-

FedEx released fiscal-Q1 results yesterday after market close

-

Sales and profits disappointed, fiscal-Q2 guidance lower

-

Guidance for full fiscal-2023 scrapped altogether

-

Company sees deterioration in macroeconomic trends

-

Shares trade almost 20% lower in premarket

FedEx (FDX.US), one of the major US shipping and transportation companies, plunged over 16% in the after-hours trading yesterday, following the release of a disappointing earnings report for fiscal-Q1 2023 (calendar June-August quarter). Company missed on both profits and revenue estimates and provided a rather downbeat commentary.

Fiscal-Q1 2023 results

As we have said in the introduction, FedEx Q1 results were disappointing. Adjusted EPS dropped 19% YoY and reached $3.44, compared to $5.10 expected, while sales were 5% YoY higher and reached $23.2 billion, slightly lower than $23.5 billion expected. Operating profit reached $1.23 billion (exp. $1.74 billion). Company said that global shipping volumes were softening and this has accelerated in recent weeks as macroeconomic trends continued to worsen. FedEx said that weakness was spotted especially in Asia and Europe but business has also worsened in the United States.

Full-year guidance removed

FedEx said that it expects outlook to remain poor in the fiscal-Q2 as well (calendar September-November quarter). In order to cope with weaker prospects, the company decided to employ cost-cutting measures like deferral of hiring, closing of some locations or cancellation of network capacity expansion. Company said that it expects fiscal-Q2 revenue to reach $23.5-24.0 billion and EPS to reach $2.65 or more. This compares to market expectations of $24.9 billion in revenue and $5.39 EPS. Company also cut CapEx guidance for fiscal-2023 to $6.3 billion, down from $6.8 billion previously. A main point of concern is that the company decided to scrap fiscal-2023 earnings and revenue guidance altogether, meaning that the company does not believe it can provide an accurate forecast of conditions it expects for the remainder of fiscal year.

Why does it matter?

Disappointing release from FedEx is named as a reason behind drop in US index futures yesterday after the close of the Wall Street session. One could ask why does it matter so much for the broad market given that FedEx is not even one of the mega-cap companies? The answer is simple - due to a large scale of its shipping operations and wide variety of goods shipped, FedEx is often considered to be a bellwether of global economic growth. Such disappointing results and gloomy comments like ones included in fiscal-Q1 release are therefore a clear hint that things are not going well overall.

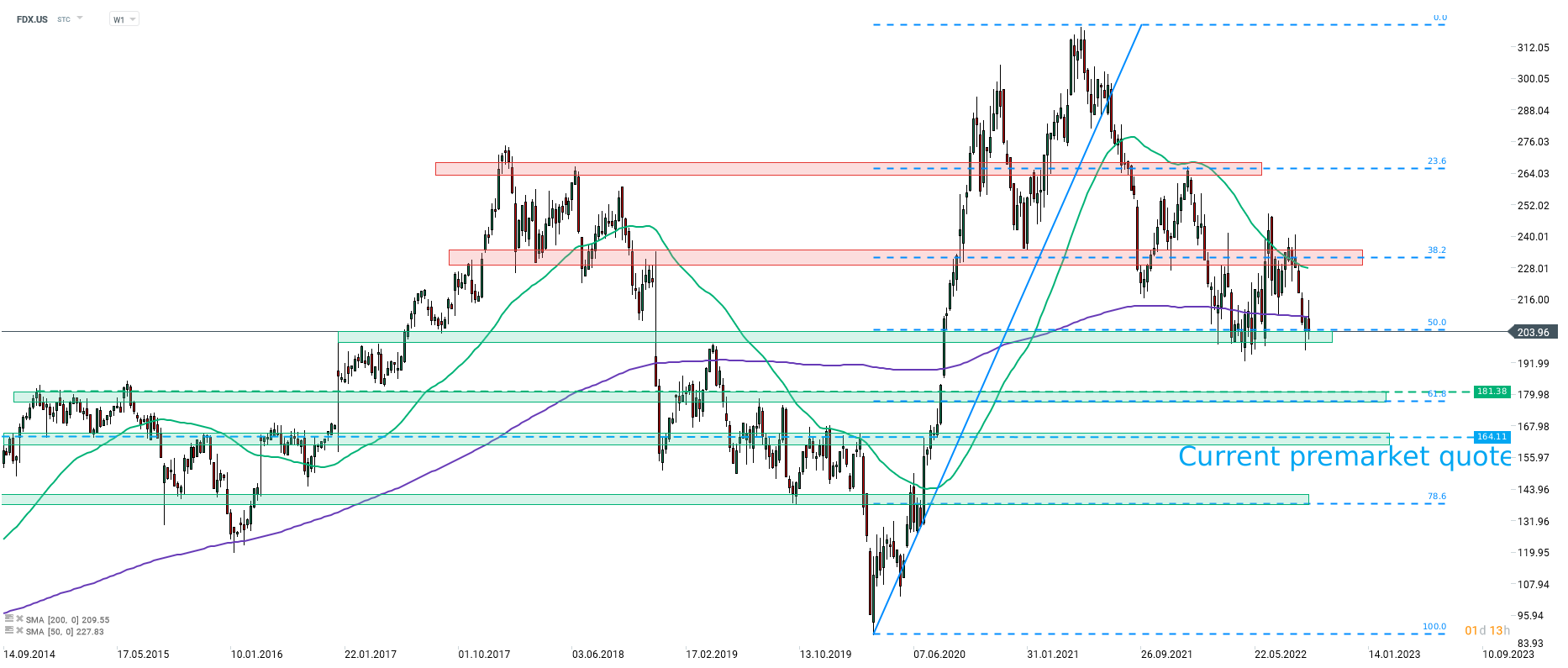

A look at FedEx (FDX.US) chart at a weekly interval, shows the massive scale of an expected drop in share price at the launch of today's session. Stock is currently expected to open at $164.11 - the lowest level since late-July 2020. This means that the stock will be testing a long-term price zone ranging below $164.50 mark and should a break lower occur, the way towards the next support zone at 78.6% retracement of the post-pandemic rally ($138.50) will be left open. Source: xStation5

A look at FedEx (FDX.US) chart at a weekly interval, shows the massive scale of an expected drop in share price at the launch of today's session. Stock is currently expected to open at $164.11 - the lowest level since late-July 2020. This means that the stock will be testing a long-term price zone ranging below $164.50 mark and should a break lower occur, the way towards the next support zone at 78.6% retracement of the post-pandemic rally ($138.50) will be left open. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.