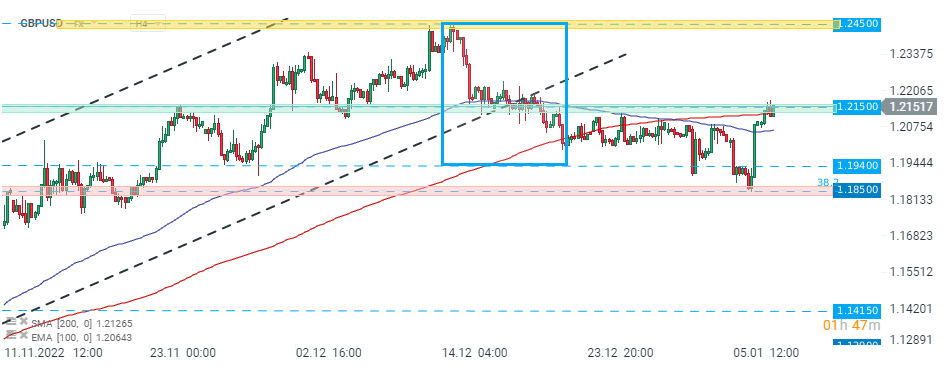

The pound sterling ended 2022 almost 11% lower, which was the worst performance since 2016, when Brits decided to leave the EU. However GBPUSD rose sharply on Friday after a fresh NFP report raised hopes the Fed will deliver smaller rate increases, which weighed on the greenback. On the other hand Fed members persistently reassure that higher interest rates will stay for longer, while the BoE pointed that its tightening process could soon end as inflation may have reached its peak, while the UK economy will most likely face recession in 2023. Further, higher temperatures in Europe pushed UK natural gas contracts to the lowest level since mid-2022, significantly easing inflation expectations. From a technical point of view, GBPUSD pair jumped to major resistance at 1.2150, which is marked with previous price reactions. If buyers manage to uphold recent momentum, upward move may accelerate towards December 2022 highs at 1.2450. On the other hand, if sellers regain control, then another downward impulse towards key support at 1.1850 may be launched. This level is marked with 38.2% Fibonacci retracement of the downward wave started in May 2021.

GBPUSD, H4 interval. Source: xStation5

GBPUSD, H4 interval. Source: xStation5

Prior to the start of the Wall Street session, the US dollar is the worst performing currency among the majors. Source: xStation5

USDIDX - the dollar index pulled back sharply last week and broke below major support at 103.40, which managed to fend off the bears several times in the past. If selling pressure intensifies and break below next support at 102.30 occurs, then declines may deepen further towards the psychological 100.00 mark.. Also medium-term 50-day SMA (green line) attempts to cross under the log-term 200-day SMA (red line). This could form a bearish ‘death cross’ which can at times precede a sharp turn lower. Source: xStation5

USDIDX - the dollar index pulled back sharply last week and broke below major support at 103.40, which managed to fend off the bears several times in the past. If selling pressure intensifies and break below next support at 102.30 occurs, then declines may deepen further towards the psychological 100.00 mark.. Also medium-term 50-day SMA (green line) attempts to cross under the log-term 200-day SMA (red line). This could form a bearish ‘death cross’ which can at times precede a sharp turn lower. Source: xStation5

U.S. dollar sell-off 🚨 USDIDX slumps nearly 1%

Hawkish Fed Comeback? 🦅 Inflation and Politics Could Keep U.S. Rates Frozen For Longer 🔍

Morning wrap (27.01.2026)

Cosmic increases in precious metals, yen in turbo mode! 🚀

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.