after Binance refused to sell tokens to Alameda at that price. Bitcoin (yellow chart) retreated to the area of $19,700. Source: xStation5

FTX chart, M30 interval. The FTX cryptocurrency's big move brought with it a wave of liquidation that spilled over into the broader cryptocurrency market. The token was unable to hold at $22 after Binance refused to sell tokens to Alameda at that price. Bitcoin (yellow chart) retreated to the area of $19,700. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.