- Acceleration in software driven by artificial intelligence and cloud is key for investors, along with hard data on contract value and monetization.

- Investors want improvements in margins and cash flows, as well as clear commentary on the impact of contract schedules.

- Traditional services, such as system maintenance and modernization, remain the foundation of recurring revenues

- The renewal cycle of Z series seventeen mainframe computers is expected to increase orders and drive sales

- Technological partnerships and integration of acquisitions should strengthen the offering and reach

- The tone of management and specific indicators of AI adoption will be crucial for evaluating the report

- Acceleration in software driven by artificial intelligence and cloud is key for investors, along with hard data on contract value and monetization.

- Investors want improvements in margins and cash flows, as well as clear commentary on the impact of contract schedules.

- Traditional services, such as system maintenance and modernization, remain the foundation of recurring revenues

- The renewal cycle of Z series seventeen mainframe computers is expected to increase orders and drive sales

- Technological partnerships and integration of acquisitions should strengthen the offering and reach

- The tone of management and specific indicators of AI adoption will be crucial for evaluating the report

IBM is one of the oldest and most recognizable technology corporations in the world. The company grew on hardware and transactional systems for large organizations, and today it combines software, services, and cloud with a broad ecosystem of partners. Its clients are primarily institutions with very high demands for reliability and security.

Today, the company is publishing its results. The two previous reports disappointed, mostly with earnings per share. Investors will be paying attention primarily to the pace of adoption of AI-based solutions, the credibility of margins and cash after recent setbacks, the condition of so-called traditional services, the significance of the patent portfolio, and the contribution of the new Z series seventeen infrastructure cycle.

- The most important expectation from investors is acceleration in the segment of software driven by artificial intelligence and cloud. The company is entering artificial intelligence cautiously, expanding its portfolio and integrating new features with existing platforms. The market will be listening to hard data on the value of contracts signed, the effects of implementations with large clients, as well as the monetization plan and the role of technological partnerships.

- The second challenge for the company is to meet conservative investor expectations regarding results after two relatively weak quarters. Attention is shifting from revenues to the quality of margins and cash flows. Investors are also looking for signs of greater cost discipline, stabilization of general and sales costs, as well as confirmation of full-year cash targets, with clear commentary on the contract execution schedule.

- The third pillar of expectations is services. Besides, projects related to artificial intelligence, so-called traditional services, such as maintenance, development, and modernization of existing systems, are of key importance. They ensure revenue repeatability but are subject to rate pressure and contract rotation. A strong patent portfolio remains an important asset, helping to defend margins, support licensing, and provide a protective umbrella for new features in software and infrastructure.

- The fourth significant area is infrastructure. It is expected that the renewal cycle of the Z series seventeen mainframe computers will bring an increase in orders and drive demand for software and services around this platform. Important will be information about the length of the cycle, the pace of implementations, and the extent to which the new generation supports applications related to artificial intelligence.

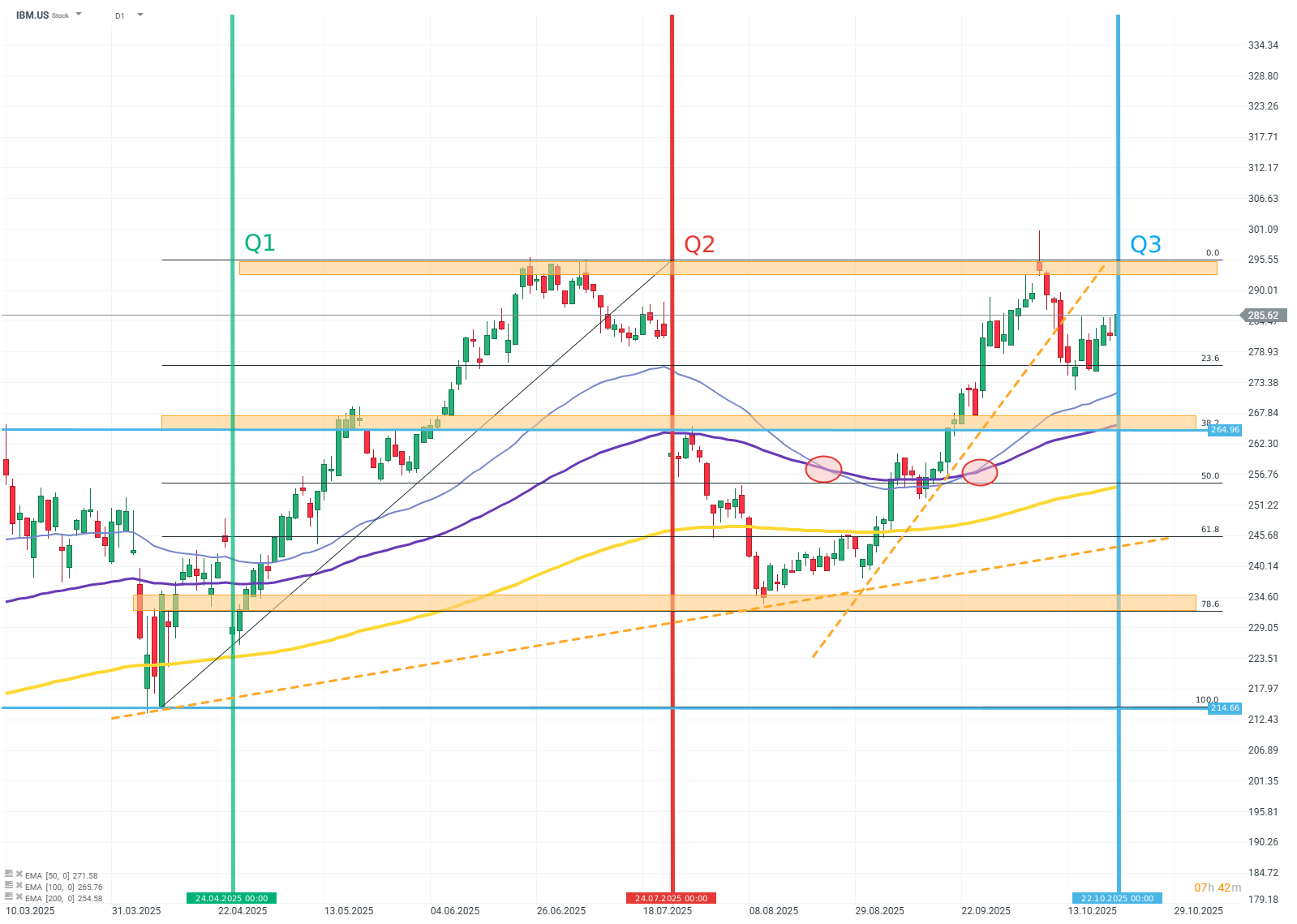

IBM.US (D1)

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Daily summary: Red dominates on both sides of Atlantic

US OPEN: Market under pressure from lacklustre tech earnings season

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.