Chinese stock indices, including HK.cash and CHN.cash are gaining more than 2% during today's session following further dovish comments from the Chinese establishment and PBOC officials. China will set up a new credit programme for technological innovation and transformation, People's Bank of China Governor Mr Gongsheng said at a briefing today, also adding that there is further room for reserve requirement rate cuts. It was these comments that largely supported bullish sentiment during today's session in APAC markets. Moreover, the banker added that monetary policy will be conducted in such a way as to "gently" support consumer prices in the state.

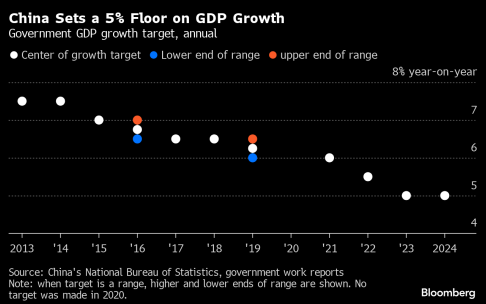

On the other hand, however, Bloomberg analysts add that the economic plan for 2024 presented by China is not quite what stock market investors can expect. Bloomberg cites the failure to provide details of the fiscal and monetary stimulus required to achieve it or other market-oriented reform plans as the main reason. Analysts added that China's leaders are focusing on something else. National security is expected to be a key theme for you, with an emphasis on technological and economic self-reliance, traditional and high-tech manufacturing and defence.

Equity purchases by Chinese government funds to support the market may also slow down in the near term if mainland equity benchmarks maintain their recent rebound, Jefferies analysts commented recently.

China is setting ambitious targets. You can find more detailed information here and here. Source: Bloomberg Financial LP

HK.cash is breaking out above the 50-day exponential moving average (blue curve), which is further reinforced by the 78.6% Fibo retracement of the upward wave initiated in October 2022. Source: xStation

HK.cash is breaking out above the 50-day exponential moving average (blue curve), which is further reinforced by the 78.6% Fibo retracement of the upward wave initiated in October 2022. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.