IBM announced its intention to acquire Confluent Inc. for 11 billion USD, offering 31 USD per share in a cash transaction. Confluent is a California-based company specializing in real-time data streaming, built on the open-source Apache Kafka platform.

The transaction, which is expected to close by mid-2026 after receiving regulatory approvals and shareholder consent, will be financed in cash by IBM. This is the company’s largest acquisition since the purchase of Red Hat in 2019 and aligns with IBM’s strategy focused on the development of software and cloud services.

Through the acquisition of Confluent, IBM plans to expand its offerings with an advanced real-time data processing platform. This technology is critical for enterprises that need to manage growing volumes of data and implement artificial intelligence solutions. Integrating Confluent’s products with IBM’s automation and security tools will enable clients to make better data-driven decisions in real time.

Confluent has recently reported significant year-over-year revenue growth, exceeding market expectations, which further underscores the company’s attractiveness in the data processing technology market. Analysts indicate that the acquisition could deliver benefits to IBM as early as the first full year after the transaction closes, with a positive impact on EBITDA and free cash flow.

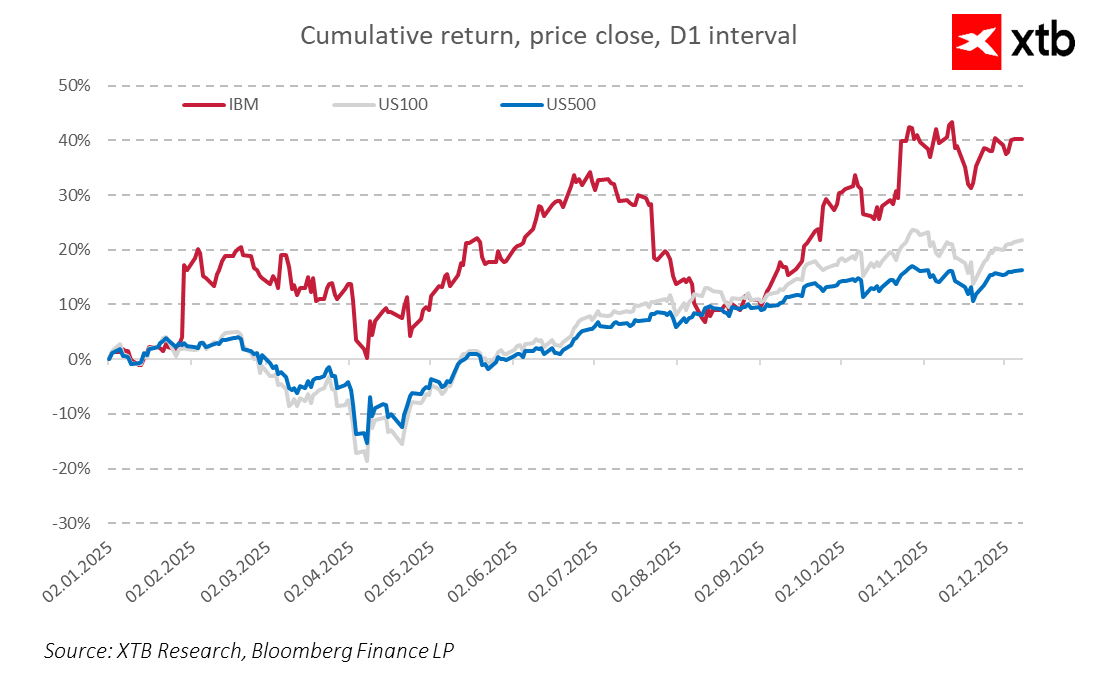

For the markets, this signals that IBM is actively investing in growth and strengthening its position in the cloud and artificial intelligence sectors, responding to increasing demand for advanced data processing technologies. Although IBM shares initially saw a slight decline, the transaction reflects the company’s long-term commitment to growth and innovation in the IT industry.

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.