Dallas Fed President, Lorie K. Logan

Logan's comments were particularly hawkish. The banker believes it is "definitely too early" to consider cutting interest rates and emphasized the need for more certainty about the economy's trajectory and inflation before making such decisions. Logan noted that there is a risk of inflation rebounding, which could turn out to be more “sticky”. The banker highlighted that the FOMC should be ready to respond appropriately if inflation data turns out to be higher than expected, and the downward momentum halts. In such a scenario, this could even mean a return to further interest rate hikes. Lorie K. Logan expressed herself in an exceptionally hawkish manner, though this tone has been maintained for some time.

Richmond Fed President, Thomas Barkin

Barkin commented on today's labor market data, describing the report as quite strong. The banker emphasized the strength in the labor market, noting the constant low unemployment rate, a situation not seen since the late 1960s. He also mentioned that employers are refraining from laying off workers despite signs of moderate consumption, likely influenced by experiences with the tight labor market during the early pandemic. Barkin also noted that inflation might be harder to defeat and bring down to the 2.00% target.

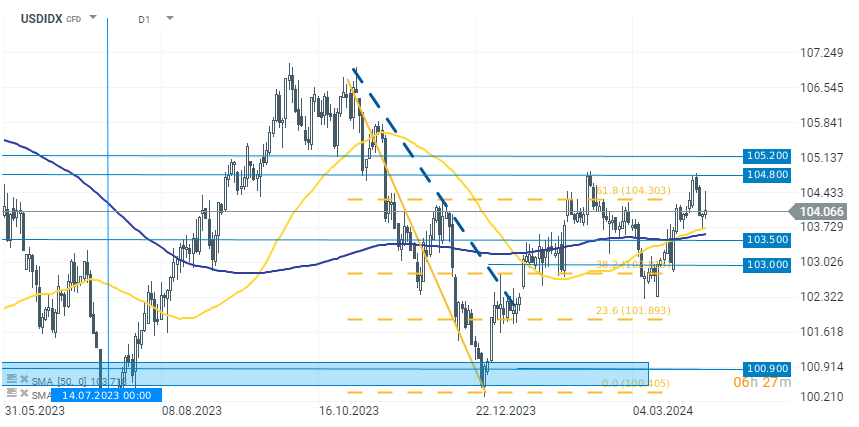

USDIDX

After today's NFP report, the dollar index significantly gained, breaking above the 104-point level. Despite the strong move, which was sustained after the publication, we currently see a reversal and a partial erasing of the gains. The lower limit remains at the 104.000-point level and further at 103.500. On the other hand, in the upward direction, bulls face resistance around 104.800 points.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.