GitLab, an all-remote software company, will debut on the Nasdaq stock exchange this Thursday. Company's shares will be available for trading on xStation platform once regular trading starts tomorrow. While an almost $10 billion IPO valuation may look small compared to Coinbase or Robinhood IPOs from earlier this year, the company has some of the world's top tech companies among its customers. Take a look at our brief overview of the company!

GitLab Inc

GitLab Inc is a software company. While not everyone may be familiar with GitLab Inc, it's GitLab platform is well-known among software developers. GitLab is a DevOps platform launched as a free and open-source project that aims to optimize workflow between software development and IT operations. Project began in 2011 and in 2014 an open-core business model was adopted that allows for monetization of open source projects. Using the platform remains free for registered users but additional features become available with paid subscription.

Client base

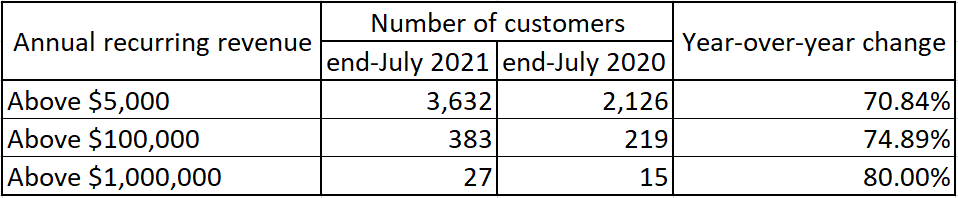

The company has a large client base and claims that its platform is used by more than 100 thousand companies and institutions. Among those we can find some big and well-known companies like Alphabet Cloud Services, NVIDIA, Alibaba Group or Amazon's AWS. Microsoft's Azure was also a client of GitLab until it acquired a rival Git repository, GitHub, in 2018. As GitLab has a subscription-based business, an Annual Recurring Revenue (ARR) is a metric to watch when analysing this company. GitLab's SaaS (software as a service) revenue growth outpaced its total revenue growth in full-2020 as well as during the first half of 2021. This is a positive development as higher share of recurring revenue makes business more predictable. The company has also managed to significantly increase the number of customers across its 3-tiers of services during the year ended on July 31, 2021 (see the table below).

GitLab managed to significantly increase the number of its top ARR customers during a year ended on July 31, 2021. Source: GitLab SEC filing

GitLab managed to significantly increase the number of its top ARR customers during a year ended on July 31, 2021. Source: GitLab SEC filing

What makes company unique?

One thing that makes GitLab a unique company is a model in which it operates. It is an all-remote software company, meaning that all of its employees are working from home. While work-from-home became popular during Covid-19 pandemic, GitLab decided on such a work model at its inception, long before the pandemic surfaced. The company has no headquarters. On one hand, it allows for cost reduction as the company does not have to maintain the office. On the other hand, it creates some risks. The company itself said that lack of office and company-owned equipment creates risk that equipment owned by its employees may be insufficient to perform some tasks.

IPO price

Initial IPO price range set by GitLab Inc. was $55-60 per share. However, it was boosted to $66-69 per share earlier this week due to strong demand. Such an IPO price range values the company at almost $10 billion. While this is nowhere as big as the $32 billion valuation of Robinhood during its debut or the over-80 billion USD listing of Coinbase, GitLab's IPO will be closely watched due to how important the company's services are to some of the world's biggest tech companies. Nevertheless, traders should keep in mind that although the company's business is improving, it is still generating losses.

Shares of GitLab will be available for trading on xStation platform since the company's IPO on Thursday, October 14. Shares will trade on xStation under GTLB.US ticker. However, it should be noted that regular share trading during hot IPOs like this often does not start until 1-3 hours of the cash session have passed.

Basic financial data from GitLab Inc. Source: GitLab SEC filing

Basic financial data from GitLab Inc. Source: GitLab SEC filing

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.