Gold is performing exceptionally well today, up nearly 3% and continuing its climb toward record levels near $5100 per ounce. Prices recently posted their strongest single-day gain since 2008, rising more than 5.2% in one session, highlighting both the strength of buyers and the scale of inflows into the market. Data from China suggests investors are still accumulating physical bullion ahead of the Chinese New Year holiday, scheduled for February 16.

Interestingly, gold buying has continued despite weak sentiment in U.S. equities and appears to be breaking through many traditional correlations, indicating that the fundamental backdrop for precious metals has not materially changed despite last week’s panic. Global capital continues to flow into bullion, with additional upside support coming from the U.S. dollar index, which is posting a second consecutive day of moderate declines.

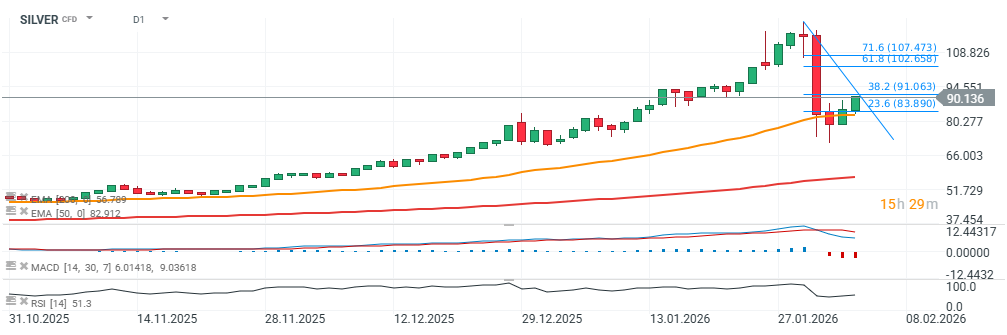

(GOLD, SILVER charts, D1 timeframe)

From a technical perspective, gold has moved above the 38.2% Fibonacci retracement of Friday’s sell-off and is now heading toward the 61.8% level near $5,150 per ounce. Key momentum support has held at the EMA50 (orange moving average). Friday’s bearish candle also left a long lower wick, as price ultimately closed above the moving average, and on Monday it successfully defended the $4,700 area as a key support zone.

Source: xStation5

Silver has joined the rebound as well, recovering toward $90 per ounce. The price held its key momentum support at the EMA50 (orange line) and is now approaching an important resistance level: the 38.2% Fibonacci retracement of Friday’s decline, located near $91 per ounce.

Source: xStation5

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.