Gold is down more than 1% today, but after mixed U.S. data, the metal initially reacted with a rise despite higher-than-expected ISM Services readings and mixed JOLTS data (quits fell from 1.2% to 1.1%, while total separations were 2% versus the previous 1.9% revision). The U.S. dollar is trading flat, but other metals, including silver, are also declining, with silver down 5%.

Published data, along with the latest final manufacturing PMI, support the narrative suggested by Trump that the U.S. is not currently facing a significant inflation risk, and the Federal Reserve may adopt a slightly more “aggressive” stance in the second half of the year.

Gold entered 2026 on a strong note, suggesting that investors still see potential for further gains amid expectations of Fed rate cuts (Stephen Miran has even suggested up to 100 bps this year), rising deficits, and geopolitical tensions that may accelerate gold purchases and reduce dollar exposure as a diversification strategy.

Gold CoT Analysis (CFTC) – December 30, 2025

By the end of December 2025, the structure of gold futures positions shows a clear contrast between Commercials and Managed Money (large speculators). Speculative capital remains bullish, while producers and direct market participants hedge deliveries at current prices, maintaining a net short position.

-

Commercials (Producer/Merchant/Processor/User):

-

Total short positions ≈ 67,000 contracts, representing ~14% of open interest.

-

Long positions decreased by 4,200 contracts last week, while shorts remained elevated, signaling moderate short-term pessimism.

-

-

Managed Money:

-

Long ≈ 149,000 contracts vs. 44,000 short, with longs representing ~31% of OI.

-

Last week, longs decreased slightly (-1,709 contracts) while shorts increased (+4,313 contracts).

-

The contrast between bearish Commercials and bullish Managed Money often drives dynamic price moves. Commercial positions can act as natural support, while speculative pressure supports upside potential. Recently, both groups appeared to align, using record gains to hedge deliveries or reduce bullish exposure.

Outlook

-

Gold remains in short-term consolidation, with the potential to break higher if Managed Money maintains or increases long positions. A sudden reduction in Commercial short positions could signal a bullish impulse.

-

Current CoT structure suggests a potential for short-term correction, while additional long accumulation by Managed Money could provide an upward push.

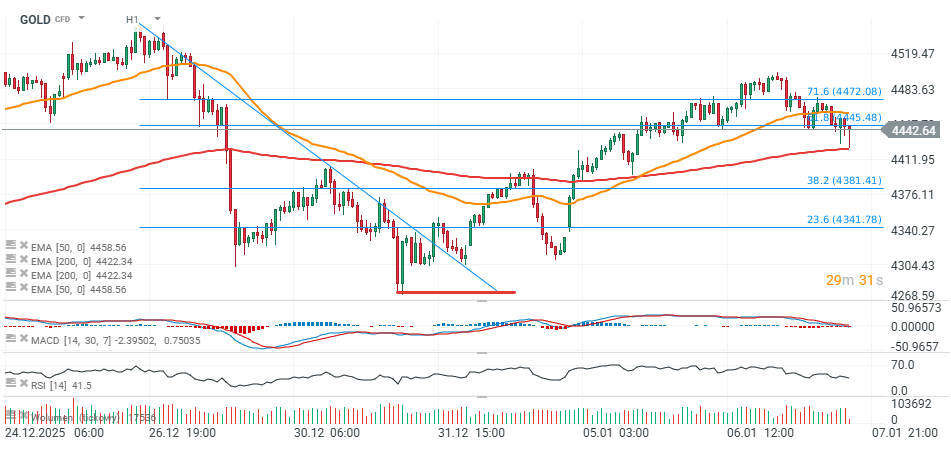

Technical Analysis (H1)

On the hourly chart, declines have halted around $4,420 (EMA200, red line), but prices remain below the 71.6% and 61.8% Fibonacci retracements of the late December down move. Immediate resistance appears near the EMA50 (orange line) at $4,460 per ounce.

Source: xStation5

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.