Summary:

-

UK release first ever flash PMIs

-

Both manufacturing and services readings miss

-

GBPUSD falls beneath $1.29 handle

The pound has fallen lower following the release of the first ever flash PMI readings for the UK which showed a contracting level of activity for both the manufacturing and services sector. These readings are intended to give an early look into the performance of these sectors in the current month and are in addition to the final readings which will be released at the start of December.

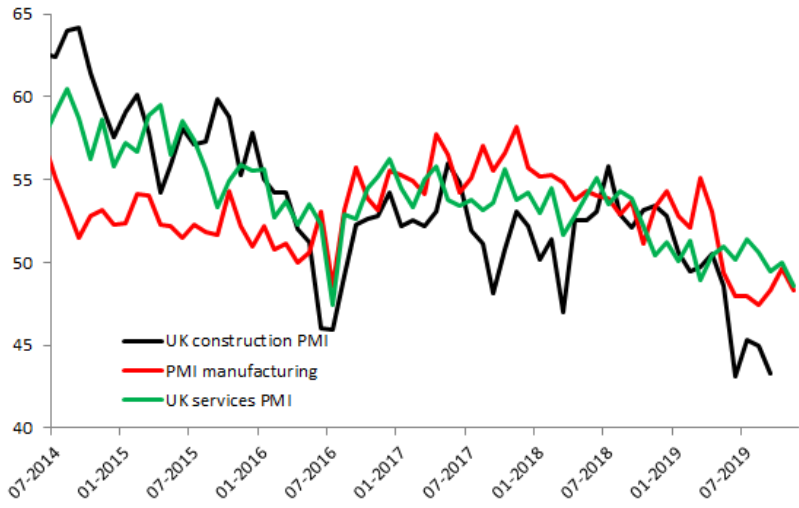

PMI readings for the UK continue to flash warning signs with the first look at the November prints for both manufacturing and services both firmly in contractionary territory. Source: XTB Macrobond

The data for November was as follows:

-

UK Flash Manufacturing PMI: 48.3 vs 48.8 forecast. 49.6 prior

-

UK Flash Services PMI: 48.6 vs 50.1 forecast. 50.0 prior

Both these readings are clear disappointments and in coming in firmly below the 50 mark indicate both of these are in contractionary territory. Looking under the hood we can see further signs for concern, with drops in output and new orders and while this could be explained away due to the heightened political uncertainty ahead of next month’s election there is little doubting the fact that the UK economy has pretty much ground to a halt.

While these data points are released sooner than the final readings and therefore will be less accurate, the methodology used to compute them means they are comparable. Going forward they could well begin to take on greater importance in terms of market moves, as traders react rapidly to the first look at the data - similar to what we see with the GDP numbers. There’s been a clear adverse reaction seen in the pound to the release, with the GBP/USD rate falling by around 50 pips to trade back below the $1.29 handle.

GBPUSD has dropped fairly strongly since the release with the pair falling back near its lowest levels in over a week to trade near the prior swing level of 1.2865. Source: xStation

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.