Gold prices are experiencing their third consecutive session of declines, marking what could be the longest losing streak since late April/early May. The precious metal is down almost 1% today, testing a critical support level.

The current downturn in gold is largely attributed to a prevailing risk-on sentiment in the broader market, despite equity indices not currently ascending from historical peaks. This optimism is also fueling a continued recovery in the oil market. Furthermore, weakening demand for gold jewelry in China and India, driven by elevated prices, has been noted as a contributing factor.

The third significant element is a strengthening US dollar. This dollar appreciation follows a reduction in perceived risk surrounding the Federal Reserve chairman's position and robust economic data from the United States. Looking ahead, next week will be pivotal with the release of the Fed's interest rate decision, alongside key macroeconomic indicators such as GDP, ISM indices, and the Non-Farm Payrolls report.

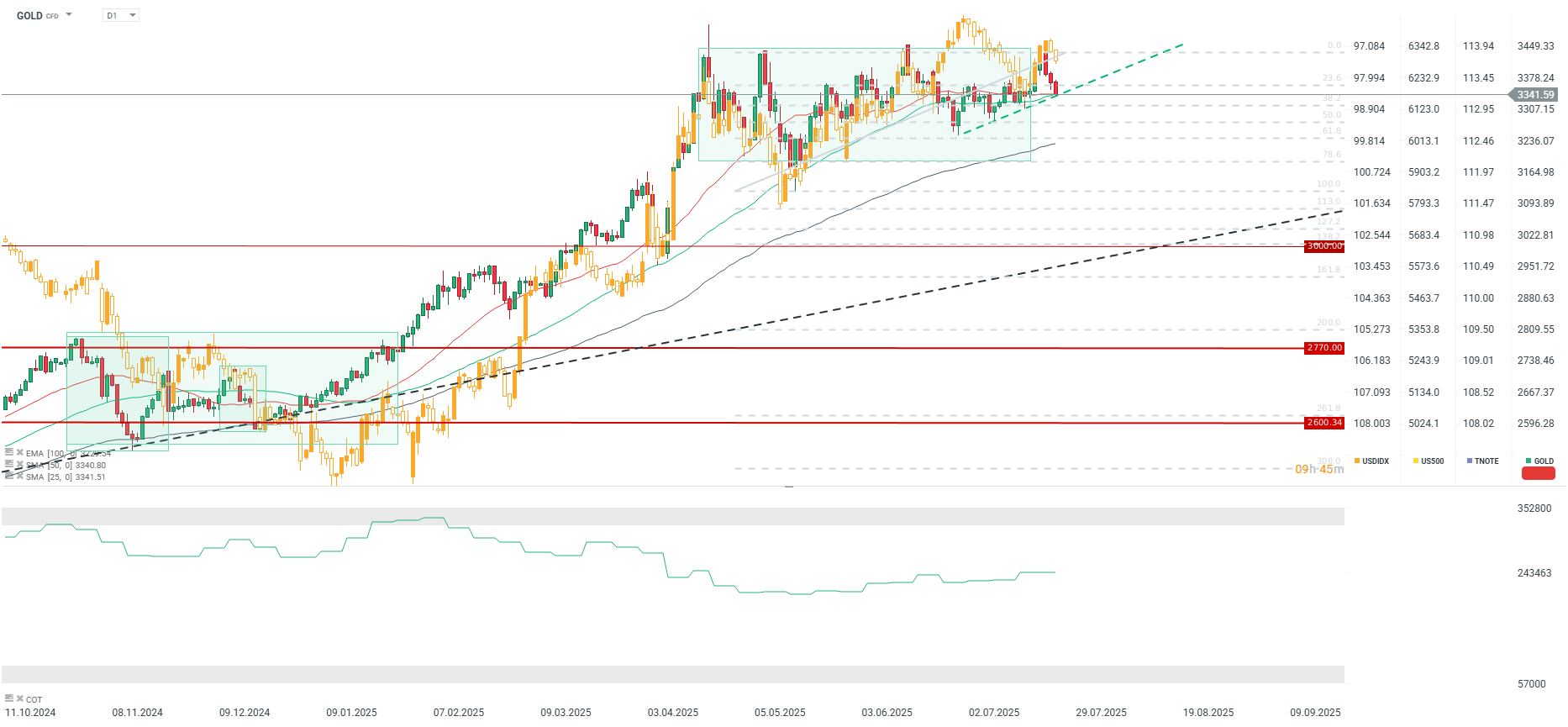

Gold is currently testing support defined by an uptrend line and the 25- and 50-period Simple Moving Averages (SMA). A decisive break below this support could see gold decline to the 3250-3280 range. However, if this support holds today, a return above the 23.6% Fibonacci retracement cannot be ruled out early next week. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.