-

GBP gains following hawkish comments from BoE officials

-

Market prices in 2 full rate hikes by June 2022

-

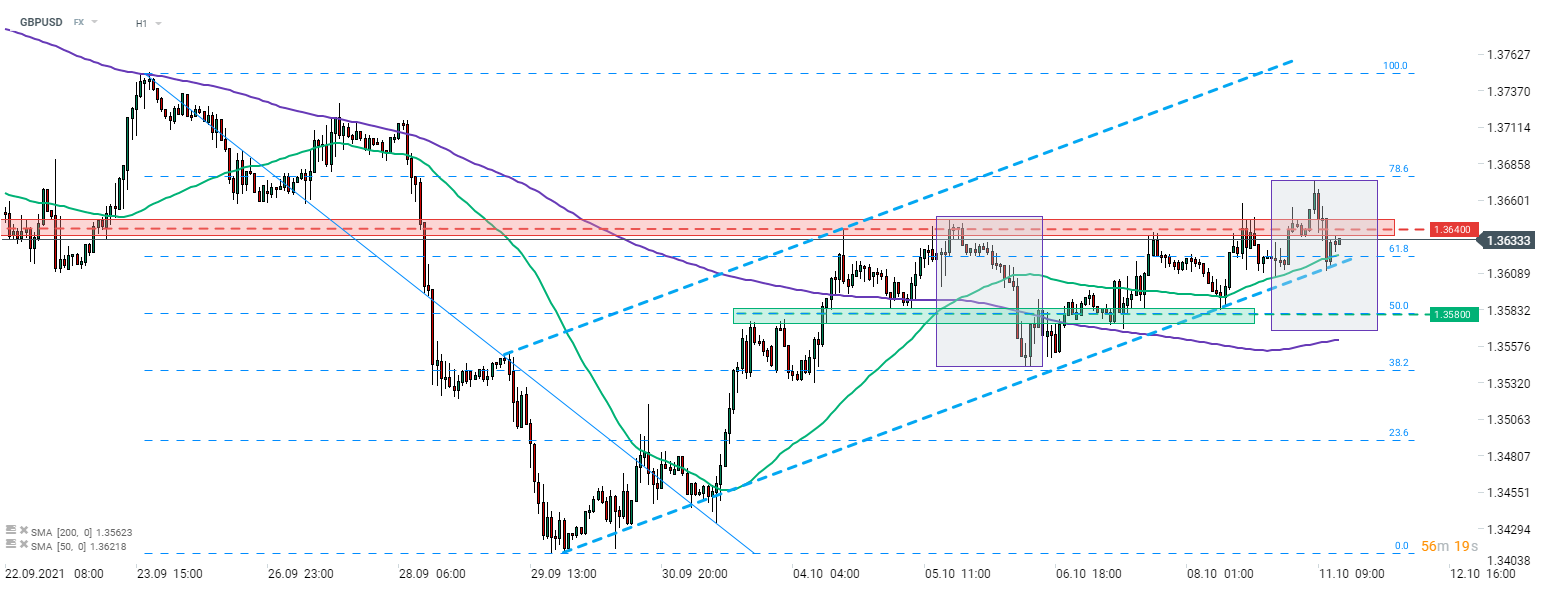

GBPUSD eyes a retest of 1.3640 resistance zone

The British pound is one of the best performing major currencies today. On one hand, solid performance of the UK currency can be ascribed to a general improvement in moods on the FX market. However, there are also more country-specific factors. Namely, comments made by BoE officials over the weekend were viewed as hawkish and provided a lift for the currency. Bank of England Governor Bailey said he is becoming increasingly concerned about acceleration in price growth while BoE member Saunders said that the market is right to expect quicker rate hikes. Interest rate derivatives market prices in a 20 basis points tightening by December 2021 and a 50 basis points tightening by June 2022.

Taking a look at the GBPUSD chart at H1 interval, we can see that the pair has erased a large chunk of today's gains after peaking in the morning. Subsequent pullback was halted at the upward trendline near the 61.8% retracement of the downward impulse launched in late-September. GBPUSD attempts to climb back above the 1.3640 resistance at press time. Should it succeed, a move back towards a recent local high near 78.6% retracement may be on the cards. On the other hand, failure to break above 1.3640 may trigger a pullback that would push the pair below the aforementioned trendline. In such a scenario, two support levels to watch are 50% retracement at 1.3580 and a lower limit of the market geometry at around 1.3570.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Daily summary: Red dominates on both sides of Atlantic

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.